Published: 2024-01-17T14:54:20.000Z

Preview: Due January 18 - U.S. December Housing Starts and Permits - November starts bounce unlikely to be sustained

Senior Economist , North America

-

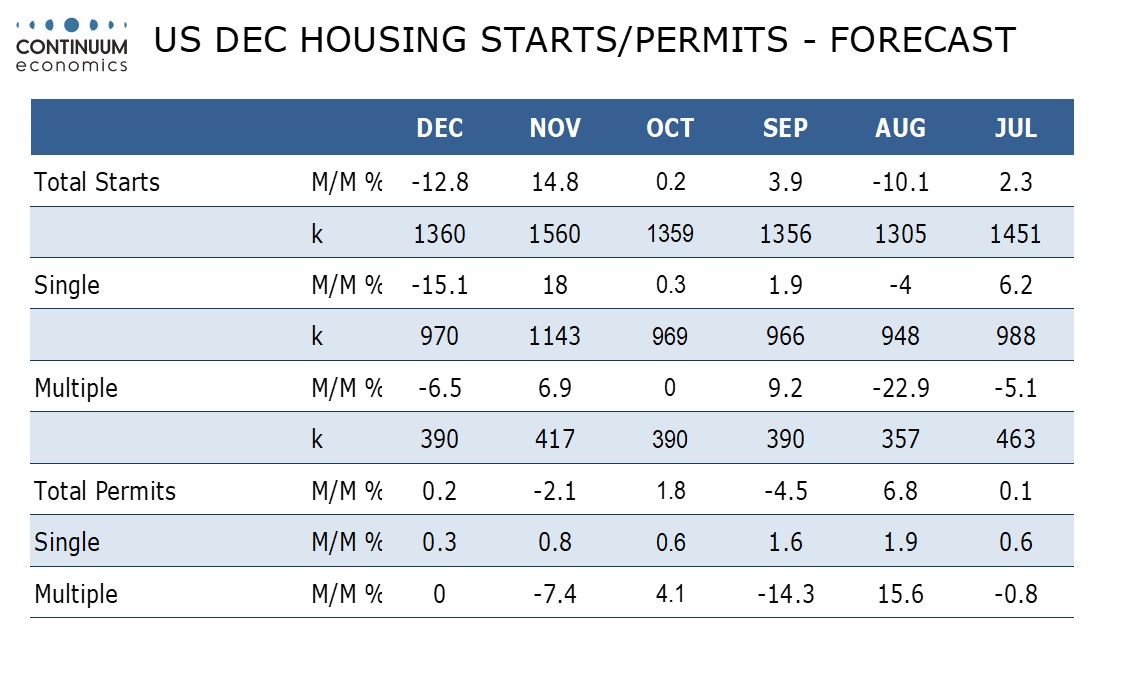

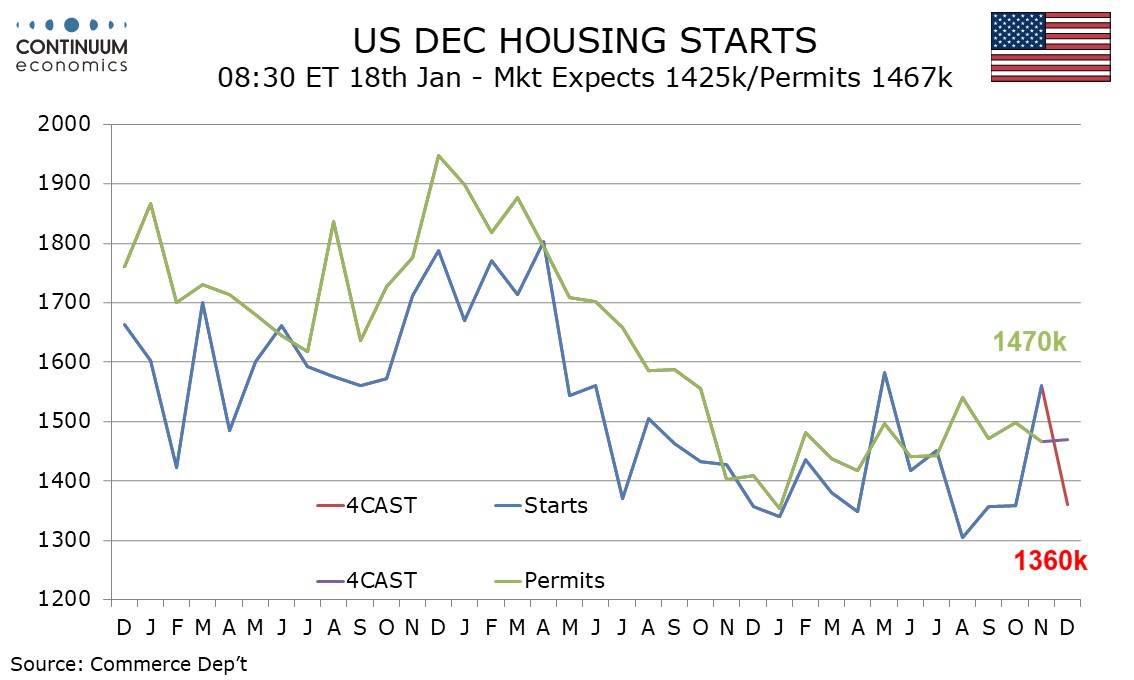

We expect December housing starts to fall by 12.8% to 1360k, largely reversing what looks like an erratic 14.8% November increase, while permits rise by a marginal 0.2% to 1470k, following a 2.1% decline in November.

Housing demand slipped in response to higher mortgage rates, though new home sales have been more resilient as has