Published: 2023-12-18T13:52:30.000Z

Preview: Due December 19 - Canada November CPI - Core rates to see two year lows

Senior Economist , North America

-

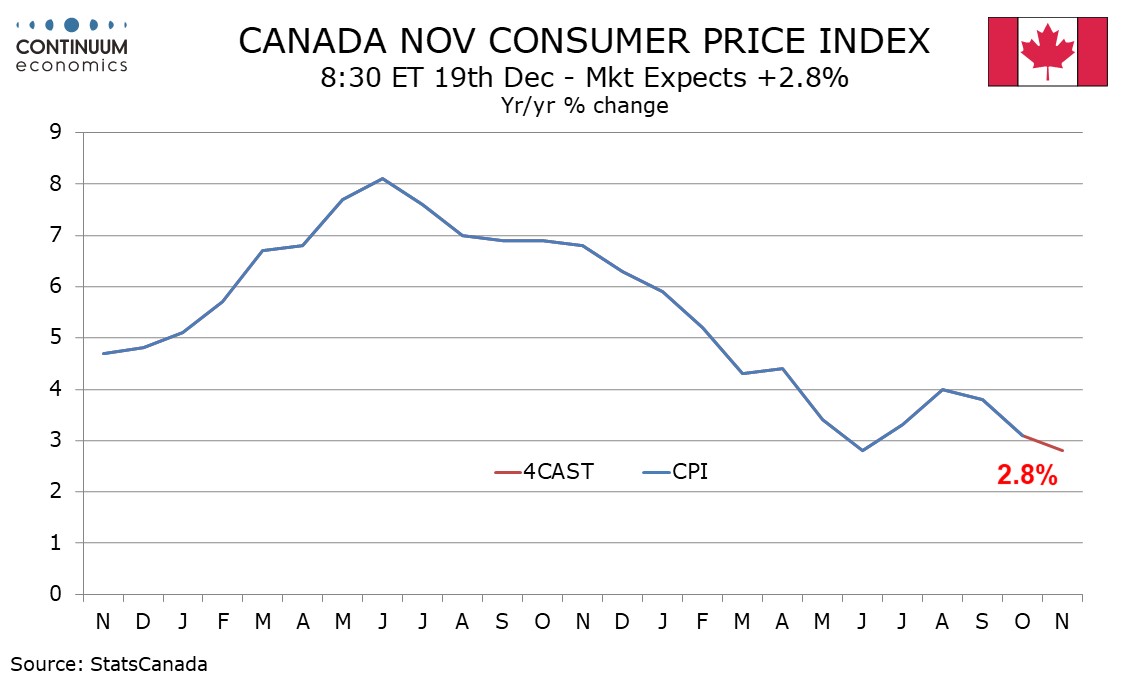

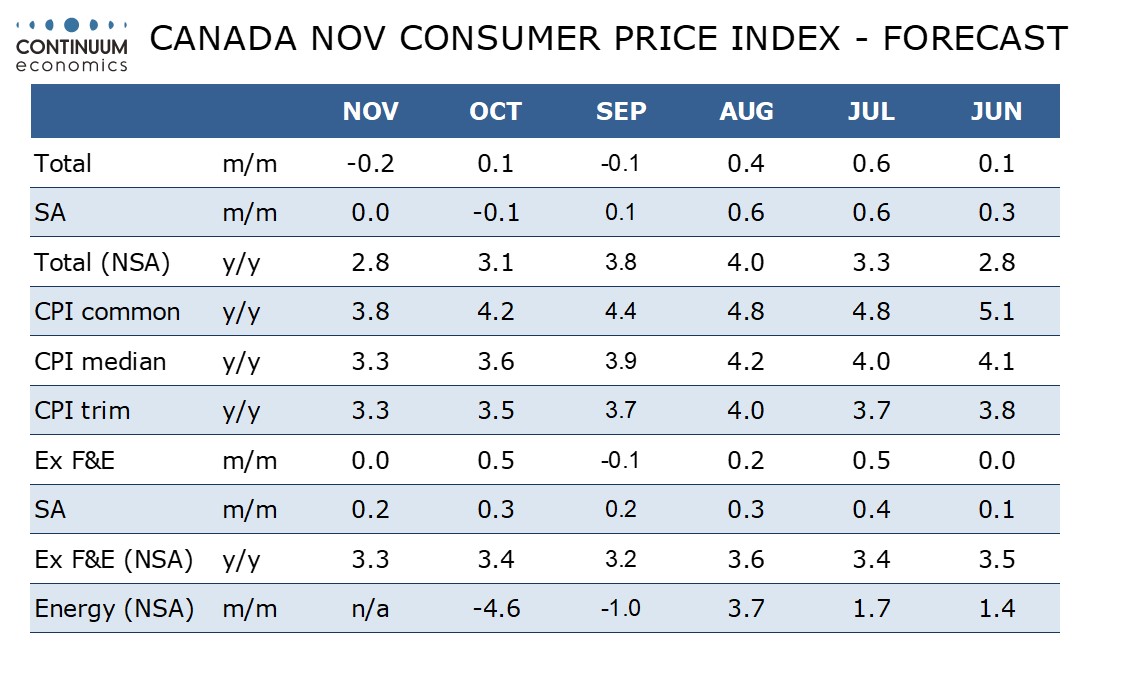

We expect November Canadian CPI to slip significantly to 2.8% yr/yr from 3.1% in October, matching the recent low seen in June. Year ago strength is likely to assist further slowing in the BoC's core rates.

We expect the monthly data to show overall CPI down by 0.2% with an unchanged outcome ex food and energy, with the seasonally adjusted changes being unchanged overall and a 0.2% increase ex food and energy. The latter would be a marginal slowing from a 0.3% increase