This week's five highlights

U.S. February CPI Stronger than Preceding

BoJ Keep Market on their Toes

USD/JPY Front Running

UK GDP Shows Emerging Recovery but Remains Fragility

Lunar New Year Boosts Chinese CPI But Disinflation Still In Place

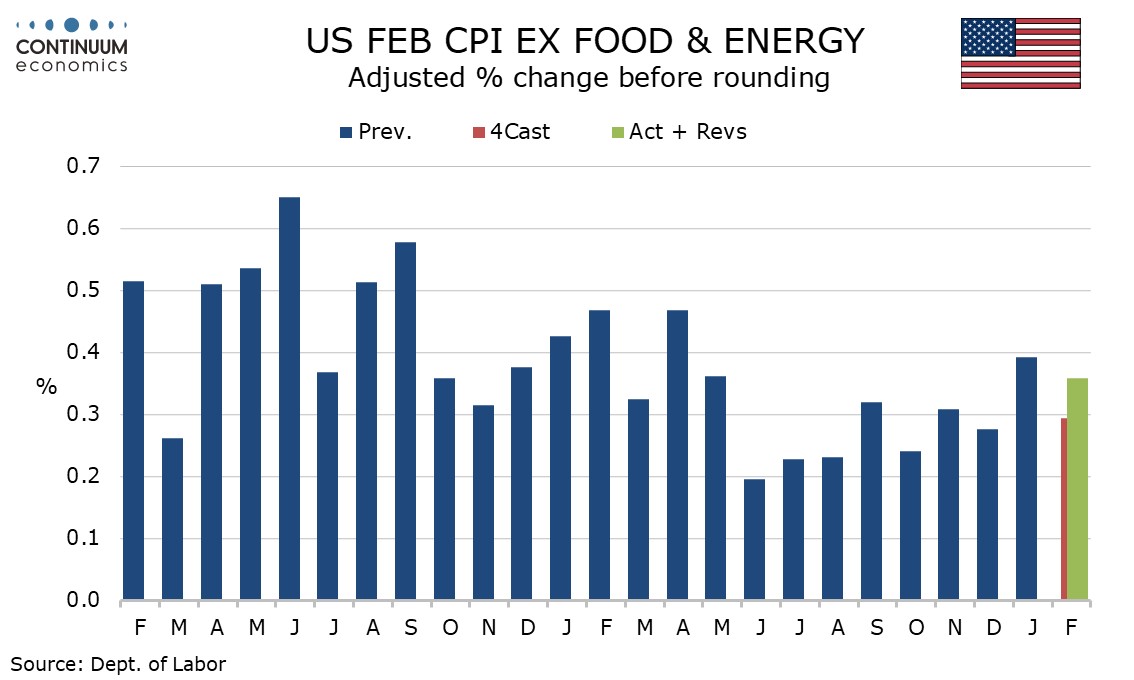

February CPI has produced a second straight rise of 0.4% in the core rate ex food and energy, showing that with the economy remaining firm, inflationary pressures still persist. Overall CPI also rose by 0.4%, this in line with consensus. Before rounding the gains were 0.358% in the core and 0.442% overall. The data was a little more balanced than in January, with commodities ex food and energy rising by 0.1% after falling by 0.3% in January, while services less energy slowed to a still quite firm 0.5% pace from January’s 0.7%. Energy with a 2.3% rise provided an expected boost led by gasoline that is visible in the data before rounding though food was unchanged.

The 0.358% rise in the core rate before rounding was only a modest surprise and slower than January’s 0.392%, though the first two months of 2024 are stronger than the final seven months of 2023, which suggests that the acceleration in the economy in the second half of 2023 is having some feed through into underlying inflationary pressures.

Our central forecast is for the BoJ to change forward guidance in March, indicating trend inflation will be achieving target and ultra-ease monetary policy is no longer necessary and hike interest rate to 0% in April as wage growth has accelerated and the latest wage negotiation is likely to ensure wage continue to growth at an faster pace. Yield curve control is only existing in name for months, thus it is not of critical importance when the BoJ officially announce its removal. Given the current development, March maybe the time for the BoJ to scrap the yield curve control policy.