residential construction, and more recent declines in mortgage rates may be putting a floor on demand.

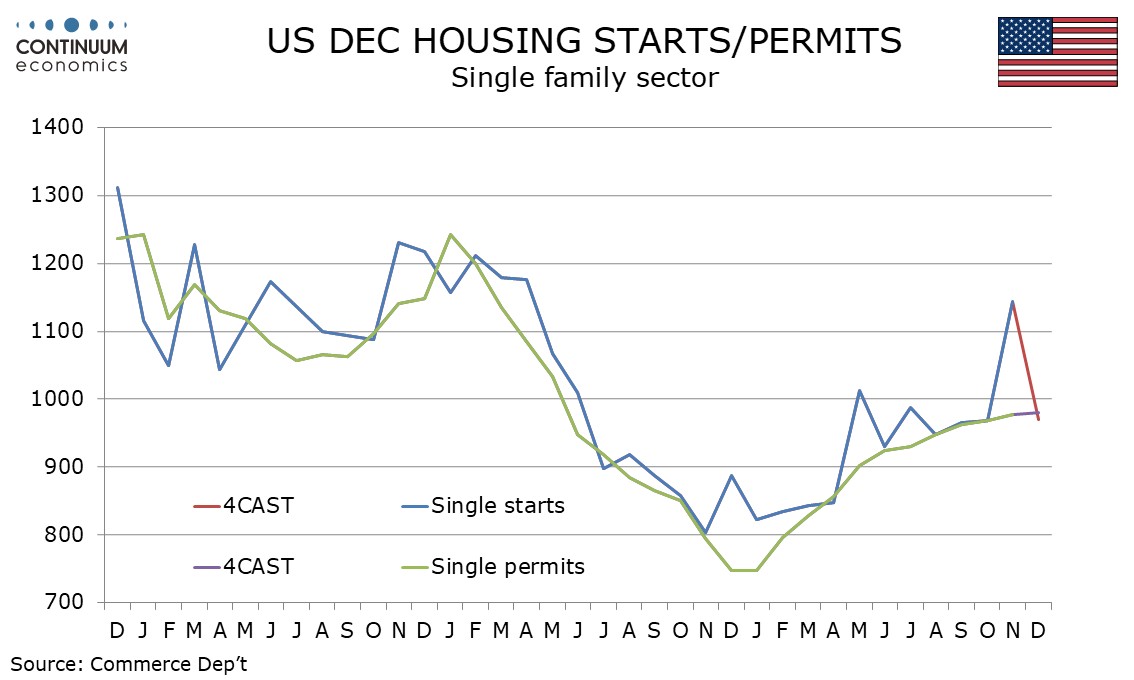

We expect single starts to fall by 15.1% after an out of trend 18.0% November increase, while single permits rise by 0.3%, which would be the slowest of 11 straight gains. The uptrend has been losing momentum with the last two gains coming in below 1.0%.

In the usually more volatile multiple sector we expect starts to fall by 6.5% after a 6.9% November increase and permits to be unchanged after falling by 7.4% in November, a rise that corrected a 4.1% October increase.