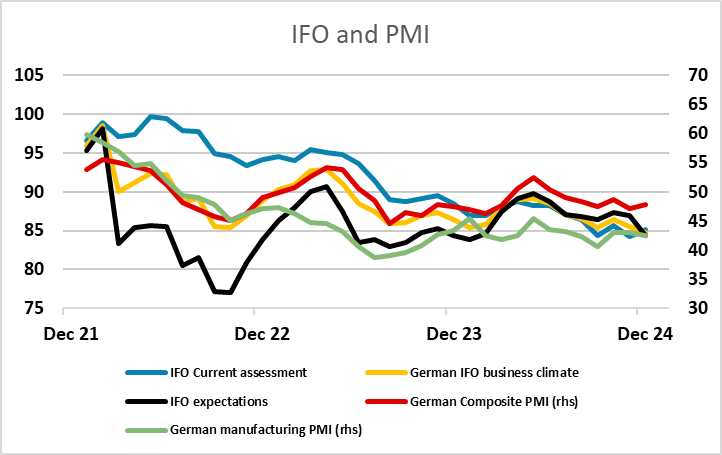

EUR flows: EUR slips on IFO

IFO business climate falls to lowest since pandemic. EUR falls but downside scope modest

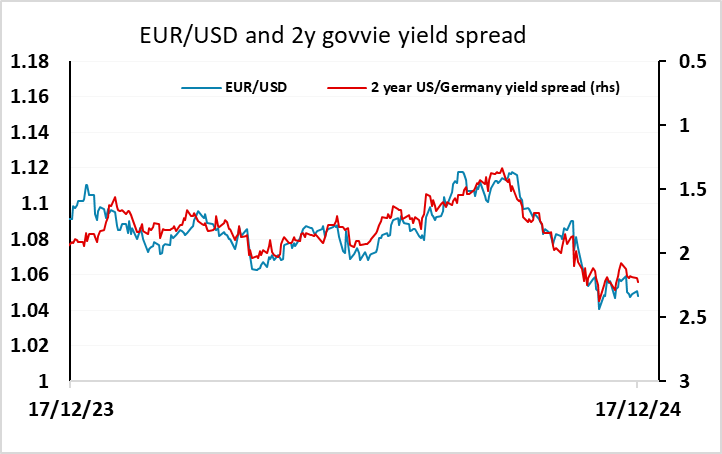

A weaker than expected IFO survey has put some further downward pressure on the EUR, which was already on the back foot in early European trading. The business climate index for December hit its lowest level since the pandemic, driven by a decline in business expectations, while the current assessment showed a small recovery. The IFO business climate index has typically moved closely with the S&P PMI composite index in recent years, but has started to underperform in recent months, with the PMI composite index managing a small recovery in December. The impact on the EUR won’t be large, as Germany isn’t the whole Eurozone and the IFO survey is somewhat weaker than the PMI, plus EUR/USD is already trading a little weaker than suggested by the correlation with 2 yar yield spreads. But it should nevertheless maintain some downward pressure on the EUR and prevent a recovery above 1.05 near term.