USD, CAD, CHF, JPY flows: CAD, CHF hit by tariffs, JPY still weak

CAD and CHF marginally weaker after higher tariff announcement, JPY still weak but verbal intervention has started

The USD is not much changed overnight ahead of today’s employment report, although USD/CAD and USD/CHF are both marginally higher following the announcement of increased tariffs on Canadian and Swiss imports to the US. The moves have been modest, in part because most don’t expect the tariffs to stick, in part because the USD reaction to tariff announcements remains unclear. Remember the USD fell in April after the initial reciprocal tariff announcement, and has recovered on the announcement of reduced tariffs in July. On this basis, the USD might be expected to fall on the announcement of higher tariffs, but when the tariff is very localised, it might be seen as a particular disadvantage to the country involved, rather than a US problem. Hence the modest reaction.

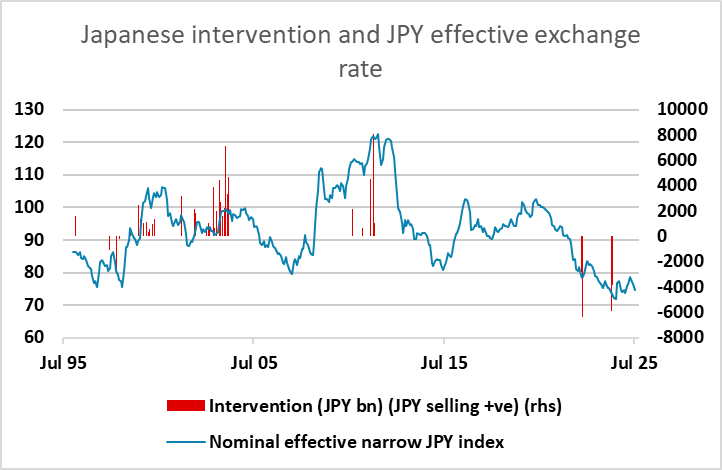

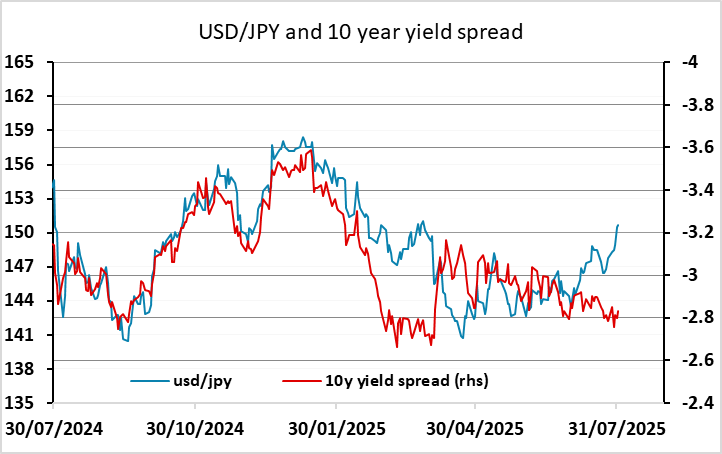

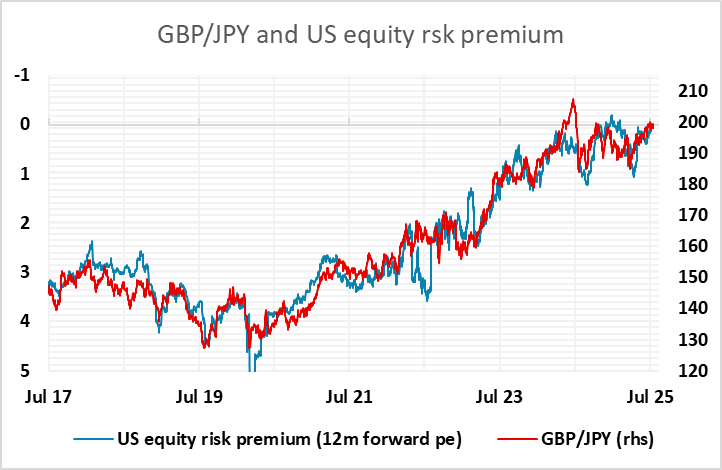

Bigger picture, we have the US employment report today and the market is typically quiet ahead of the release. Overnight we have seen the first verbal intervention from Japan in response to the recent decline in the JPY, with USD/JPY reaching its highest levels since March and the effective exchange rate remaining close to all time lows. Actual intervention could follow, with USD/JPY also well away from the normal yield spread correlation, but only if weakness persists into next week. Softer equity markets overnight also should provide some support for the JPY, but technical targets in the 151-152 area may need to be hit before a reversal.