U.S. Initial Claims, Housing Starts, Philly Fed - No real surprises but consistent with a modest slowing

The latest data is all close to consensus, initial claims partially correcting a sharp rise last week, housing starts correcting a sharp fall last month but permits seeing a second straight dip while the Philly Fed corrected from a strong preceding month but remains positive. All this is consistent with an economy losing some momentum but with no sign of any real weakness.

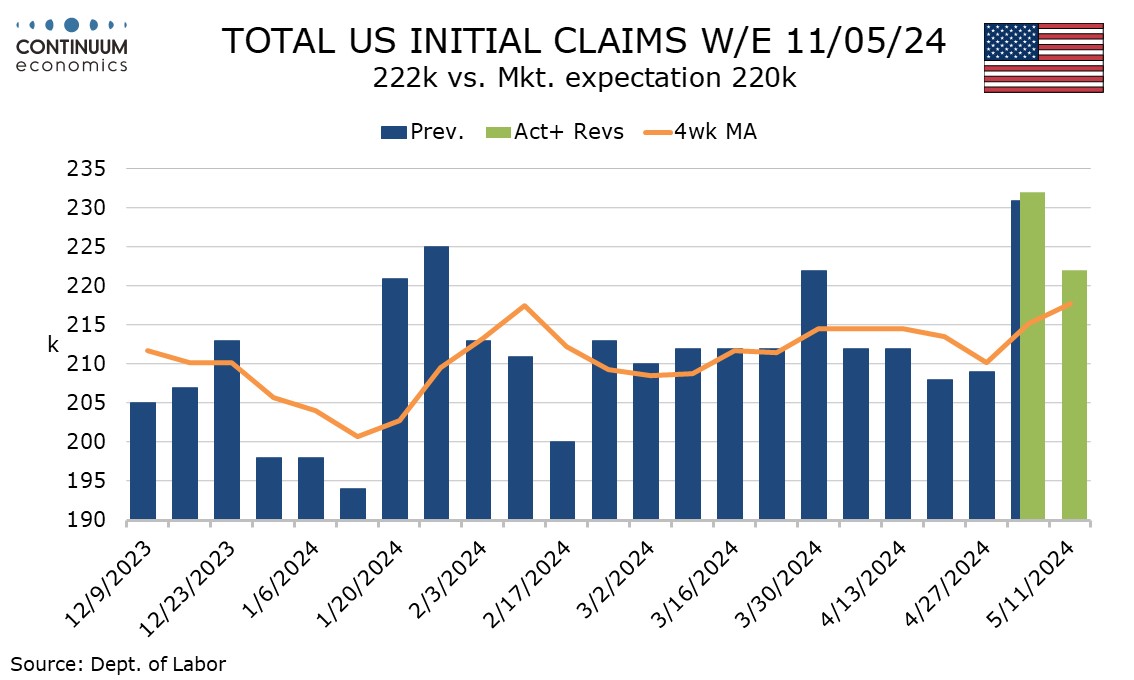

Last week’s initial claims outcome of 232k (revised from 231k) was the highest since August 26, but was treated with skepticism with around half of the rise coming in New York. The latest outcome of 222k is, apart from last week, the highest since March 30 where Easter may have caused seasonal adjustment problems, and suggests trend is starting to move higher. The 4-week average of 218k is the highest since November 2023 but has not moved very much.

