U.S. January ADP Employment - A weaker month which may underperform payrolls

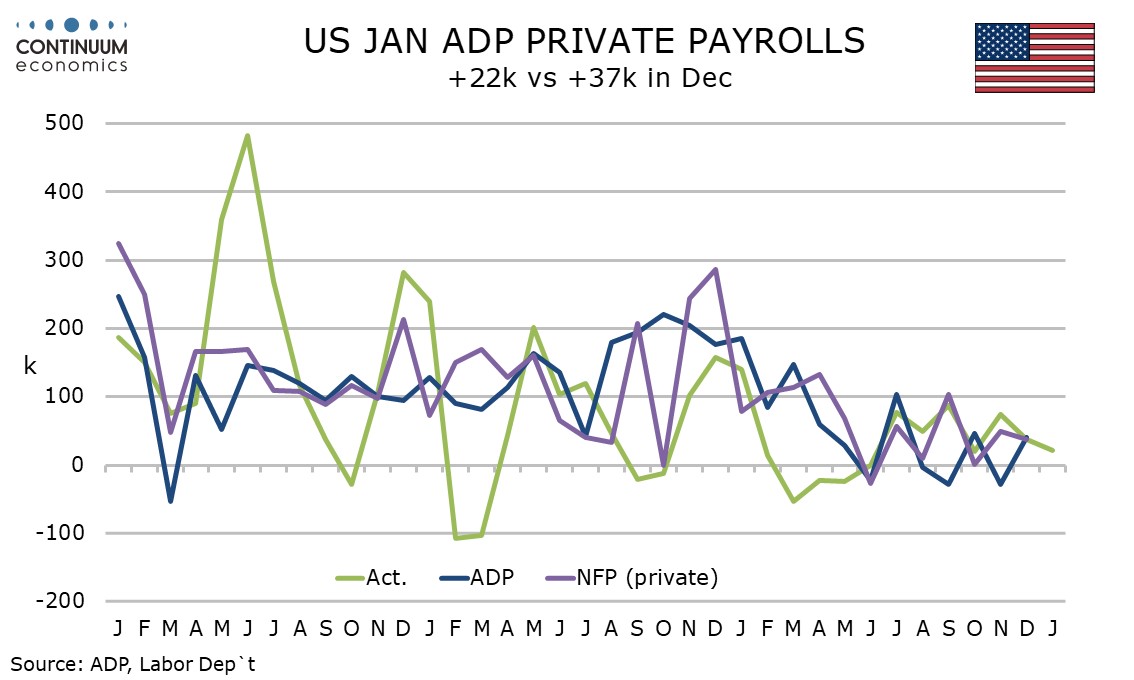

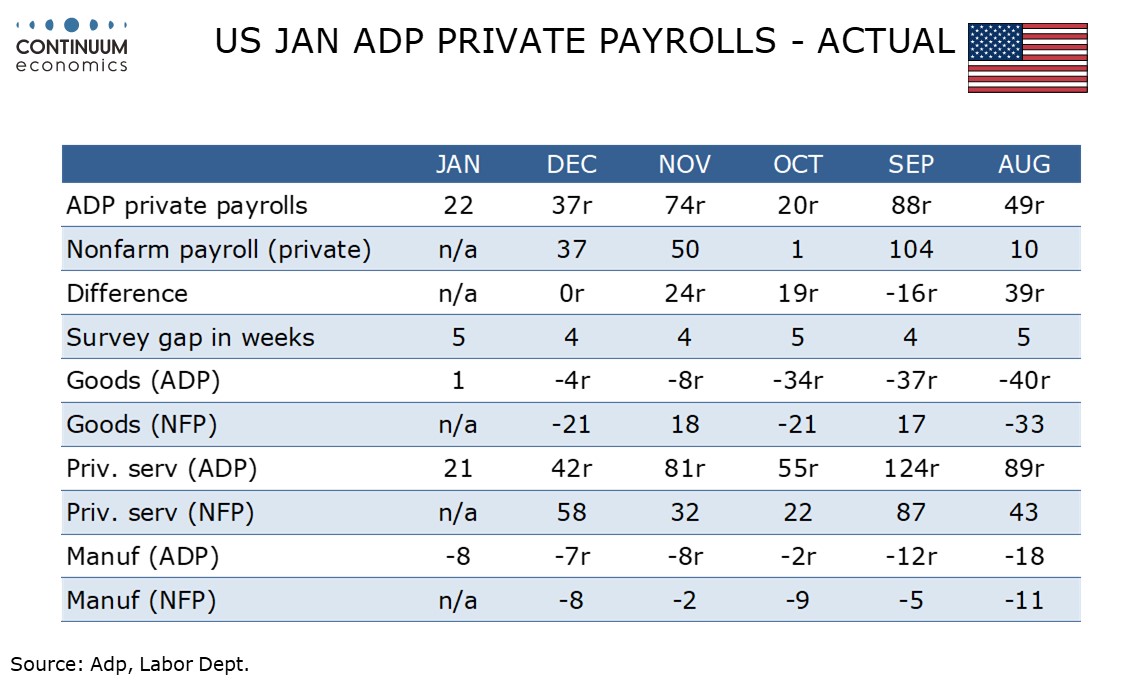

January’s ADP’s estimate of private sector employment of 22k falls short of expectations. We still see scope for non-farm payrolls to outperform the ADP data given very low initial claims and positive seasonal adjustments, though a recent tendency for ADP data to underperform payrolls is no longer there after historical revisions to the ADP data.

We expect a rise of 85k in overall payrolls, with 80k in the private sector. Given the recent government shutdown payrolls have been delayed from Friday’s scheduled release but with the shutdown now resolved the release can be expected next week. Historical revisions are also due to payrolls.

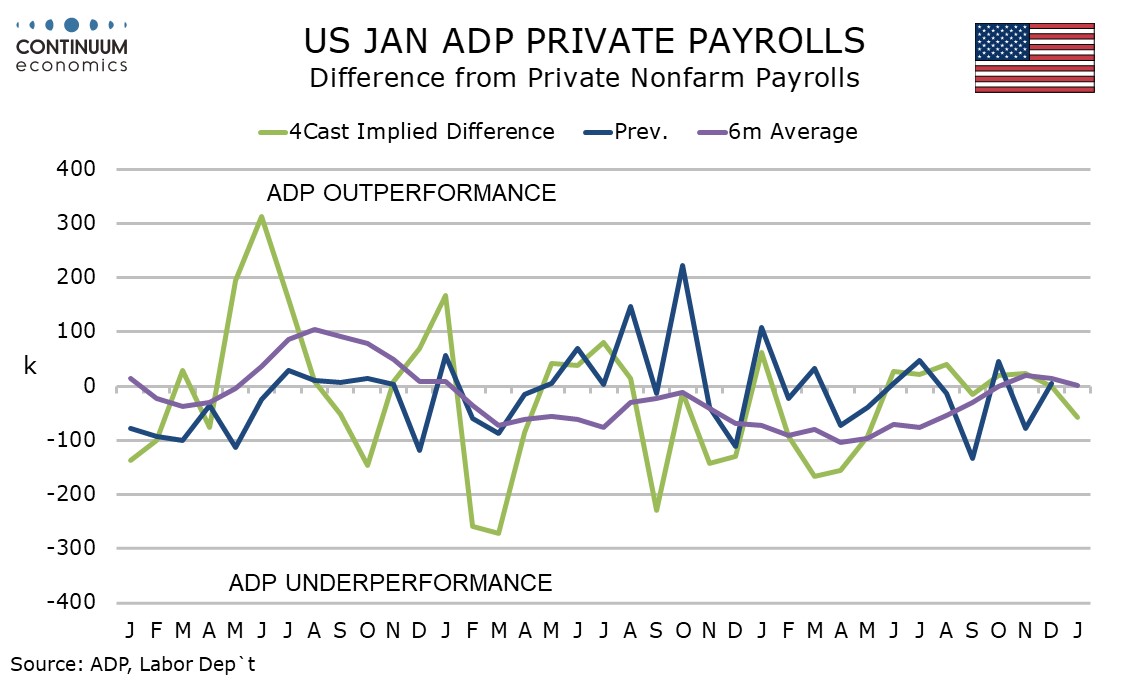

We expect payrolls will see downward revisions, but they will be most pronounced in early 2025, where ADP data is now underperforming by more, than in late 2025, where ADP data is now marginally outperforming. Its 6-month average is 48k, down from 57.5k in December, when private payrolls showed a 6-month average of 43k. Going further back, some ADP data has been revised sharply leaving the series suspiciously volatile.

ADP detail showed goods employment up by 1k with construction up by 9k, hinting at improving housing sector activity and manufacturing down by 8k, still weak despite a stronger ISM survey. Services saw education and health, a sector that has tended to underperform payrolls, strong at 74k, with the main offset being a 57k plunge in professional and business. Overall services increased by 21k.

Wage growth was little changed at 4.5% yr/yr for job-stayers but for job-changers it slowed to 6.4% from 6.6%. This is consistent with an environment of limited layoffs but limited hiring.