JPY, EUR flows: USD opening softer

JPY gains supported by Tokyo CPI data. EUR strength less solidly based but German retail sales better than they look

The USD is starting the European day generally softer, having lost a lot of ground against the JPY overnight following the stronger than expected November Tokyo CPI data. However, while sentiment is clearly more JPY positive after the data, it is noticeable that Japanese yields have barely moved and the market is still only pricing a marginally higher probability of a BoJ rate cut in December. This is now seen as around a 57% chance from around 52% before the data. But yield spreads have still moved in the JPY’s favour because of lower US yields. Although this is an untrustworthy move given the US Thanksgiving holiday, JPY gains look likely to hold as any reversal higher in US yields is now more likely to be matched by JGB yields following the Japanese data.

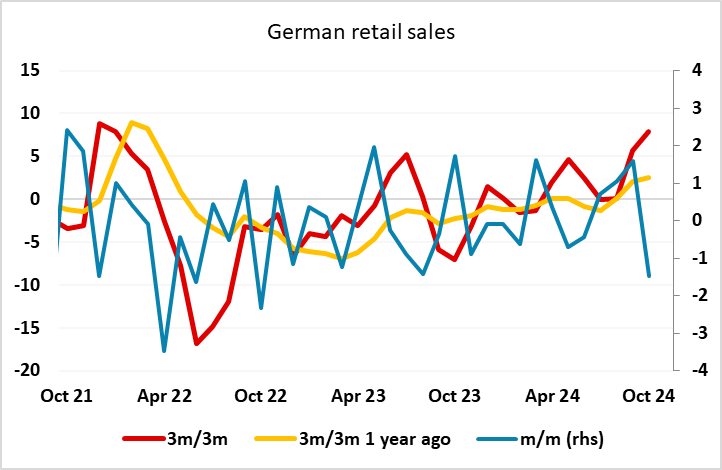

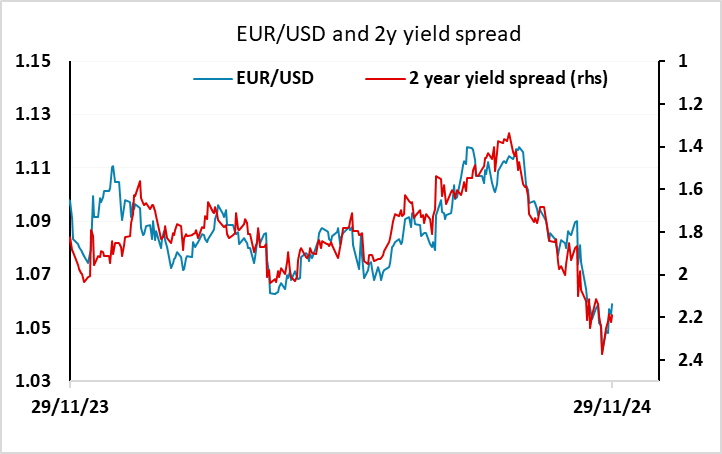

USD losses elsewhere are less obviously robust, as there is no real data support for the EUR recovery. The weaker German CPI data yesterday increases the chance of a more dovish ECB, and this morning’s German retail sales data was also on the weak side of consensus. However, we would note that despite being weaker than expected, the German retail sales data is showing a strongly improving trend, with the 3m/3m gain the highest since January 2022. While this isn’t the reason for the EUR’s strength this morning, it does work against the view that the ECB will be inclined to cut 50bps in December. Still, there doesn’t look to be enough behind the EUR/USD rally to secure a break above 1.06.