Published: 2023-12-12T16:54:49.000Z

Preview: Due December 22 - U.S. November Durable Goods Orders - Trend still marginally positive

Senior Economist , North America

-

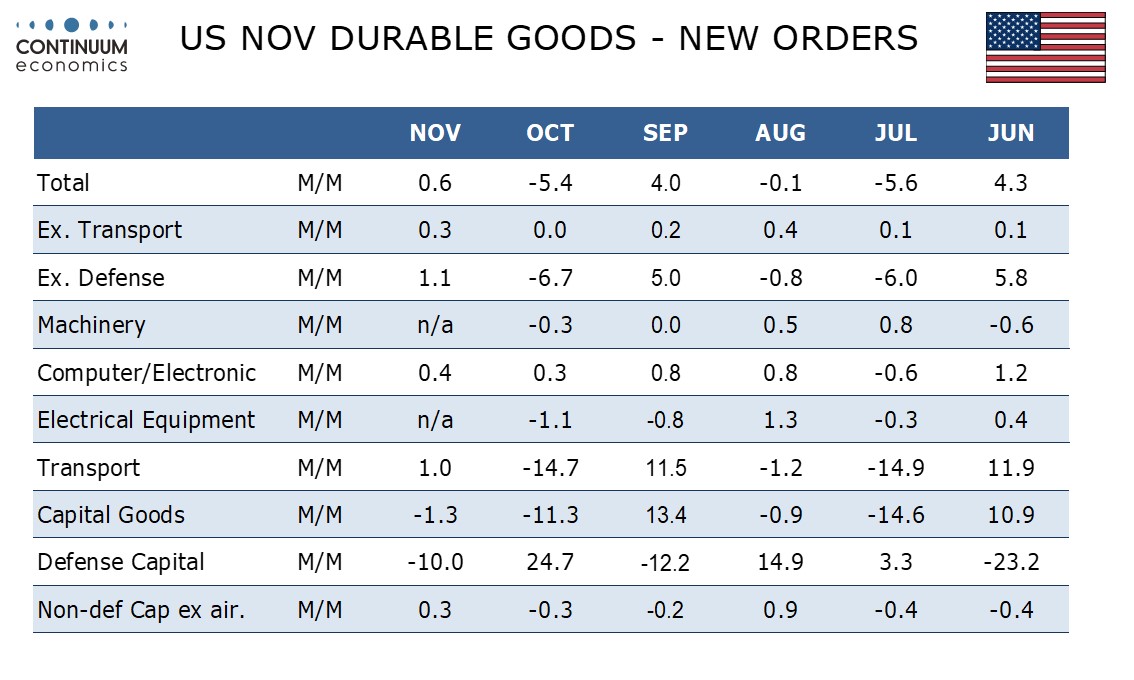

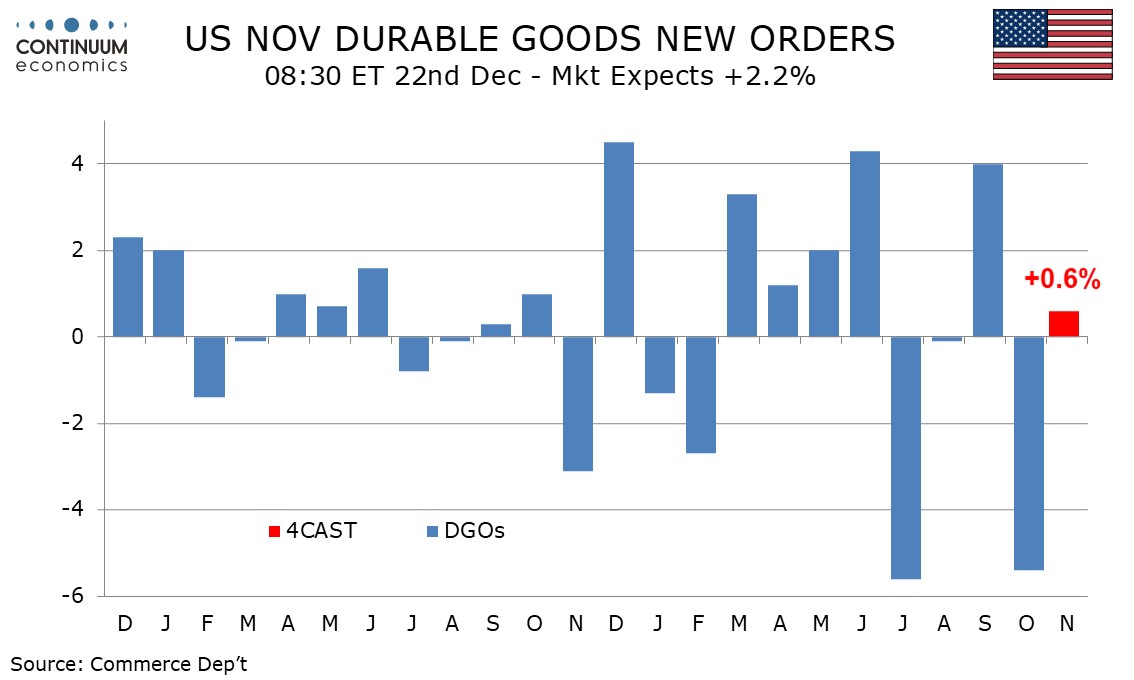

We expect November durable goods orders to see a 0.6% increase overall with a modest 0.3% increase ex transport, the latter keeping underlying trend marginally positive after a flat October ex transport outcome.

We expect a modest 1.0% increase in transport orders after aircraft reversed a sharp September rise in October. Boeing data suggests aircraft will see little change in November but we expect a rise in autos after two straight declines, assisted