JPY flows: JPY gains on strong wage data, further upside seen

Japanese December wage data surges pulling JPY higher. Yield spreads indicate further JPY gains

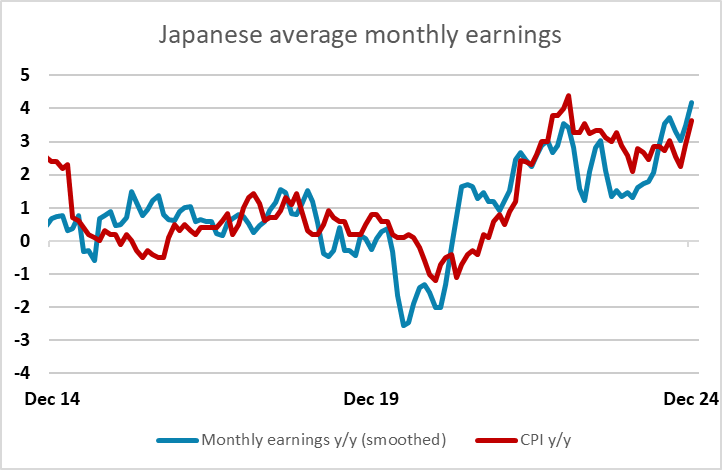

The main news overnight was the big rise in Japanese wages reported for December. This is bonus related, but nevertheless is very much supportive of the more hawkish BoJ stance involved in the January rate hike. As it stands, the Japanese money market is still not fully pricing in another rate hike until September, but we would see some further rise in front end yields in the coming sessions as the market starts to consider an earlier hike.

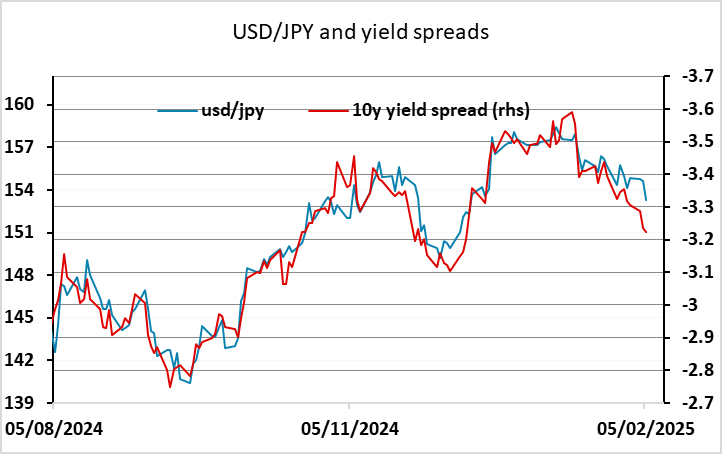

In any case, even without any further move, the rise in Japanese yields this year supports further JPY gains. USD/JPY has closely tracked the 10 year UST/JGB yield spread in the last 6 months, and the narrowing in recent days suggests scope to 151. A slightly longer term view over the previous few years suggests a much larger decline, while any consideration of real exchange rates and long term value points even lower still. Sharp JPY gains are still only likely to be seen if global risk appetite weakens, but steady JPY gains look well justified even in more benign risk conditions.