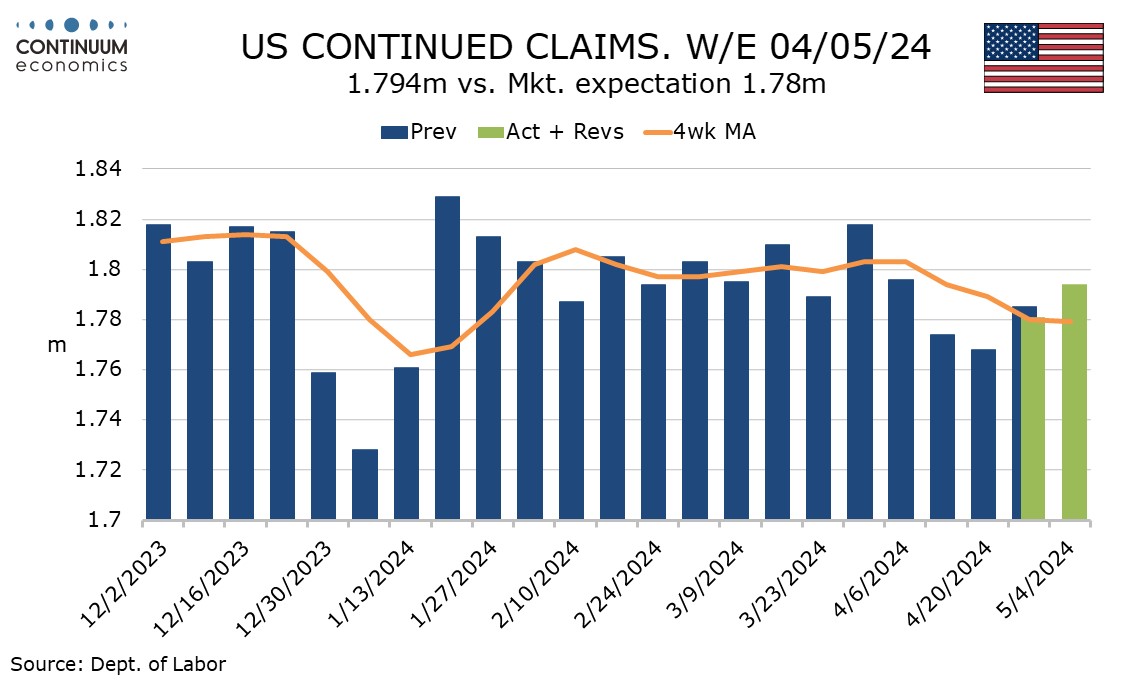

Continued claims, covering the week before initial claims, rose by 13k to 1.794m, a second straight rise after three straight declines. Here the 4-week average continues to edge lower. Signs of labor market slowing are still marginal but after a slower April non-farm payroll increase, they are notable.