by the end of strikes. Defense however, which has a large overlap with transport, may correct from October strength. We expect orders to rise by 1.1% ex defense.

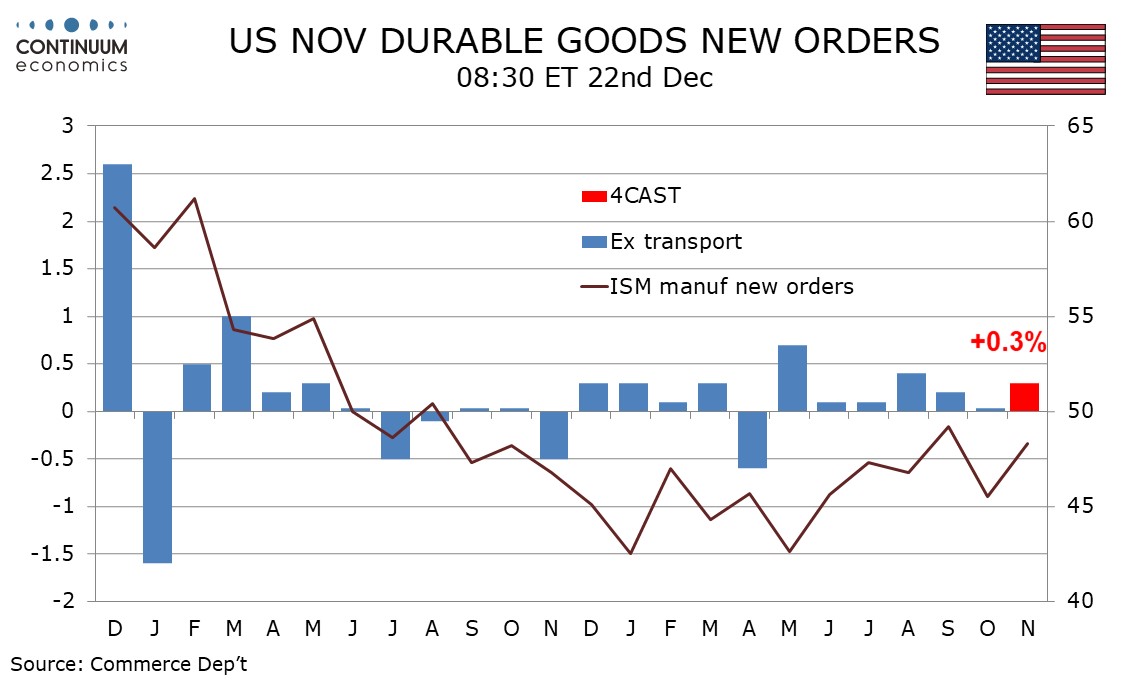

The ex-transport series has not seen a move of 1.0% in either direction for over a year with the last decline being seen in April, making October’s unchanged outcome on the low side of trend. A modest improvement in the ISM manufacturing new orders index suggests that November will see the marginally positive underlying trend resume. We expect non-defense capital orders ex aircraft, a key indicator of business investment, to also rise by 0.3%, this correcting to straight marginal declines.