JPY, CHF, GBP flows: JPY weakness getting stretched

JPY weakness has extended again today, but recent run of losses is getting overdone

JPY weakness has remained a theme today, even though the JPY has rallied a little in the last hour. As it stands we are on our ninth consecutive day of gains for both GBP/JPY and CHF/JPY, which is rare – we have only seen nine consecutive days of gains in GBP/JPY once before this year, and CHF/JPY hasn’t managed nine consecutive days of gains since August 2023.

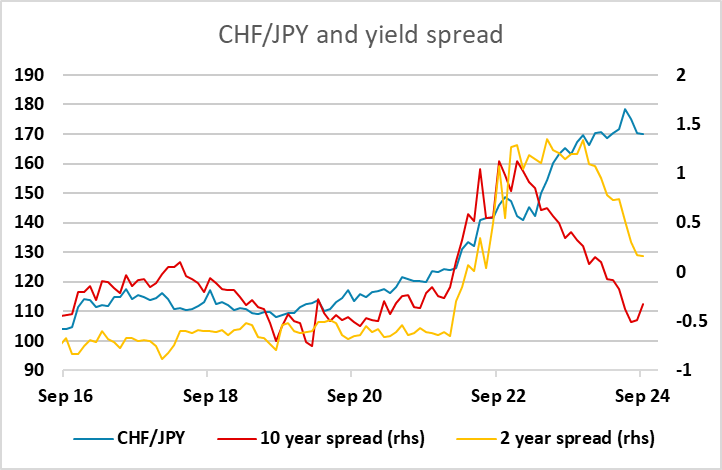

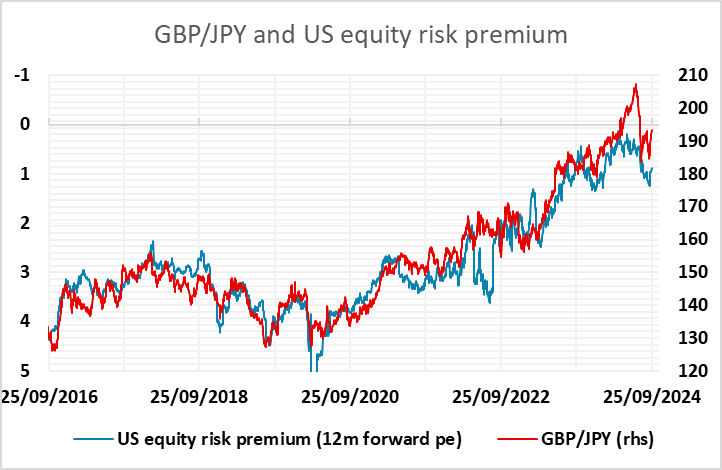

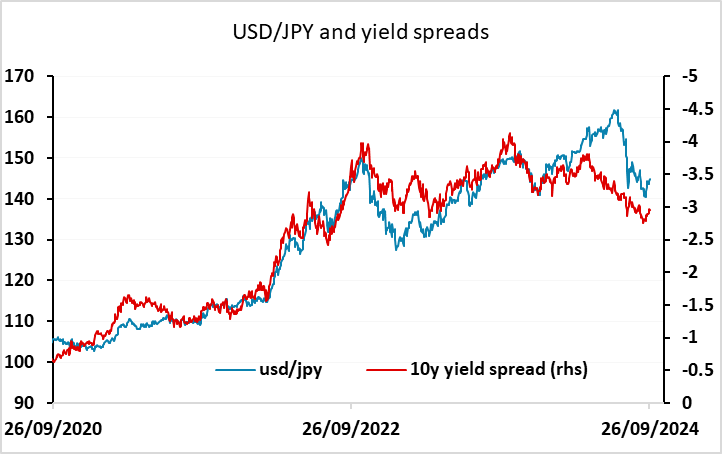

The strength in the equity market on the back of the Fed cut rate and the Chinese stimulus announced this week is clearly boosting risk sentiment, and the JPY has remained the favourite funding currency as markets have re-entered carry trades. But this is looking overdone. Yield spreads are not supportive of USD/JPY above 140, never mind 145, and US equity risk premia look dangerously low given the slowing US economy. It also looks risky to treat the JPY as the favoured funding currency, when Japanese yields are likely to rise again soon, spreads are narrowing, and the CHF looks an attractive alternative given the SNB’s rate cut and their likely opposition to further CHF strength.