Published: 2024-07-22T11:56:57.000Z

Preview: Due July 23 - U.S. June Existing Home Sales - Pending home sales suggest weakness

5

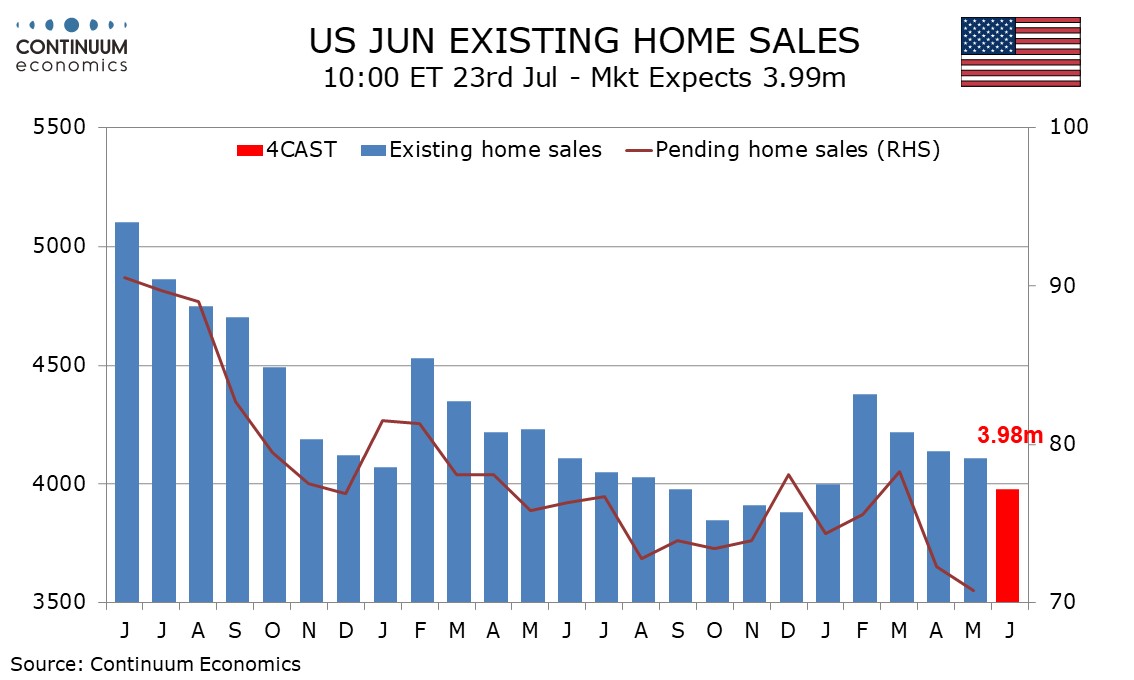

We expect June existing home sales to fall by 3.2% to 3.98m. This would be a fourth straight fall and a steeper one than May’s 0.7% decline. The level would be the weakest since December 2023.

Most housing sector signals have been moving lower recently, in particular pending home sales, which are designed to predict existing home sales and in May fell below the lows seen at the height of the pandemic. Existing home sales are unwinding a sharp rise seen in February. Something similar happened after a sharp rise in February 2023 and June 2023 saw renewed slippage after a pause in May. Should the Fed get closer to easing however, the picture may start to improve.

We expect a seasonal gain on the month in the median price of 2.5% but this would be a little slower than in both April and May and would see yr/yr growth slip to 4.8% from May’s 19-month high of 5.8%.