USD, JPY flows: Hassett triggers risk recovery, but...

Hassett suggestion that there may be a 90 day pause in tariffs has stabilised things for now, but enough damage has been done to suggest any JPY decline is a buying opportunity

We’re seeing a general rally in equity markets helped by comments from White House economic adviser Kevin Hassett saying Trump is considering a 90-day pause in tariffs for all countries except China. This has also helped trigger some moves out of the safe haven currencies, with USD/JPY rising back above 147 and EUR/CHF back above 0.94. We still see the damage that has already been done to equity markets justifying further JPY gains, but short term positioning is likely to be adjusted away from the safe havens. A pause in tariffs would be welcome compared to the alternative, but also wouldn’t be ideal as it would preserve uncertainty. It might also mean a further big surge in imports to the US as firms try to build inventory before tariffs are imposed.

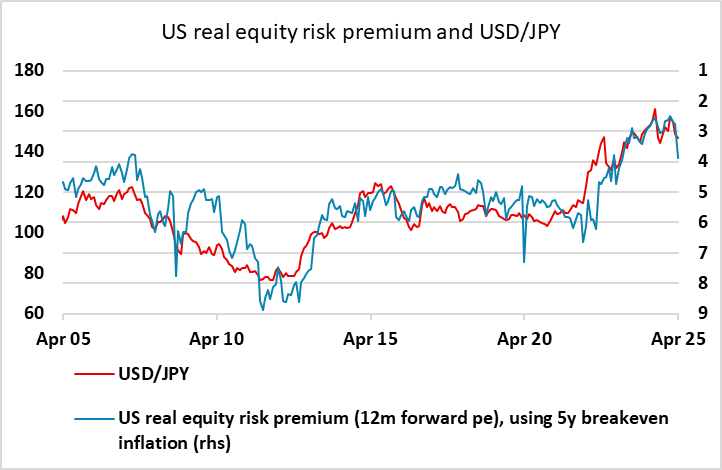

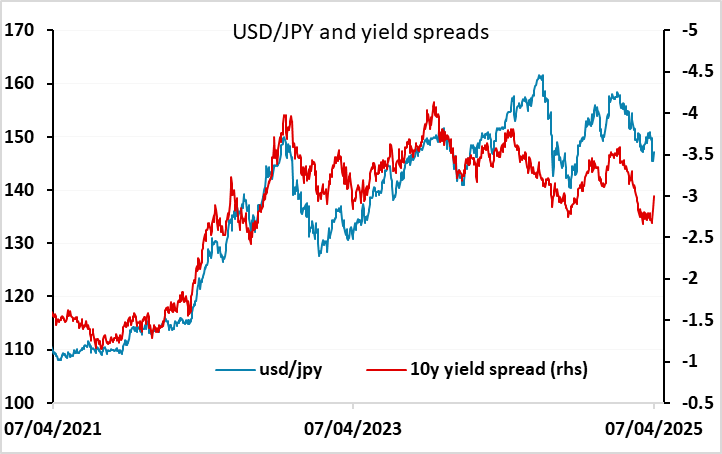

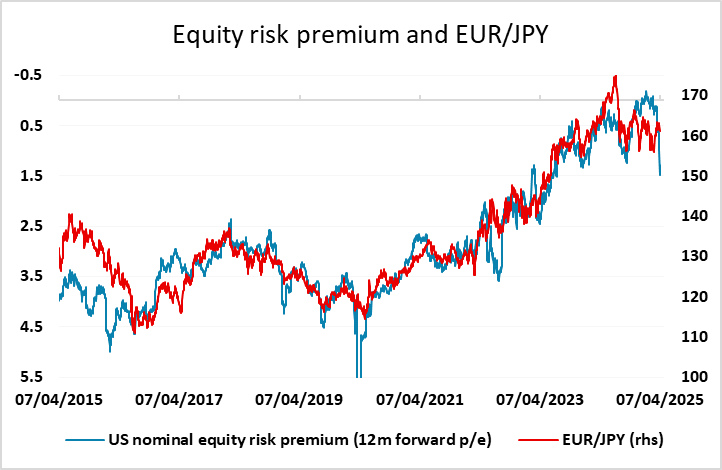

So it’s enough to stabilise things for now, but as long as the threat hangs over the market, we wouldn’t see much case for a significant equity market rally. Remember also that the US market is still expensive relative to bond yields, and Europe no better than fair. To see this as a longer term equity market buying opportunity would require a belief that growth will be at or above trend, which seems a heroic assumption at this point. Similarly, even if we see some risk positive moves short term, we have already seen sufficient damage to equities and sufficient movement in yield spreads to justify substantial gains in the JPY.