U.S. January Consumer Confidence - Labor market softens, inflation expectations rise

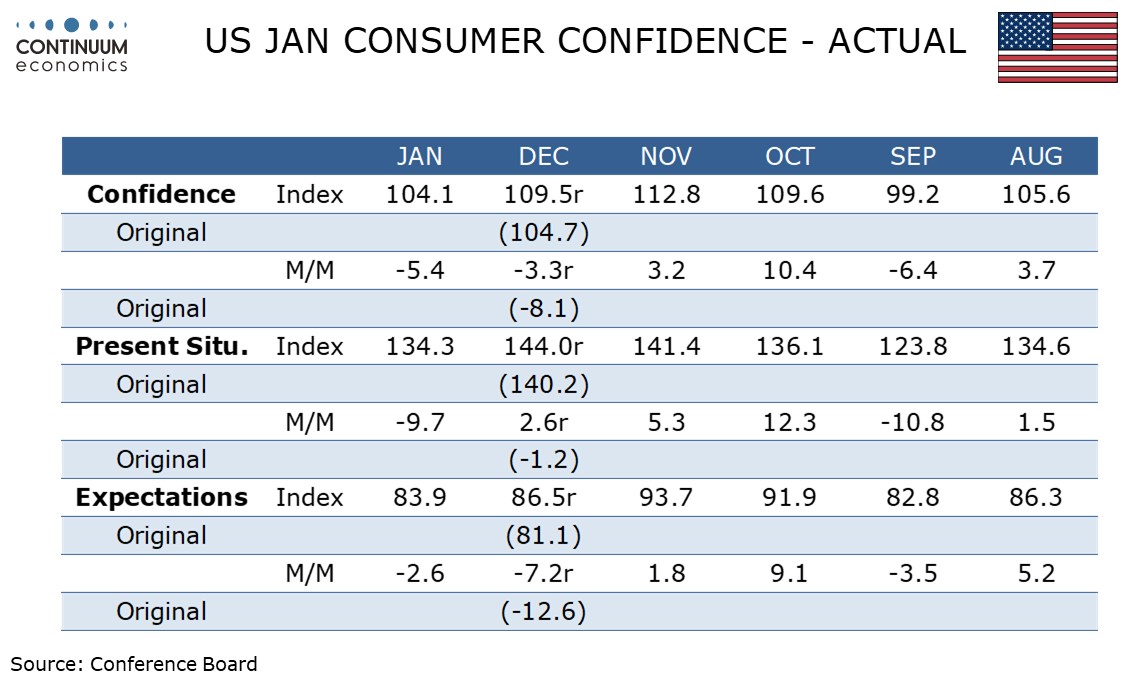

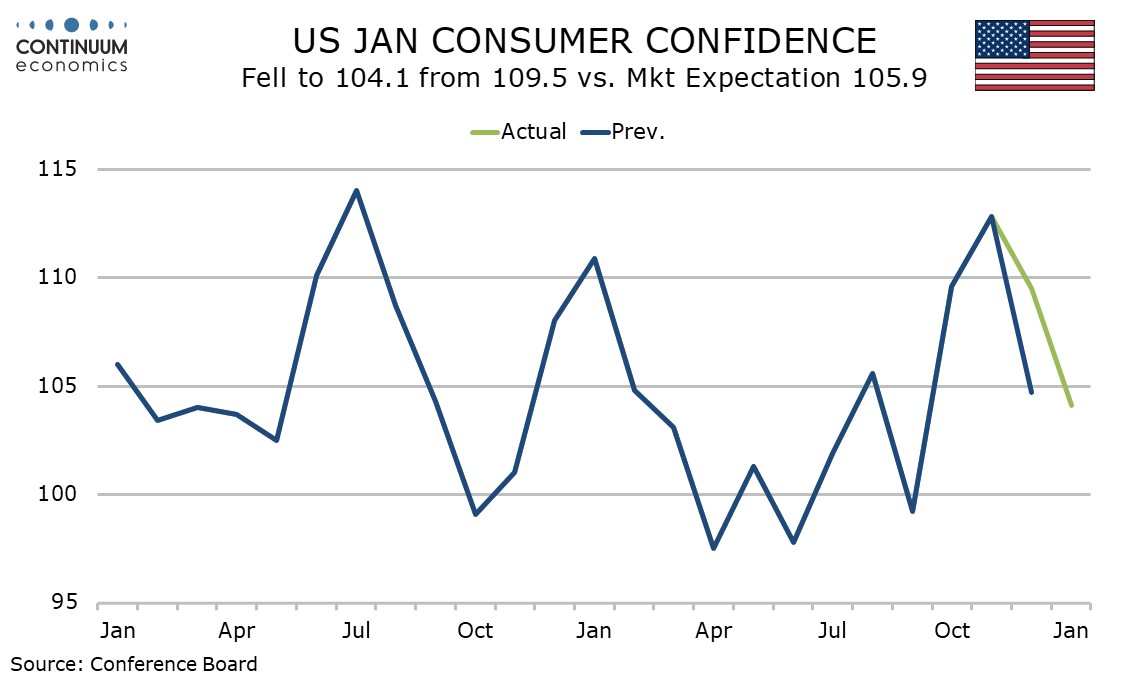

January’s consumer confidence report at 104.1 is slightly weaker than expected and down from 109.5, which saw a significant upward revision from 104.7, making December’s dip from 112.8 a lot less sharp than originally reported.

After revisions, December’s index is not much changed from October’s 109.6, meaning that the election did not change much, which probably reflects that in a