EUR, USD flows: USD remains under pressure

USD still under pressure, 10 year yields still rising despite weaker PPI

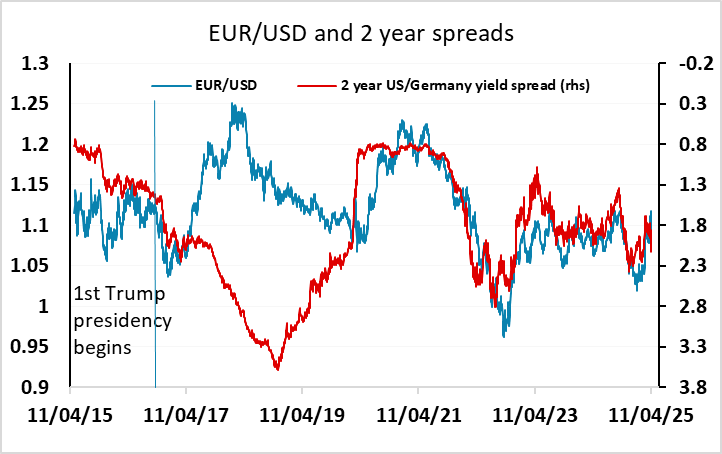

The USD remains under pressure, losing a little ground after a weaker than expected PPI, but the data is currently irrelevant with price increases set to be much more substantial in the coming months as the effects of the tariffs kick in. It is also notable that US 10 year yields continue to rise, perhaps partly due to technical factors, but the simultaneous decline in US equities and bonds suggests some general loss of confidence in the US. The market may also be responding to the expectation of Fed easing against a background of rising inflation. In practice, the Fed may well not ease to the extent that the market is pricing in. The 100bp of rate cuts priced in for this year are 50bps more than indicated by the dots at the March FOMC, and it may be that many FOMC members are resistant to aggressive cuts in a rising inflation environment, even if the rises prove to be one off. If the higher yields persist they may provide some USD support down the road if the US economy proves more resilient than expected. However, it was notable in the first Trump presidency that EUR/USD (and the USD in general) weakened dramatically in the first half of his term, moving in the opposite direction to yield spreads. We may be in for a repeat if the loss of confidence persists.