Published: 2025-04-23T12:57:06.000Z

Preview: Due April 24 - U.S. March Durable Goods Orders - Aircraft to rise, ex transport to correct lower

1

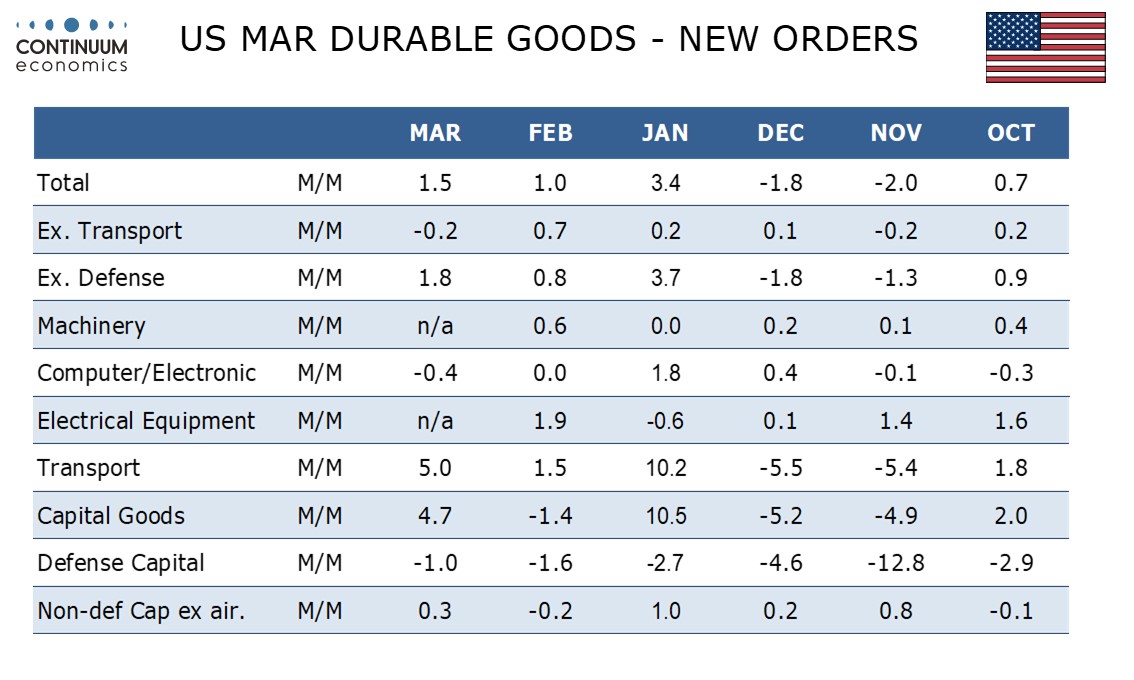

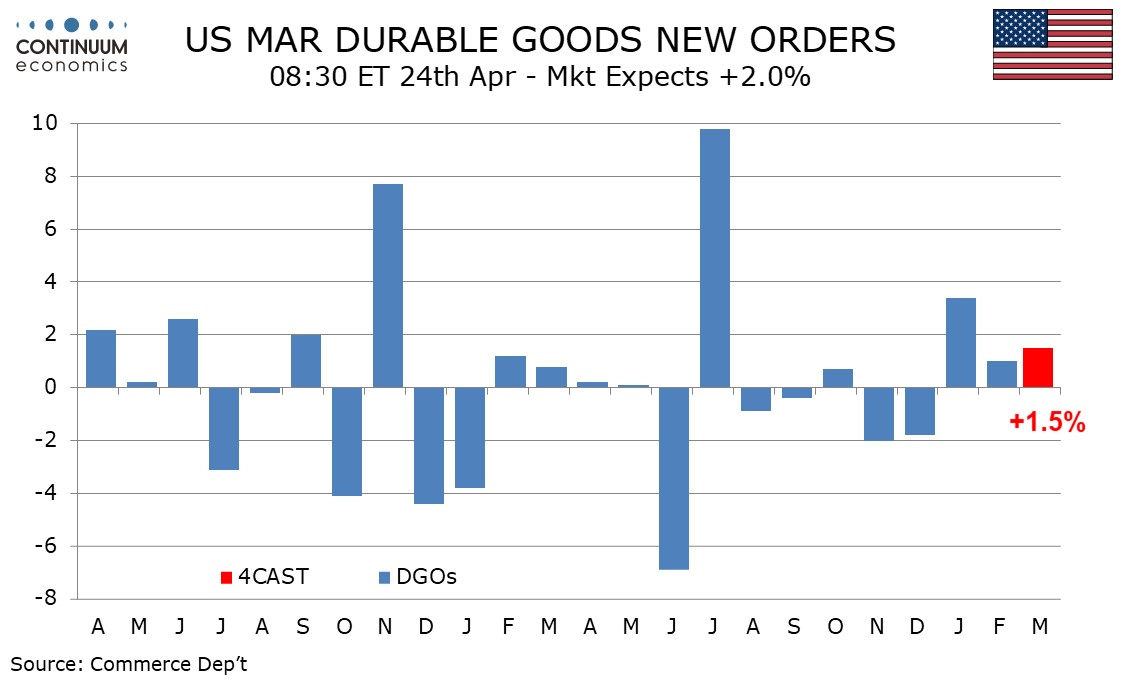

We expect March durable goods orders to increase by 1.5% overall led by a strong rise in aircraft but ex transport we expect a 0.2% decline to correct a 0.7% increase in February.

Boeing reported a strong rise in orders in March and that is likely to lead a 5.0% increase in aircraft. Autos are also likely to contribute. We expect a negative contribution from defense after a positive in February. Ex defense we expect orders to rise by 1.8%.