close election those pleased by the result only mar4ginaly exceeds the number who were disappointed.

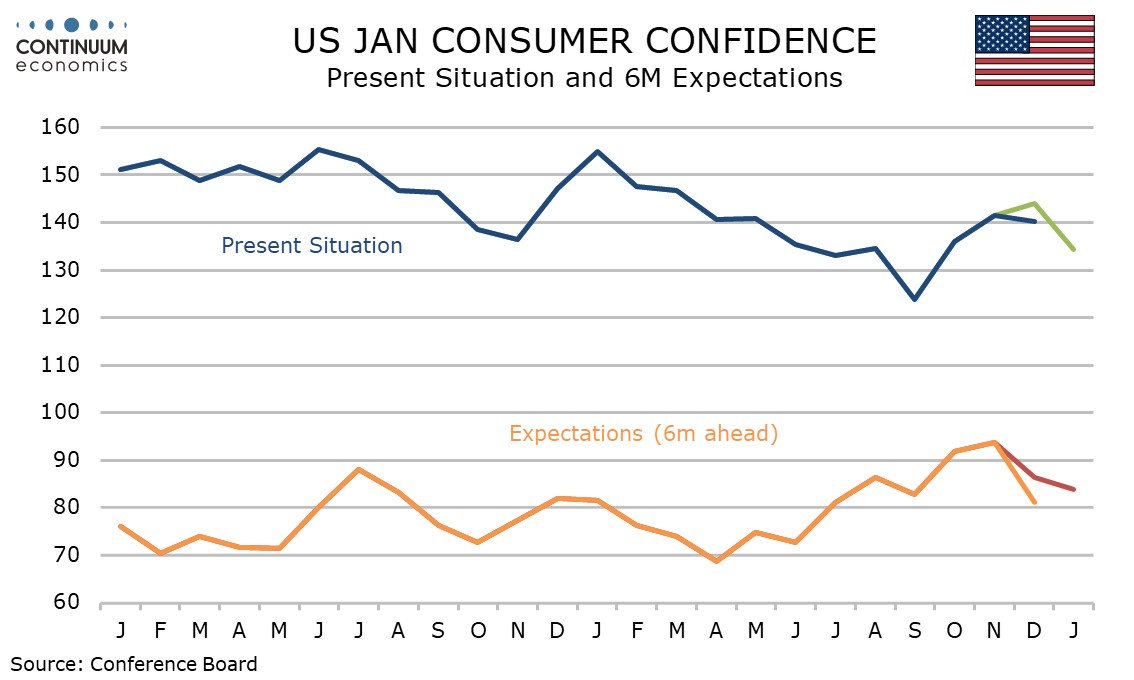

However, expectations have seen two straight dips since November, to 83.9 in January from an upwardly revised 86.5 in December and 93.7 in November. Still the index is higher than September’s 82.8.

The dip in January was sharper in the present situation, which fell to 134.4 from 144.0 after rising from 141.4 in November. The dip may reflect temporary factors such as cold weather and the Los Angeles fires.