in October but matching September's outcome, implying a continued, but not sharp loss of underlying momentum. Gasoline will see a second straight decline, but less sharply than in October.

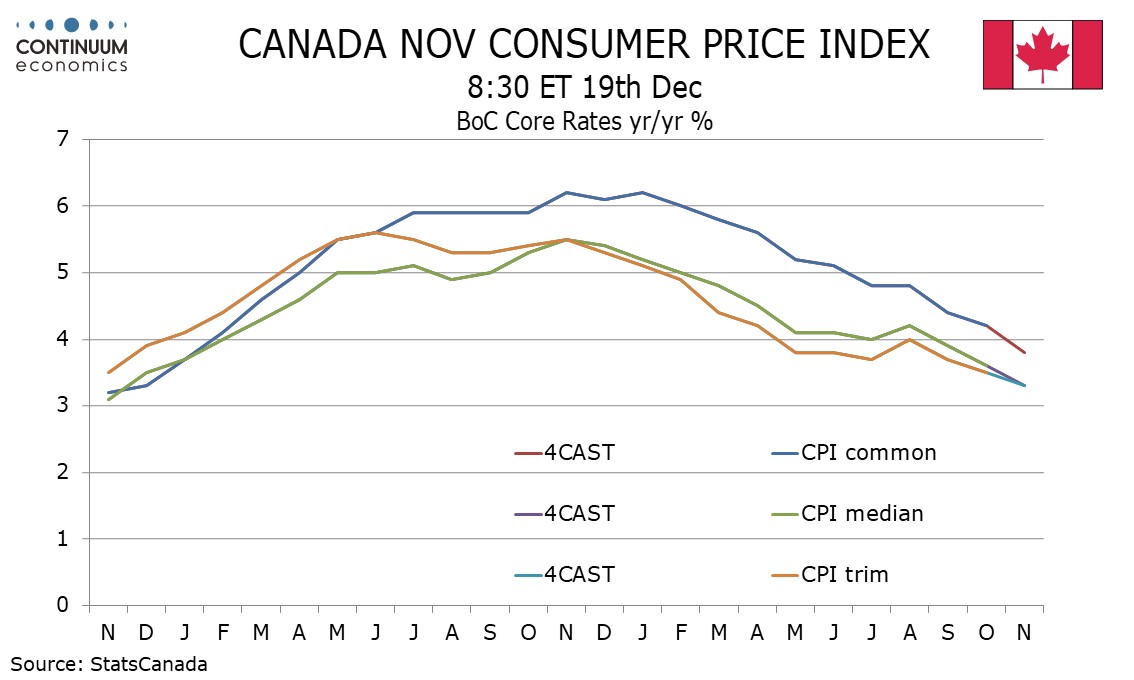

The ex food and energy rate is not one of the BoC's core rates, which accelerated in November 2022 to reach peaks of 6.2% for CPI-common (this matched once in January 2023) and 5.5% for both CPI-median and CPI-trim, which were not repeated. This will assist slowing in November 2023, we expect to 3.8% from October's 4.2% for CPI-common, to 3.3% from 3.6% for CPI-median, and to 3.3% from 3.5% for CPI-trim. This will put the average of the three at a two year low of 3.5%.