In the March meeting, the BoJ will change their forward guidance to they now see trend inflation target being reached and ultra-loose monetary policy is no longer appropriate. It is clear that BoJ think it will be a 50-50 call for a hike in March or April as they emphasize the need to see the result of wage negotiation that is expected to be completed three days before the March BoJ meeting. While headline wage growth reached 2% (a level Ueda mentioned would be favorable for trend inflation to achieve target) and early signs of wage negotiation suggesting higher wage hike than expected (Toyota accepted hike request of 5.5% and multiple unions said at least a 5% hike was accepted by large companies), headline inflation had moderated faster than expectation and there is no rush for the BoJ to tighten policy.

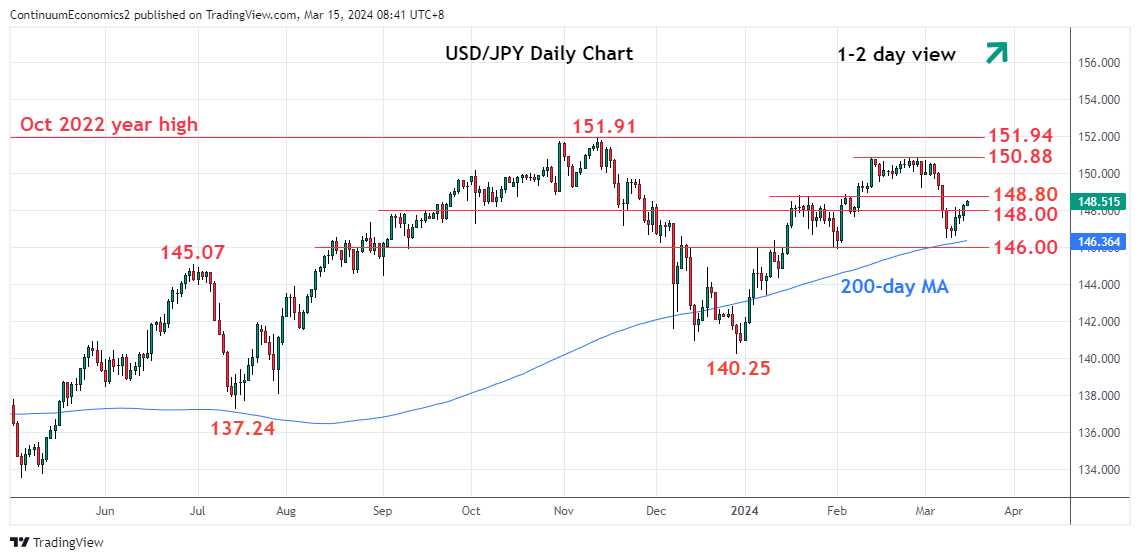

Before the monetary policy changes are announced, USD/JPY had already did its rounds. We see USD/JPY dropped last week in anticipation of policy change in the March meeting as labor cash earning reached 2% and wage negotiation results are doing good. This week we are beginning to see such move partially reversed as a March tightening looks unlikely with the latest rhetoric from BoJ despite the Japanese cabinet officially announced the end to deflation. The ebb and flow will continue until we see the forward guidance from the BoJ.

On the chart, the break above the 148.00 level clears the way for stronger correction from the 146.48 low. Higher see room to the strong resistance at the 148.80/149.20 area which is expected to cap. Correction seen giving way to selling pressure later and break of the 147.00 level and 146.48 low will see room to further extend losses from the 150.88 high. Lower will see room to the 146.00/145.89 congestion and February low and where break here will open up deeper pullback to target 145.55, 50% Fibonacci retracement, then the 145.00 level.

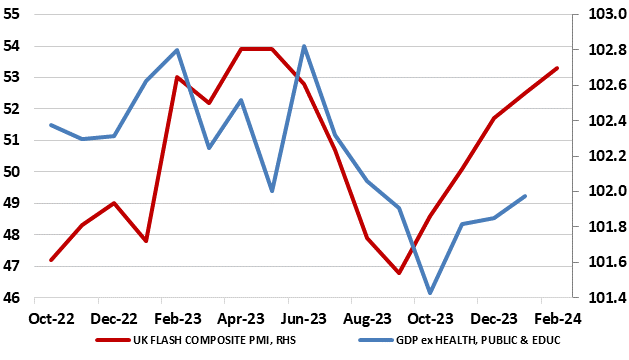

Figure: Tentative Recovery – But PMI A Poor Guide to GDP Swings?