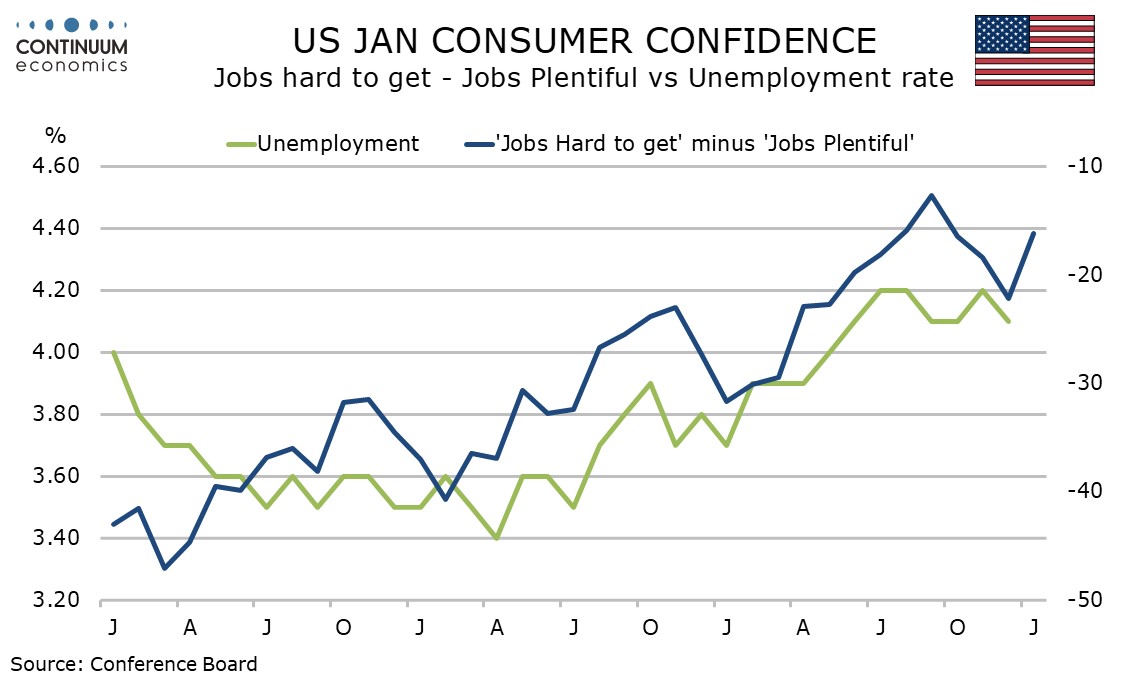

The labor market saw s significant weakening in January, with those seeing jobs as plentiful exceeding those seeing them as hard to get by 16.2%, down from 22.2% in December and the lowest since September. We expect a slower non-farm payroll gain of 125k in January, restrained by weather.

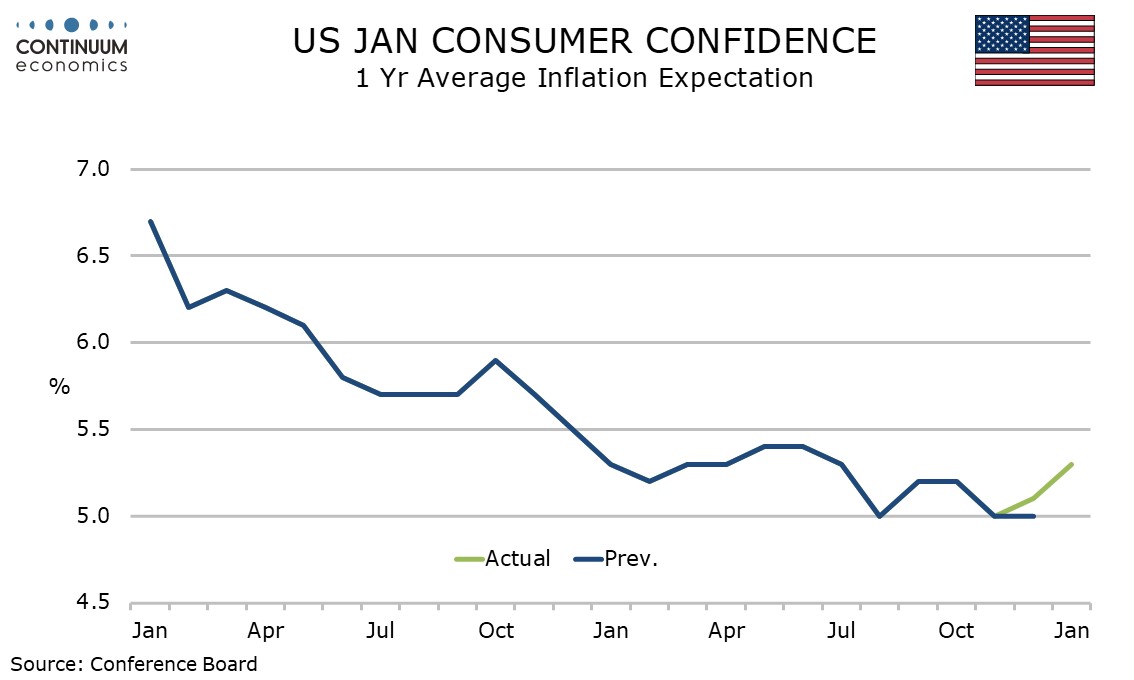

Inflation expectations are ticking up, the average view at 5.3% from 5.1% the highest since a matching July as was the median, which rise to 4.3% from 4.0%. Tariffs may be causing concern.