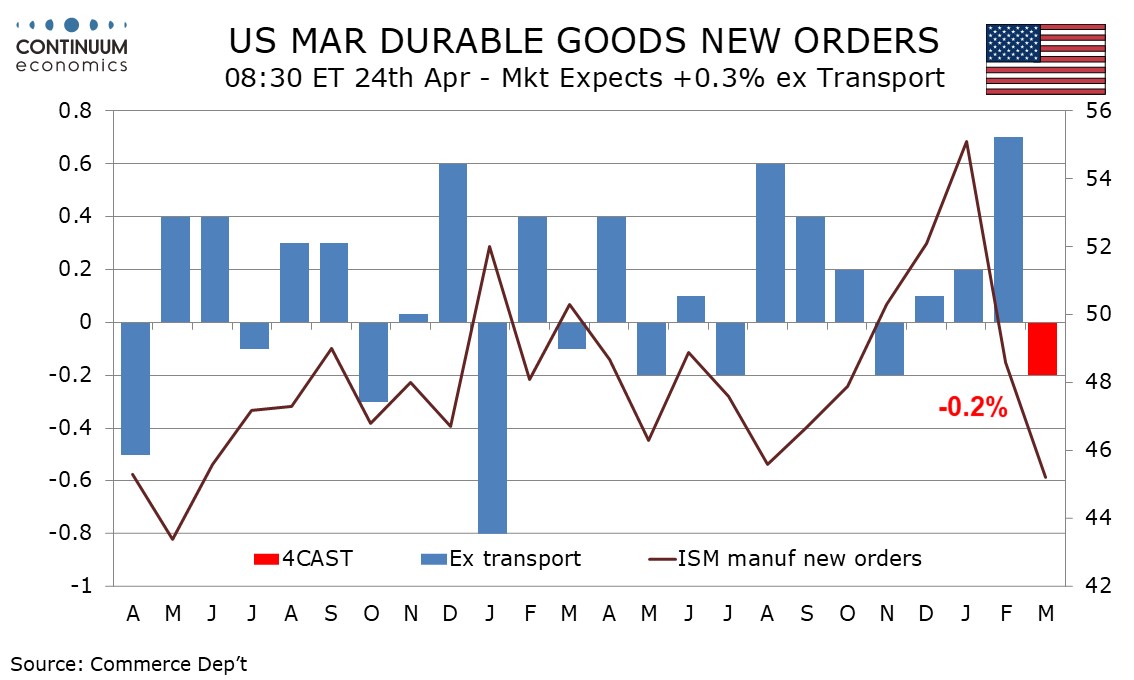

An above trend 0.7% increase in February orders ex transport looks like a lagged response to a strong January ISM manufacturing new orders index. The ISM index slipped back in February and weakened further in March, suggesting downside risk, even ahead of the April 2 tariff announcement.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to rise by 0.3%, outperforming the ex transport series after February underperformed with a 0.2% decline. Trends in both series are modestly positive, with non-defense capital ex aircraft marginally the firmer.