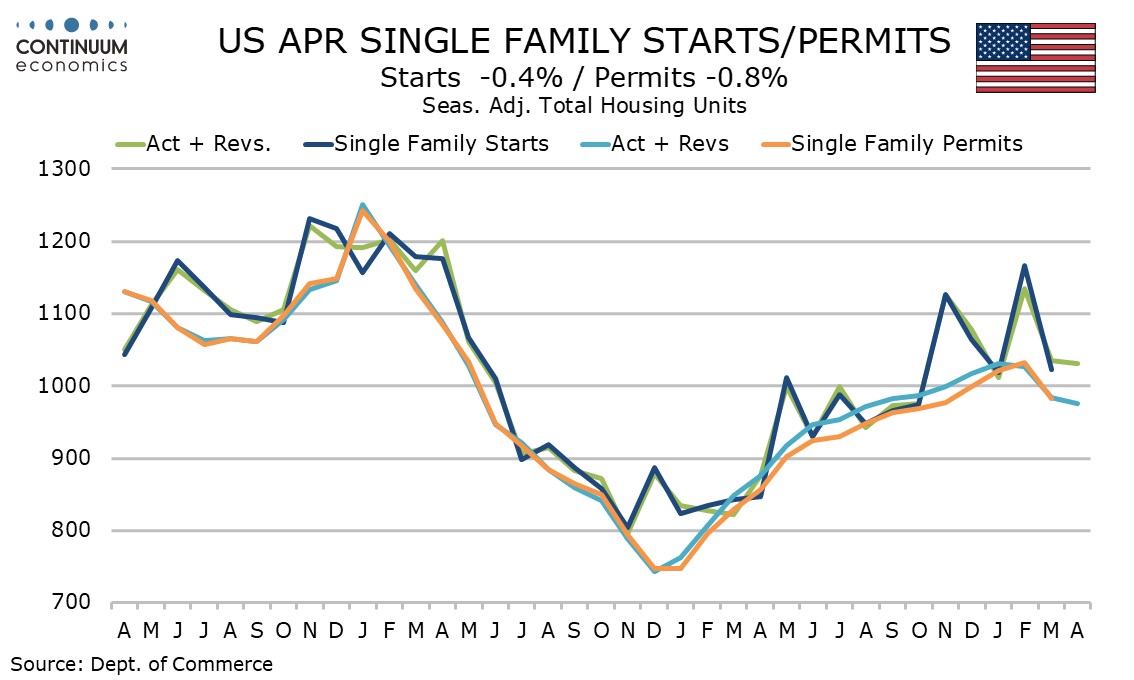

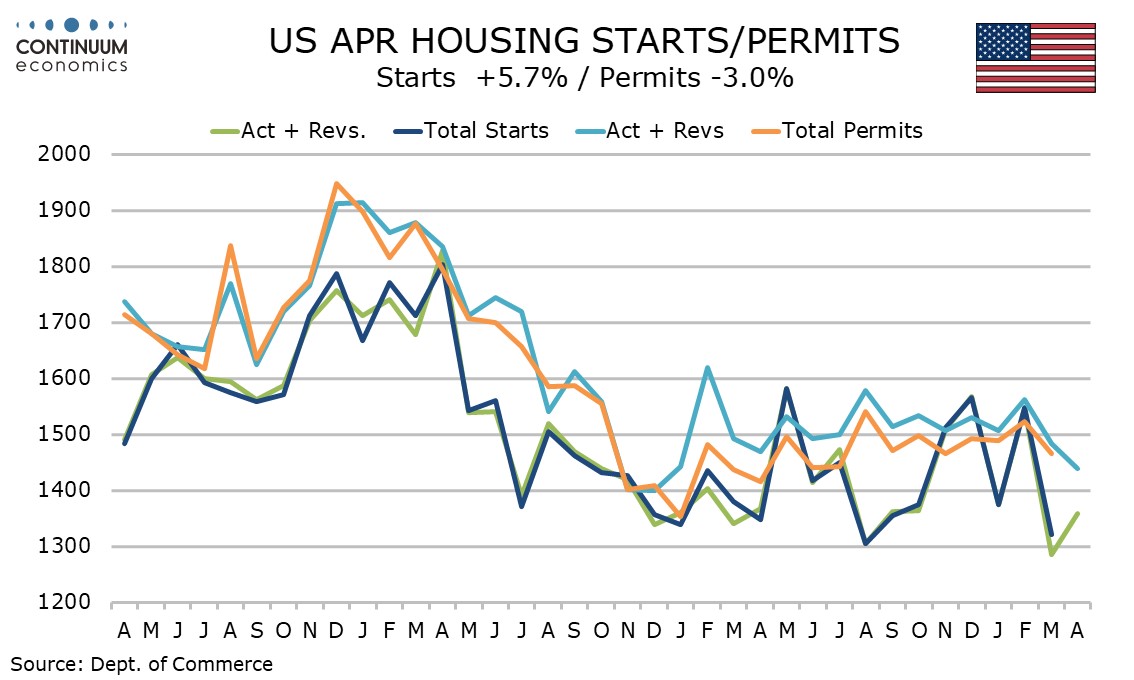

April housing starts rose by 5.7% to 1360k after a 16.8% March decline though single starts fell by 0.4%, a second straight decline, if not completing a reversal of a strong February rise. Permits with a 3.0% April decline to 1440k extended a 5.0% March decline. Permits saw only a 0.8% decline in singles, but this is a third straight decline to follow twelve straight gains. This suggests trend is starting to weaken in response to gains in mortgage rates in Q1.

May’s Philly Fed reading of 4.5 was still positive if slower than April’s 15.5 which outperformed most other manufacturing surveys. May’s details are quite soft, with new orders slipping to -7.9 from a positive 12.2 and indices for employment and the workweek remaining negative. Six month expectations for activity however are still quite firm at 32.4 if down from 34.3 in April.