U.S. March Final Michigan CSI - Even more pessimistic

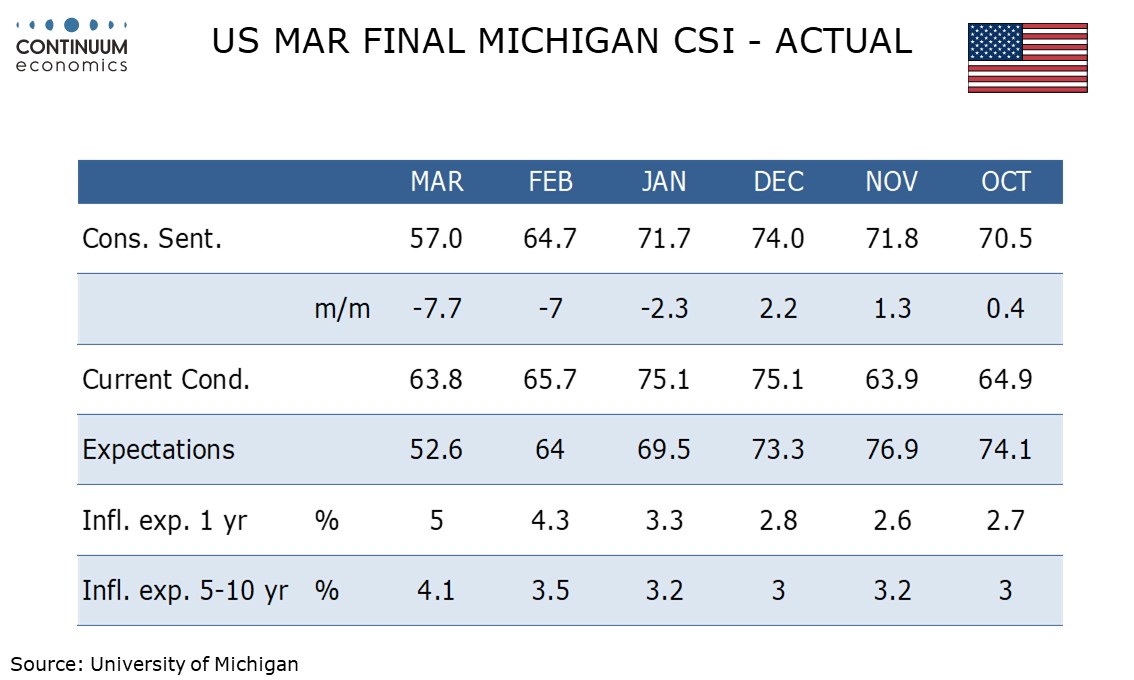

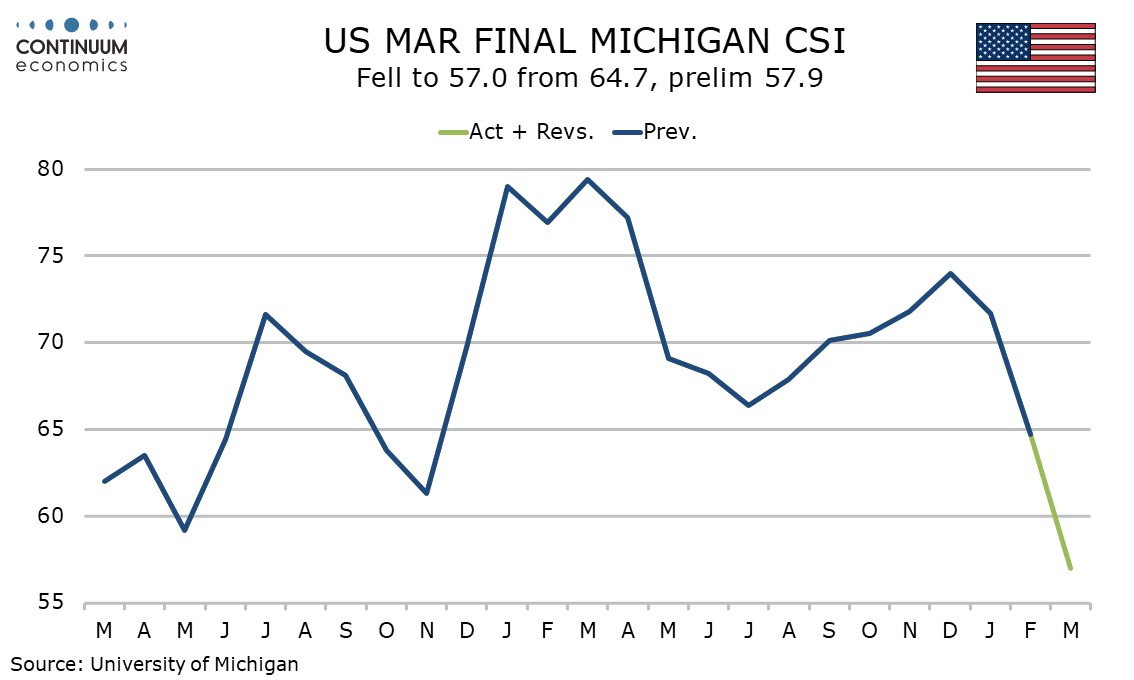

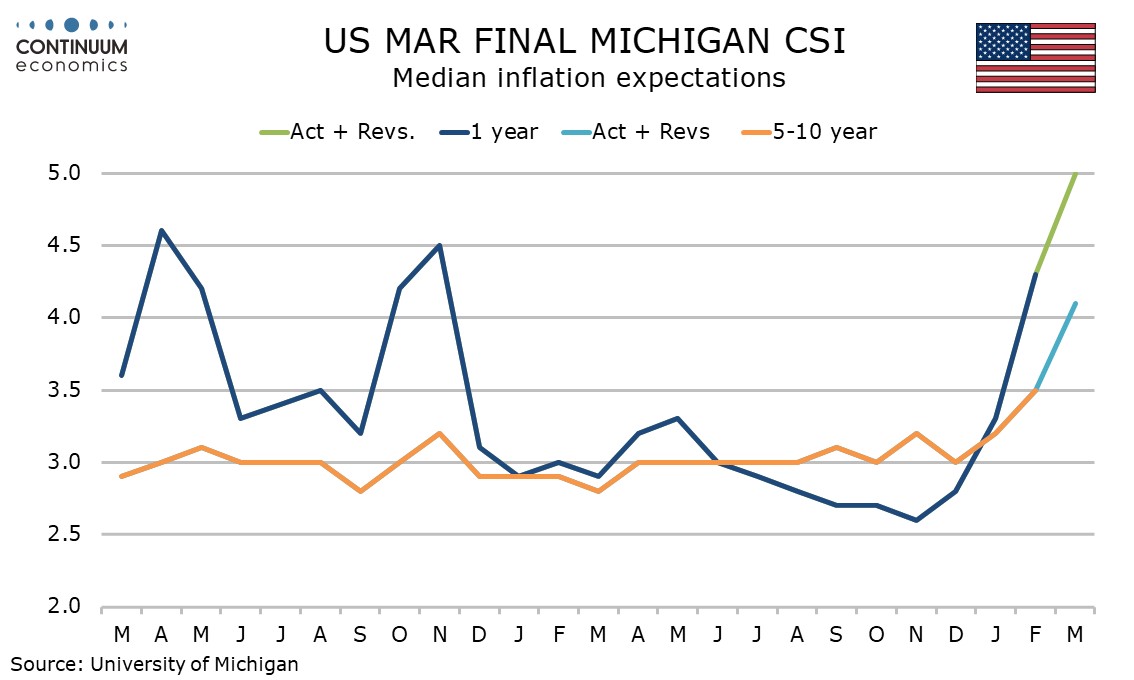

March’s final Michigan CSI does not appear to have got any support from a slightly improved equities picture, with the overall index revised down to 57.0 from 57.9, and inflation expectations even higher, the 1-year view at 5.0% from 4.9% and the 5-10 year view at 4.1% from 3.9%.

The overall index is still the weakest since November 2022.

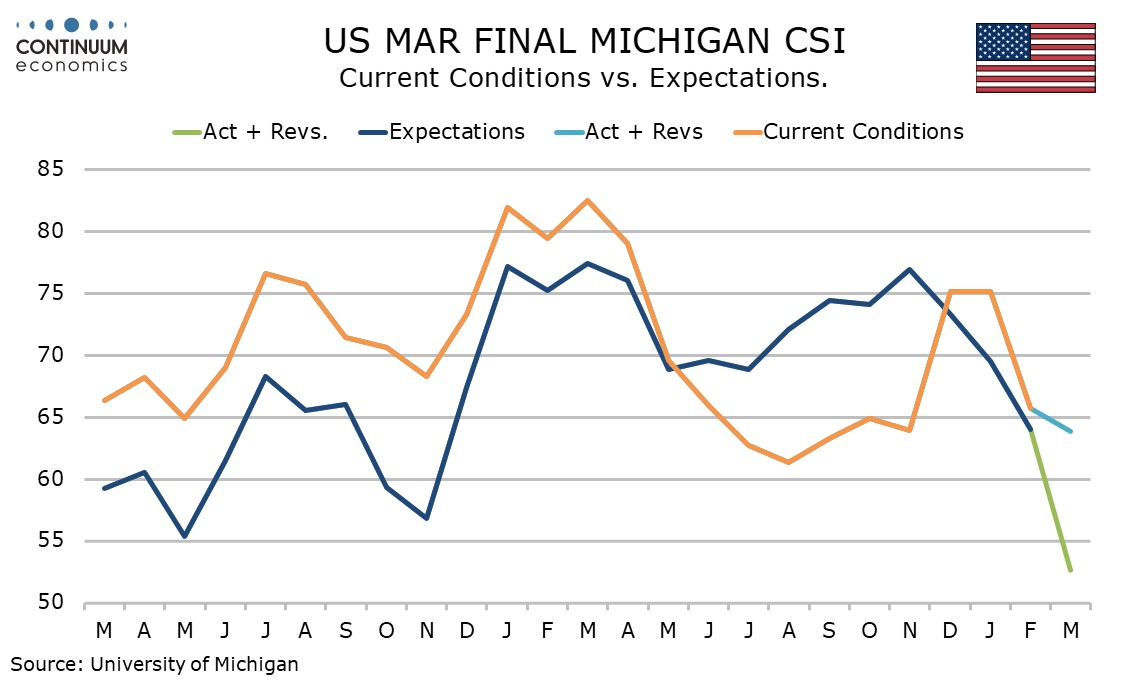

Current conditions were revised up from 63.5 to 63.8 and were weaker as recently as September 2024. Expectations were however revised down to 52.6 from 54.2 and remain the weakest since July 2022.

Inflation expectations have accelerated dramatically in the last two months after having been previously stable in the 5-10 year view near 3.0% for several years. The latest 1-year view is the highest since October 2022 but the 5-10 year view has not been this high since 1993.

There is a problem in the data with consumers often having strong political bias. Republican optimism on inflation probably has a floor near zero but there is no obvious upper bound to Democratic pessimism.