Coming in as largely expected, and despite industrial action, GDP rose by 0.2% m/m in January more than reversing the 0.1% drop in December data, a result that reflected the bounce in retail sales and recovery in construction. The data does look as if the economy is recovering, albeit with the pick-up nothing more than a continuation of the monthly swings seen of late, which still suggest a drop of 0,1% in the last three months. Notably, the apparent recovery, and in contrast to the message of business surveys, is still very much dependent upon non-cyclical parts of the economy, in particular public services, which are likely to come under pressure from spending restraint in the medium term. We remain cautious on the scale and pace of recovery although it now looks more likely that the economy this quarter will grow by 0.1% q/q, a result in line with current BoE thinking, but where policy by the latter is being shaped by price and costs developments not real activity.

The data does seem to chime with business survey data. As for the economic outlook, our relatively gloomy scenario, which still sees nothing better than zero growth in 2024, may seem to be in conflict with survey data that have seemingly shown some degree of resilience in the last few quarters. Indeed, PMI data have perked up late but these numbers have been very poor indicators of actual GDP swings in recent years (Figure), especially the composite measure which excludes the public sector. The data also excludes construction and retailing, perhaps the key sectors most affected by policy both monetary and fiscal.

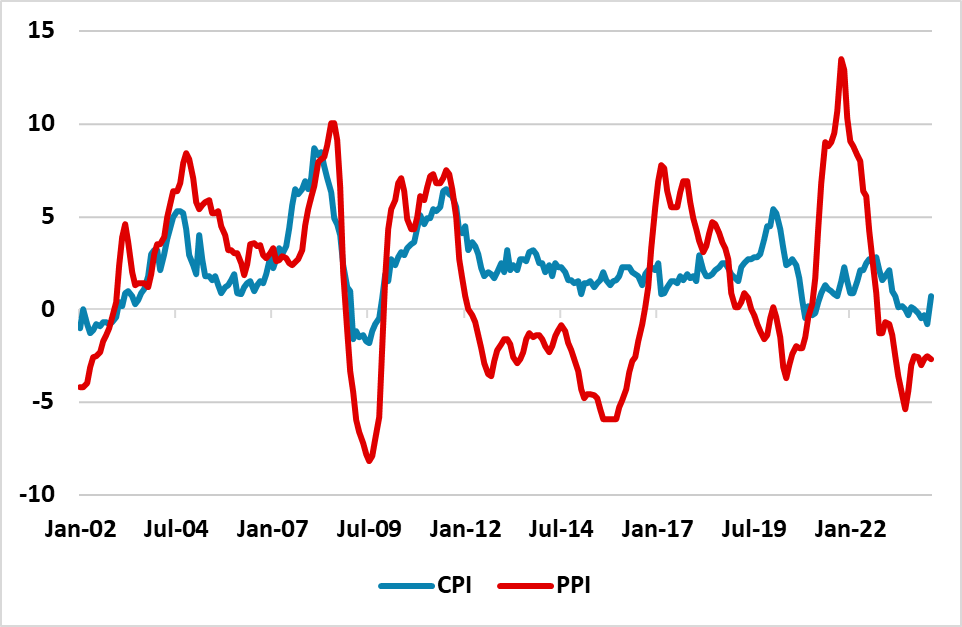

Figure: CPI and PPI (Yr/Yr %)

February China CPI surged to +0.7% v -0.8% Yr/Yr due to three factors. The late lunar New Year boosted CPI seasonally, while the good lunar New Year also boosted pork/food prices and travel prices. The bounce is unlikely to be sustained and we see a fall back to 0.3-0.4% Yr/Yr in March. The breakdown of the CPI data provides some context on the headline CPI rebound. Food prices were -0.9% Yr/Yr versus -5.9% in January, with pork prices up 7.2% on the month. Meanwhile, the tourism subcategory surged to 23% Yr/Yr. In both cases a good lunar New Year holiday period was the main driver, with travel numbers back to pre COVID levels. Additionally, the timing of lunar new year in February boosted the CPI seasonally, as the holiday has been in January last year. Core CPI also surged from 0.4% Yr/Yr to 1.2%.

However, the momentum from February is unlikely to be repeated and some of the CPI categories will likely go into reverse in March and we look for a +0.4% Yr/Yr. The lunar New Year was a special period and households will face all the uncertainties around the housing market and employment – consumer confidence remains weak. Also PPI fell 2.7% Yr/Yr v -2.5% in January, as excess production continues to be a disinflationary force. Still the February bounce means a better profile for CPI and we revise 2024 from +0.2% to +0.5%.