RBNZ Review: Higher Rates for Longer

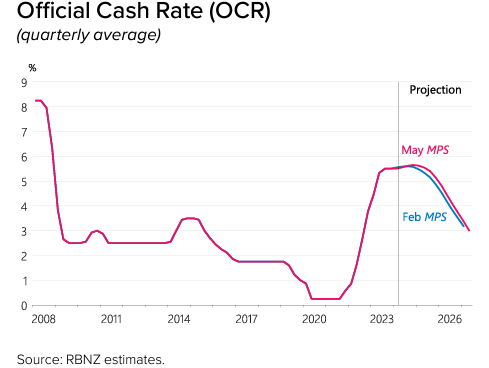

RBNZ kept rates unchanged at 5.5% but revised OCR path in 2025 almost one 25bps hike higher

RBNZ Kept Rates Unchanged

Thee OCR path has been revised higher in the May meeting, mostly in 2025 and thus not suggesting an imminent hike but rather higher for longer. Some key takeaways:

- Restrictive Policy is Working: "Restrictive monetary policy has reduced capacity pressures in the New Zealand economy and lowered consumer price inflation." .The RBNZ continue to expect CPI to return to the one to three percent target range by end 2024.

- Service Inflation's Stubbornness Delays Easing: "...services inflation is receding slowly, and expected policy interest rate cuts continue to be delayed.". While goods inflation cools, RBNZ highlights that service inflation is moderating slower than expected and will be delaying the planned rate cuts.

- OCR Revised Higher: The OCR has been revised higher but mostly in 2025. By September 2025, the OCR forecast has been revised almost 25bps higher and around 3% by mid 2027. The revision seems to suggest the RBNZ is not looking for an imminent hike, rather OCR will be staying higher for longer.

The key to the May meeting from the RBNZ is the upward revision of OCR due to service inflation remain stubborn. However, the RBNZ is also aware capacity pressure and labor market is softer and will be contributing to a cooler domestic inflation. The difference in sensitivity to interest rate is the reason why the RBNZ would rather keep rates higher for longer than further tightening. The inflation forecast is close to unchanged with previous meeting.

Given the current inflation dynamics and RBNZ's upward revision in OCR path, we do not see both a hike or cut being imminent.