This week's five highlights

No surprise from RBA

U.S. Initial Claims correct lower but trend continues to rise

U.S. July ISM Services Employment highest since September

U.S. and Canada report stronger trade balances in June

Bank of Canada Minutes expect further easing

The RBA kept the cash rate on hold at 4.35% as the current inflation picture does not support any change of monetary policy. The forward guidance statement has changed to "Data have reinforced the need to remain vigilant to upside risks to inflation and the Board is not ruling anything in or out. Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range." from "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.". However, we do not see the change in wordings equal to opening the doors to more tightening with them highlighting both "Inflation in underlying terms remains too high" and "Momentum in economic activity has been weak.... Wage growth seems to have peaked". Yet, the RBA acknowledged there is upside risk to their current inflation forecast.

Despite the latest Q2 CPI has shown a rebound to 3.8% y/y and has eliminated the possibility of any early easing from the RBA, the RBA trimmed mean CPI is lower than forecast and monthly CPI in June has rotated lower to 3.8% from 4% in May. To the contrary, PPI is steadily edging higher to 4.8% y/y in June which may translates into a certain level of inflationary pressure but is likely balanced by the softer domestic consumption and slower wage growth. The RBA did not change their inflation forecast and seems to be content with the trajectory of inflation by seeing 2-3 percent in 2025. We maintained our forecast of terminal rate to be 4.35% and now only see one 25bps easing by year end 2024.

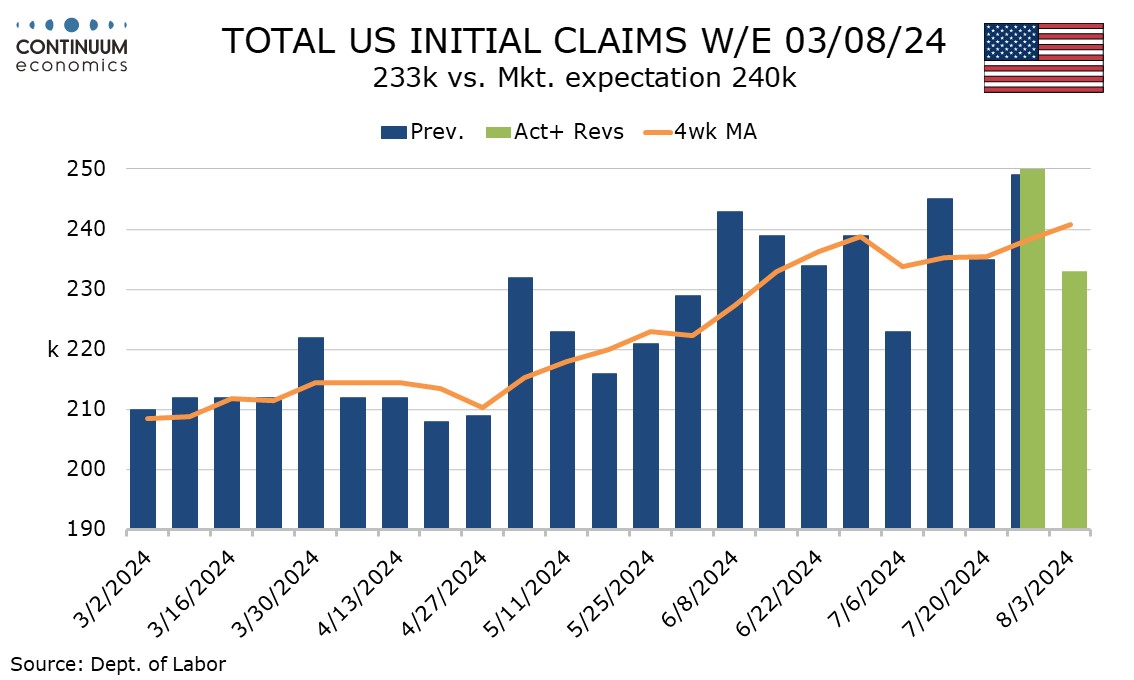

Initial claims at 235k are lower than expected and down by 17k from last week’s 250k, which was the highest since August 5 2023. The fall more than fully reverses a preceding 15k increase though the 4-week average of 240.75k is the highest since August 26 2023. Last week’s rise was exaggerated by seasonal adjustments, with the unadjusted data falling by 9k to 217k. This week also saw unadjusted claims fall, by 14k to 203k. The survey week for August’s non-farm payroll is still two weeks away.

