RBNZ Review: Cutting Along the Playbook

RBNZ cut its cash rate by 50bp to 4.75%

The RBNZ cut its cash rate by 50bp to 4.75% in the October meeting along with the August OCR revision and sees CPI to be within target range with further moderation momentum. Some key takeaways:

Policy Change: "The Committee assesses that annual consumer price inflation is within its 1 to 3 percent inflation target range and converging on the 2 percent midpoint." The RBNZ now sees inflation to be within the 1-3% target range and continue to forecast more moderation. They agreed that it is appropriate to cut the OCR by 50 basis points to achieve and maintain low and stable inflation.

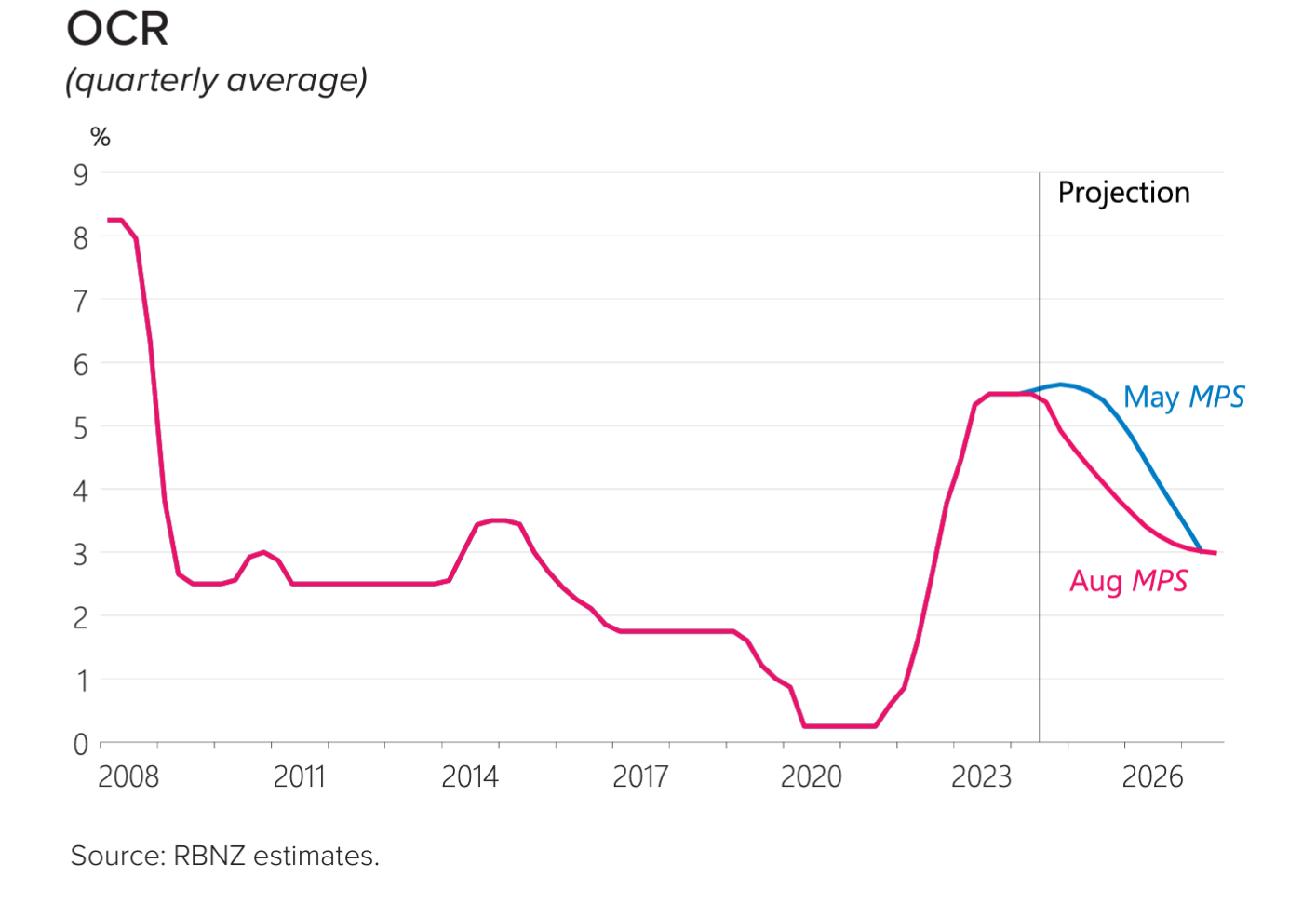

Forecast revision: The RBNZ has made almost no changes to their forecast. The OCR forecast did not change from the August forecast and shows continuous easing until year end 2026 at 3% terminal rate. Q2 2024 CPI has been revised lower to sub-two percent from three percent.

Forward Guidance Change: The forward guidance is changed to "The Committee confirmed that future changes to the OCR would depend on its evolving assessment of the economy." from "The pace of further easing will depend on the Committee’s confidence that pricing behaviour remain consistent with a low inflation environment, and that inflation expectations are anchored around the 2 percent target." as the August OCR forecast did not suggest another ease in 2024. The RBNZ is signalling they are likely done for 2024. Given the current OCR path, it looks like the RBNZ is expecting to cut rate by 2.25% till 2026, which is almost one every meeting.

The October meeting clearly shows the RBNZ have entered the easing cycle. The inflation picture is cooling rapidly in the recent months and prompted the RBNZ to ease further.