USD, EUR, CAD, JPY flows: EUR steady, JPY still firm, CAD in danger

EUR steady after weak German retail sales with rate expectations steady after yesterday's ECB meeting. JPY still looks biased higher on yield spreads. CAD in danger from tariff threat

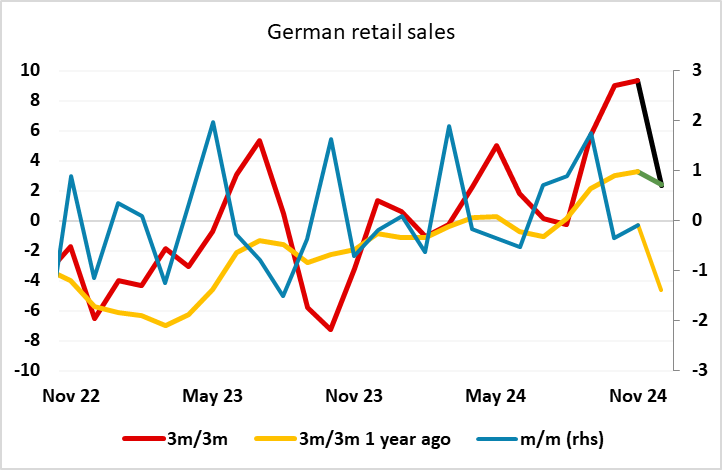

The session kicks off with weak German retail sales, which fell 1.6% m/m in December. This is now the third consecutive monthly decline, and significantly undermines the recent narrative of an improving trend. Coupled with the weak Q4 German GDP data released yesterday, the picture in Germany continues to look quite grim, even though the survey data improved modestly in the last month.

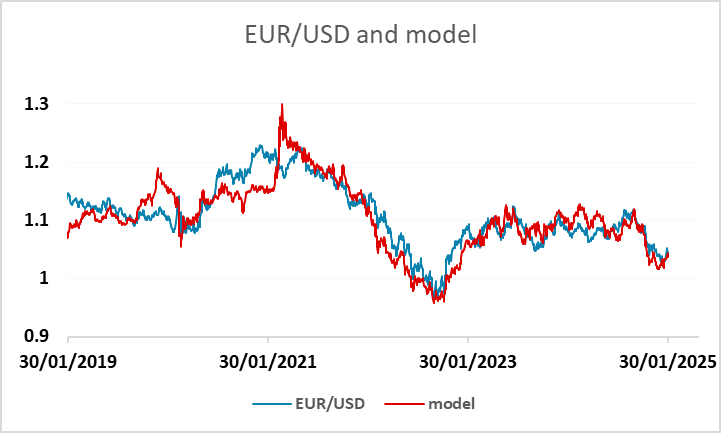

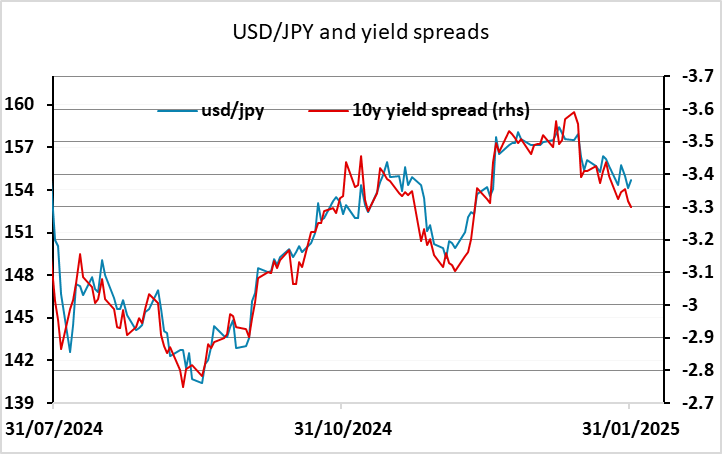

EUR/USD continues to trade close to 1.04, which looks fair based on our model, even though short term yield spreads have moved somewhat in the EUR’s favour in recent weeks, with the outperformance of the US economy still providing the USD with some support. USD/JPY, however, continues to look biased lower, with higher Japanese yields overnight moving yield spreads in the JPY’s favour and pointing USD/JPY towards 153.

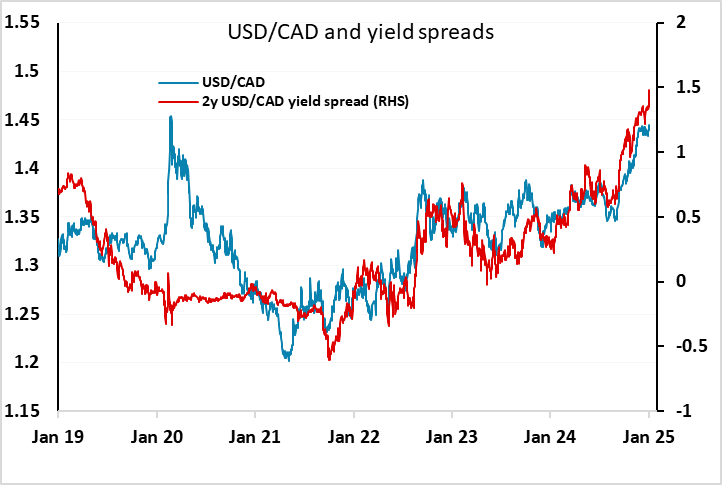

French and German preliminary January CPI data will be the first focus this morning, but with rate expectations not much changed after the ECB meeting yesterday, we doubt the data will have a big impact. Otherwise, the CAD may be under the spotlight, with Trump still indicating he will impose 25% tariffs on Canada and Mexico from tomorrow, although there are some reports he may exclude oil. There is no obvious risk premium in USD/CAD to account for this, which would certainly be very damaging for the Canadian economy if Trump goes ahead. Although the CAD is already quite cheap from a fundamental perspective, it has moved broadly in line with yield spreads in recent months, so some further CAD weakness looks likely if tariffs are imposed.