U.S. July Durable Goods Orders - Signs of underlying improvement

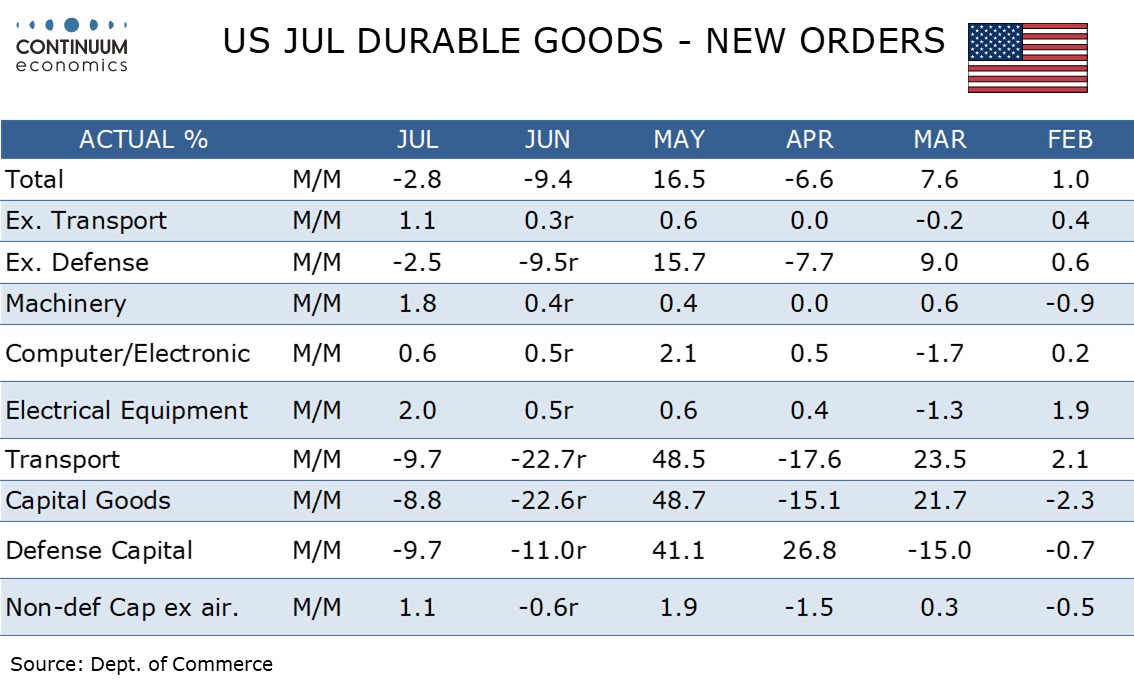

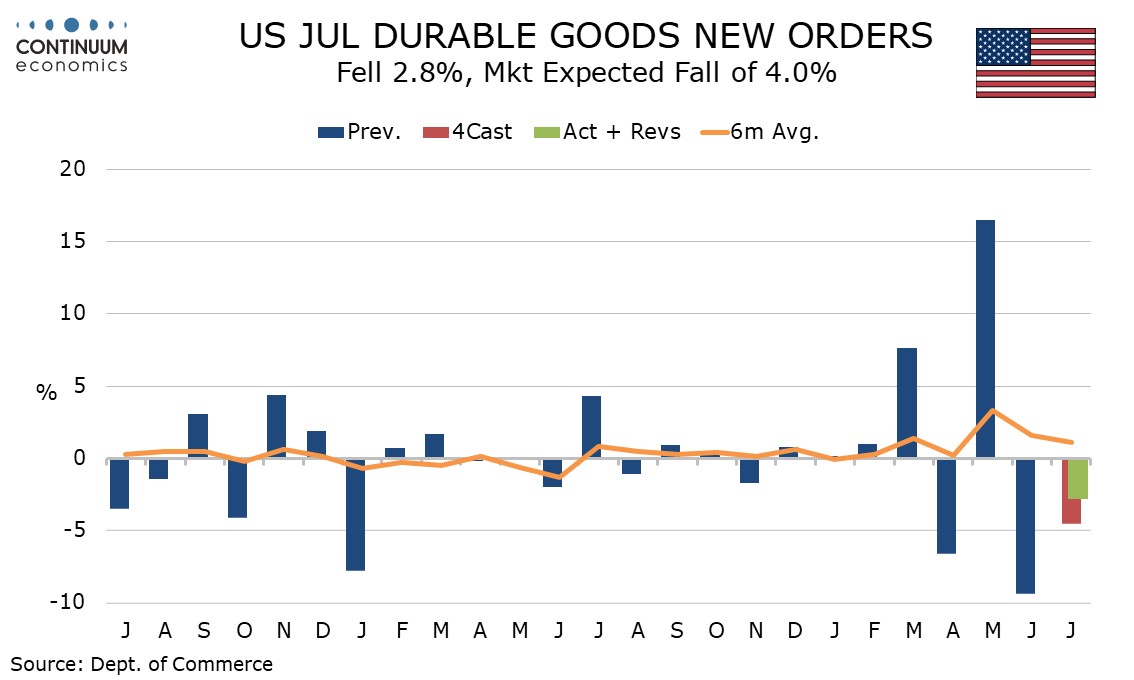

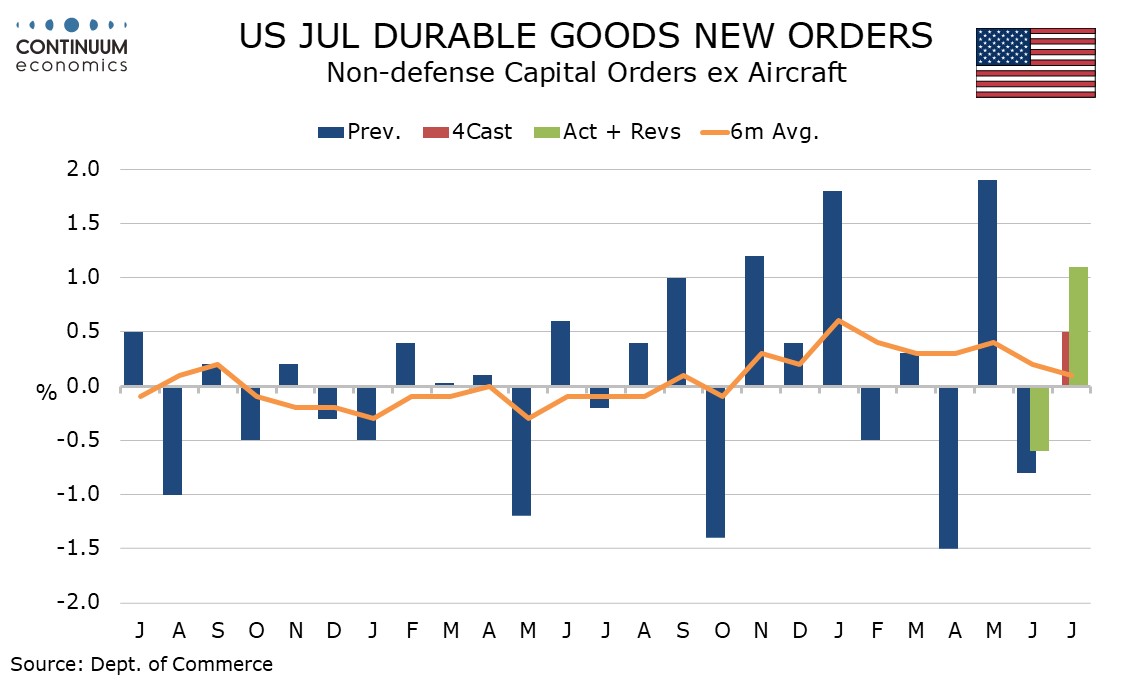

July durable goods orders with a 2.8% decline are less weak than expected given a strong 1.1% rise ex transport, where trend appears to be gaining some momentum. While manufacturing surveys are mixed August’s S and P manufacturing survey was stronger too.

As suggested by Boeing data, civil aircraft are back to a more normal level after an exceptional May was followed by a still strong, if less exceptional, June. Autos showed a marginal rise and defense aircraft were stronger though transport orders still fell by 9.7%.

