Published: 2024-01-10T15:02:02.000Z

Preview: Due January 12 - U.S. December PPI - Completing a softer Q4

-

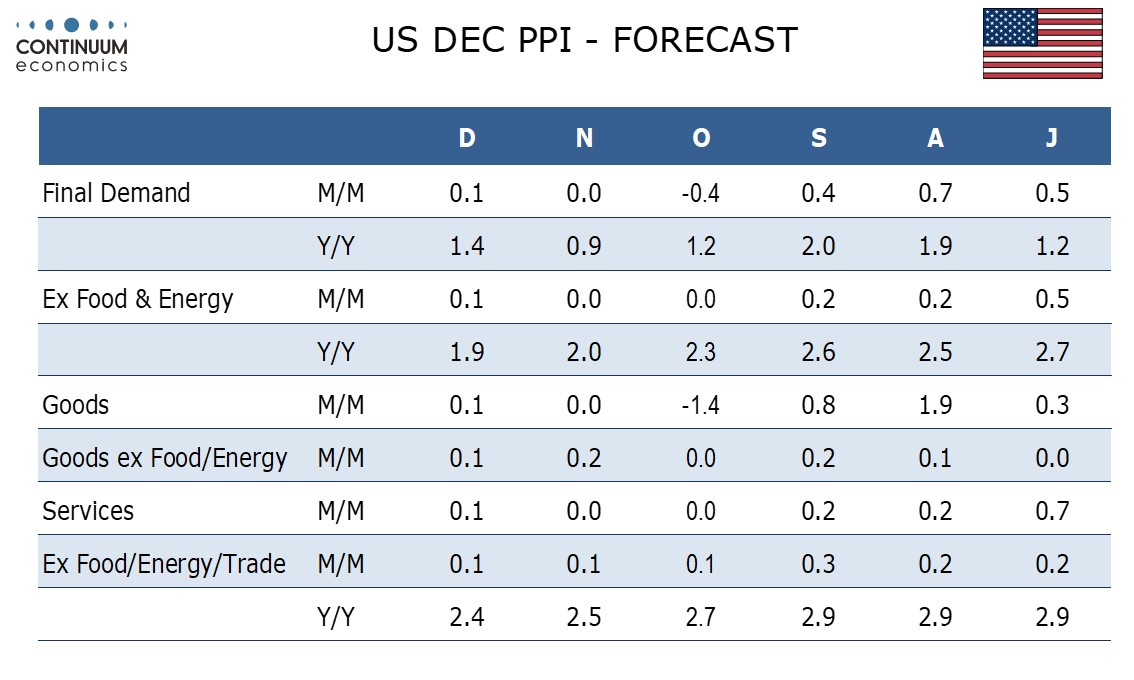

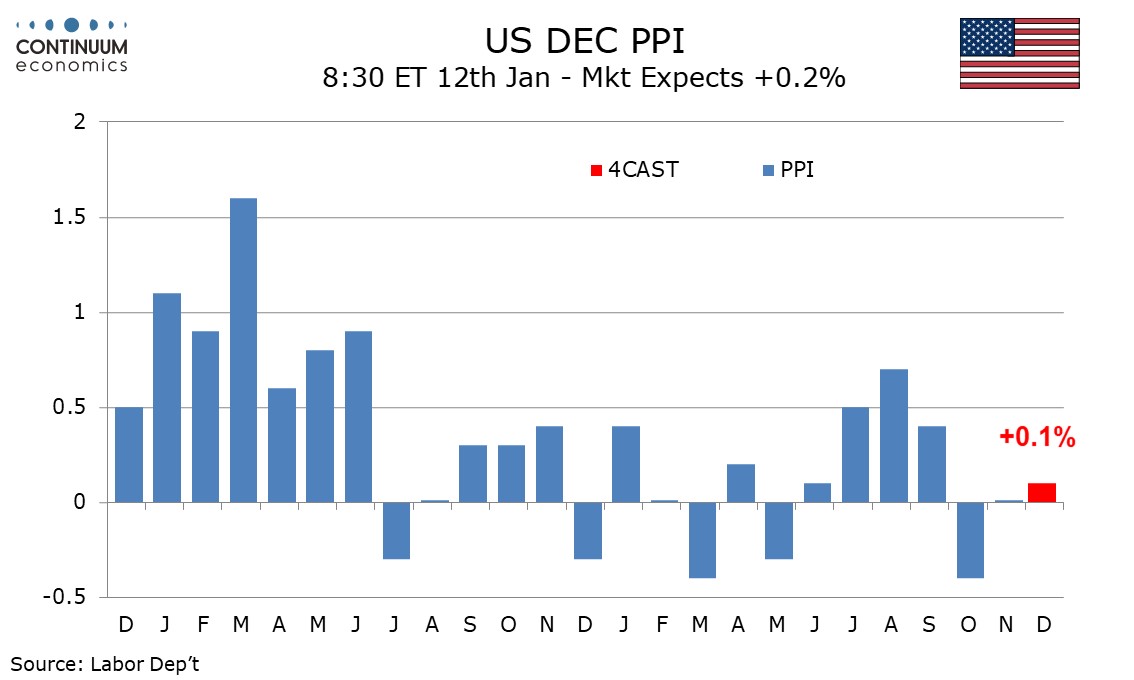

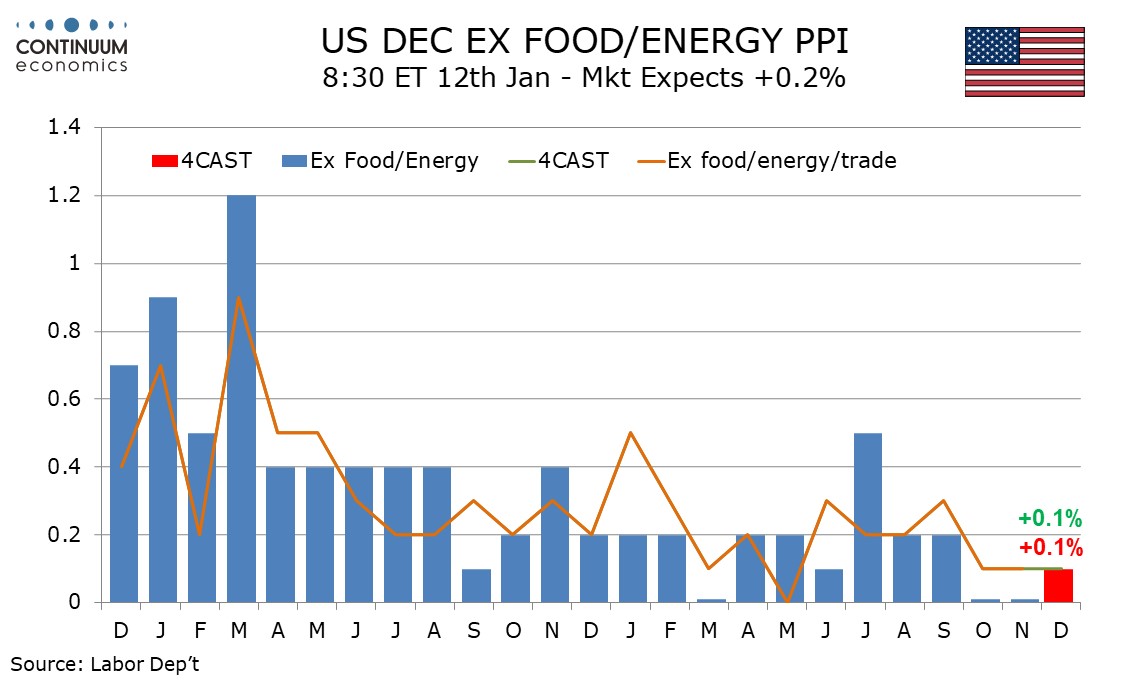

We expect a subdued 0.1% increase in December November PPI with 0.1% gains also in both core rates, ex food and energy and ex food, energy and trade.

0.1% gains overall and ex food and energy would be slightly stronger than in October and November but a 0.1% rise ex food, energy and trade would be the third straight. This would suggest that underlying trend, already subdued through the first three quarters of 2023, softened further in Q4.

Gasoline prices appear to be little changed after two straight declines and we expect food prices to pause after a 0.6% rise in November.

Yr/yr PPI under our forecast would increase to 1.4% from 0.9% but the core rates would soften further, ex food and energy to 1.9% from 2.0% and ex food, energy and trade to 2.4% from 2.5%. The core rates would be the lowest since January 2021 ex food and energy and February 2021 ex food, energy and trade.