Published: 2025-05-12T12:51:48.000Z

Preview: Due May 22 - U.S. May S&P PMIs - Manufacturing to slip below neutral, Services to hold above

4

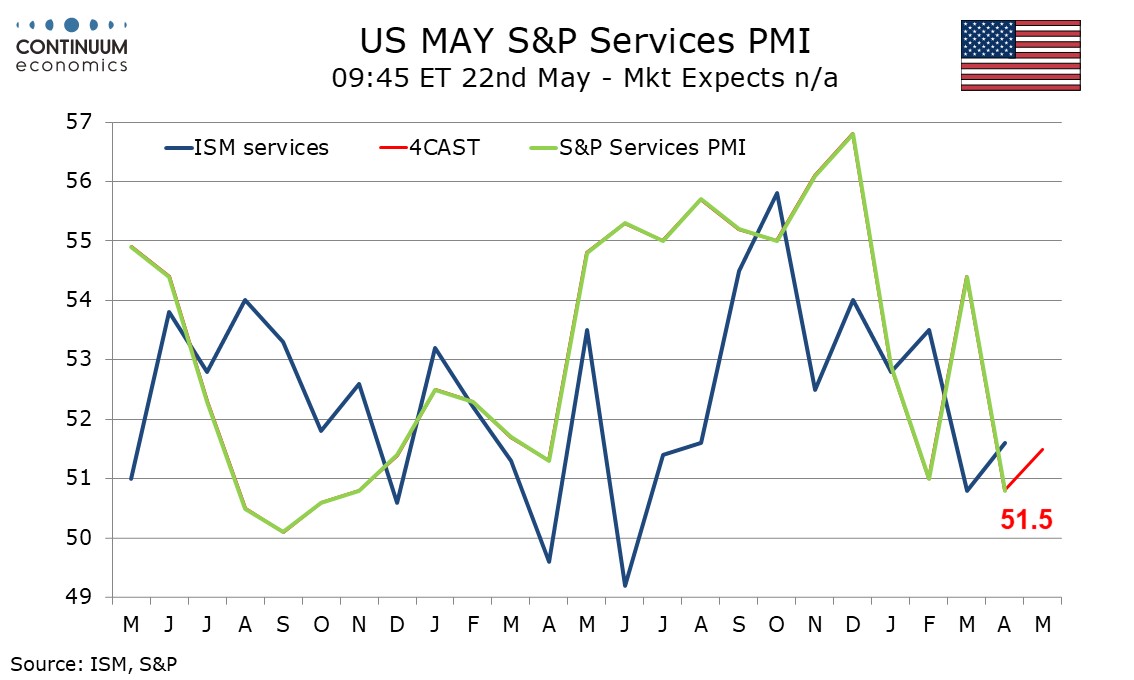

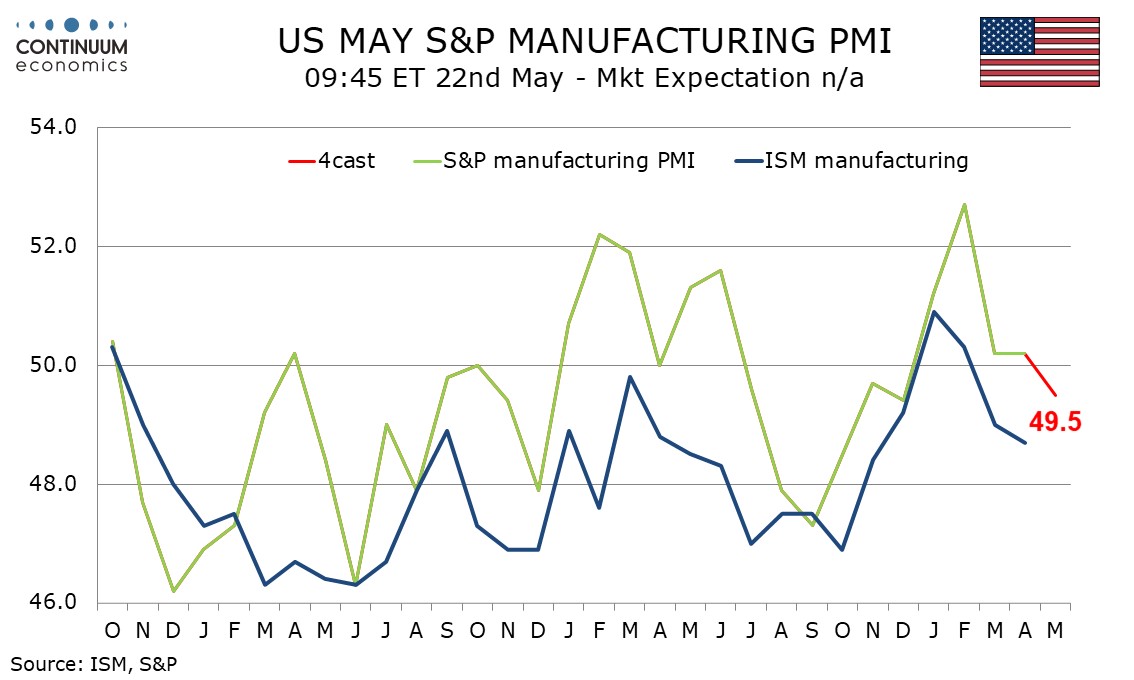

We expect May’s S and P PMIs to show slippage in manufacturing, to 49.5 from 50.2, but a correction higher on services, to 51.5 from 50.8. Underlying momentum in both series appears to be slowing, though this may fade if trade uncertainty is reduced.

Manufacturing was unchanged in April, after showing an increase in the preliminary release, and that contrasted weaker data from the ISM and most regional manufacturing surveys. That suggests slowing is likely in May’s S and P index. Reduced tariffs on China may reduce the downside risk, but probably came too late to give the index a lift.

A modest rise in the S and P services index would put it at a level consistent with April’s ISM services index, though most regional service surveys were weaker in April. The ISM and S and P services indices have been volatile with monthly moves often in opposite directions, but both have moved off recent highs as tariff fears have undermined consumer confidence, while holding above the neutral 50.