Despite the rise in defense aircraft overall defense capital orders were weaker. Ex defense orders fell by 2.5%.

A 1.1% rise ex transport is the third straight gain and the strongest since September 2024. The 6-month average of 0.4% is also the strongest since September 2024. Recent ISM new orders data has been unimpressive but mixed reginal data has on balance seen some improvement and August saw a significant bounce in the S and P manufacturing PMI. There appears to be some strengthening in manufacturing taking place.

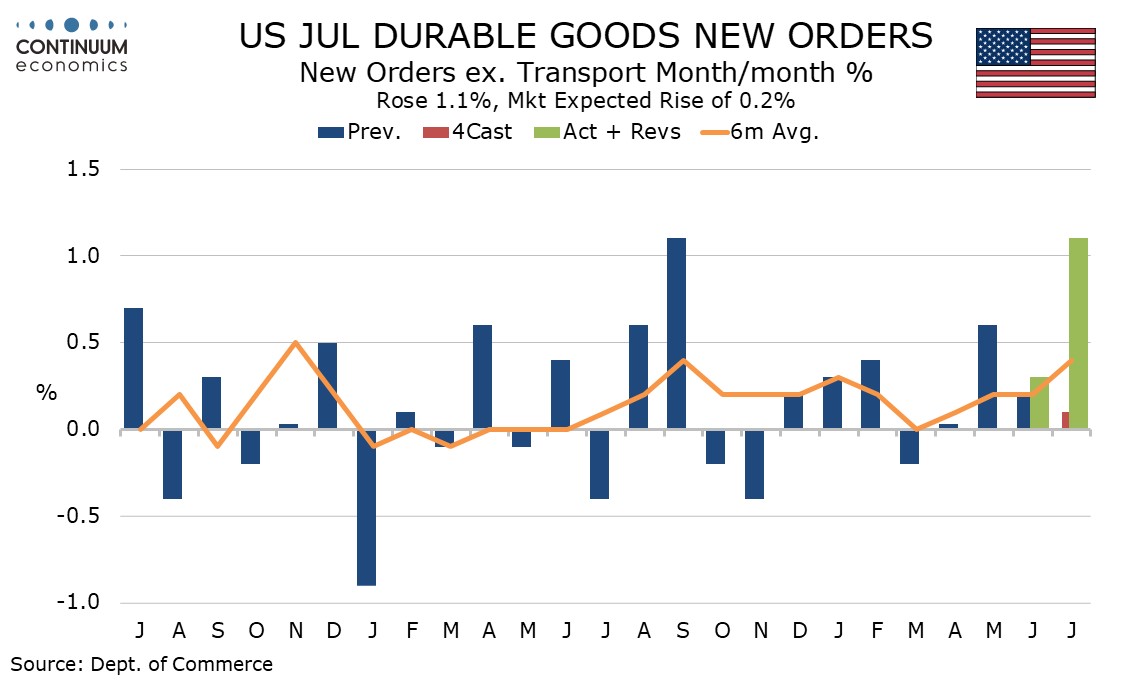

Non-defense capital orders, a key signal for business investment, also rose by 1.1%, while a 0.7% rise in shipments in the sector is positive for Q3 GDP. Also a modest positive for Q3 GDP is a 0.3% rise in inventories, the strongest since December 2024.