EUR, JPY, USD flows: Quiet on Thanksgiving, EZ CPI awaited

USD recovers back to Wednesday's late afternoon European levels

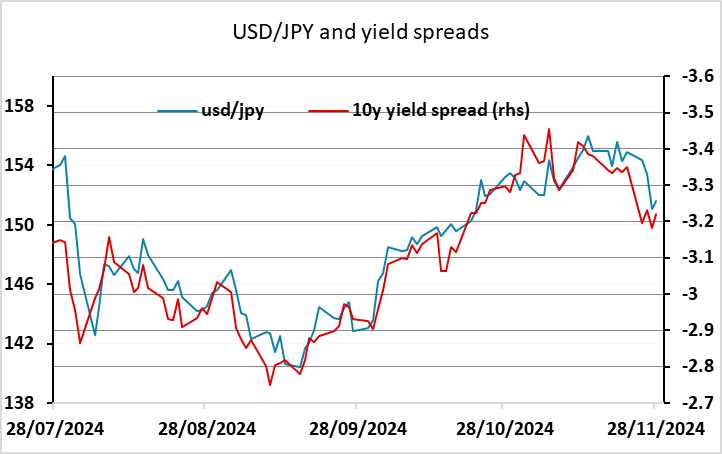

A fairly quiet overnight session saw the USD recover the losses seen around European close on Wednesday, but without any obvious triggers. The Wednesday decline came in the wake of US PCE data that was essentially in line with expectations, and probably reflected pre-Thanksgiving squaring rather than any fundamentally driven move. USD/JPY has seen the biggest round trip, but there has been little net movement since 15:00 GMT yesterday.

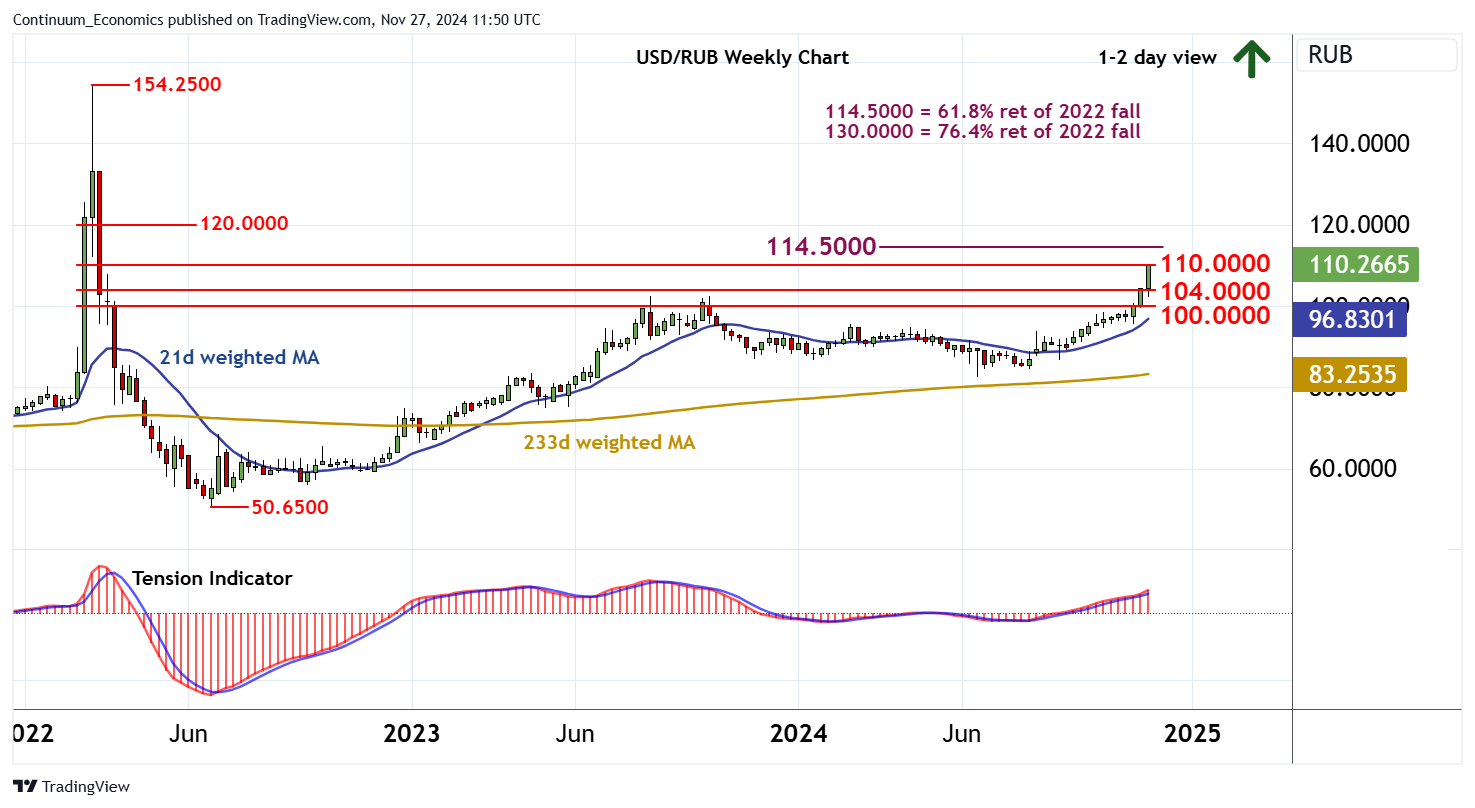

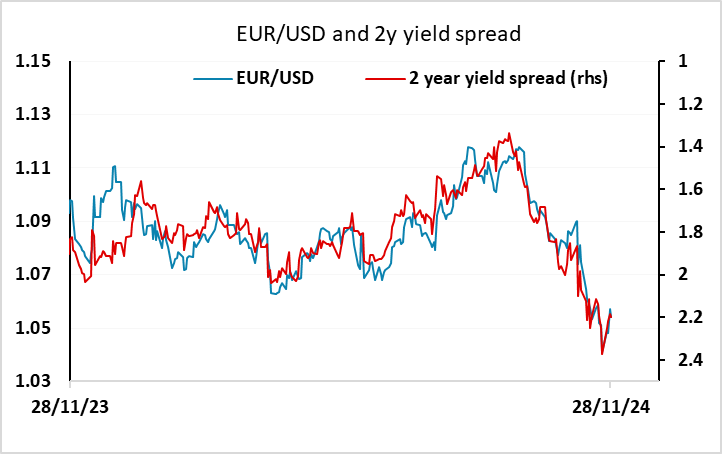

The Spanish and German CPI data will be the main focus today, with lower than expected numbers needed to keep the hopes of a 50bp ECB cut in December alive. Otherwise, EUR/USD and USD/JPY are essentially in line with short term yield spread correlations, so big moves seem unlikely. However, there is some geopolitical uncertainty, with weakness in the Russian rouble seen as a sign that Russia no longer has the ammunition to prop up the currency. This could have ramifications that go beyond economics, so may mean some nervousness. The CHF and JPY may therefore be the favoured currencies.