Continued claims, covering the week before initial claims, rose by 6k to 1.875k, and the highest level since November 2021, though only because last week was revised down from 1.877k. Before seasonal adjustment continued claims fell by 23k to 1.911m.

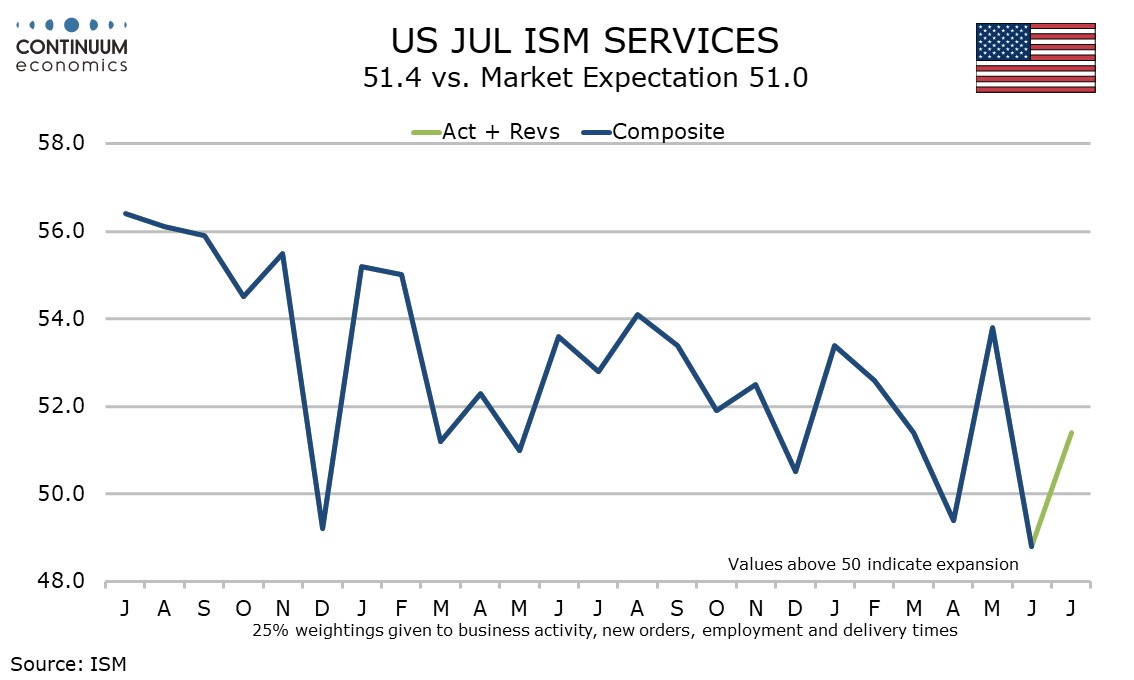

July’s ISM services index has recovered to a modestly positive 51.4 from June’s weak 48.8, easing some of the recession worries generated by Friday’s employment report. The ISM services employment index of 51.1, up from 46.1 in June, is actually the highest since September 2023. The ISM data is still underperforming the S and P services PMI, though the latter has been revised down to 55.0, now slightly down from 55.3 in June, from a preliminary July reading of 56.0.

Three of the four components that make up the ISM services composite increased, in addition to employment, business activity rose to 54.5 from 49.6 and new orders rose to 52.4 from 47.3. The exception was a dip in delivery times to 47.6 from 52.2, which suggests easing supply worries. The details of ISM services index, mostly higher but a lower deliveries index, is the opposite of the manufacturing detail, which was softer in most components but stronger for deliveries.

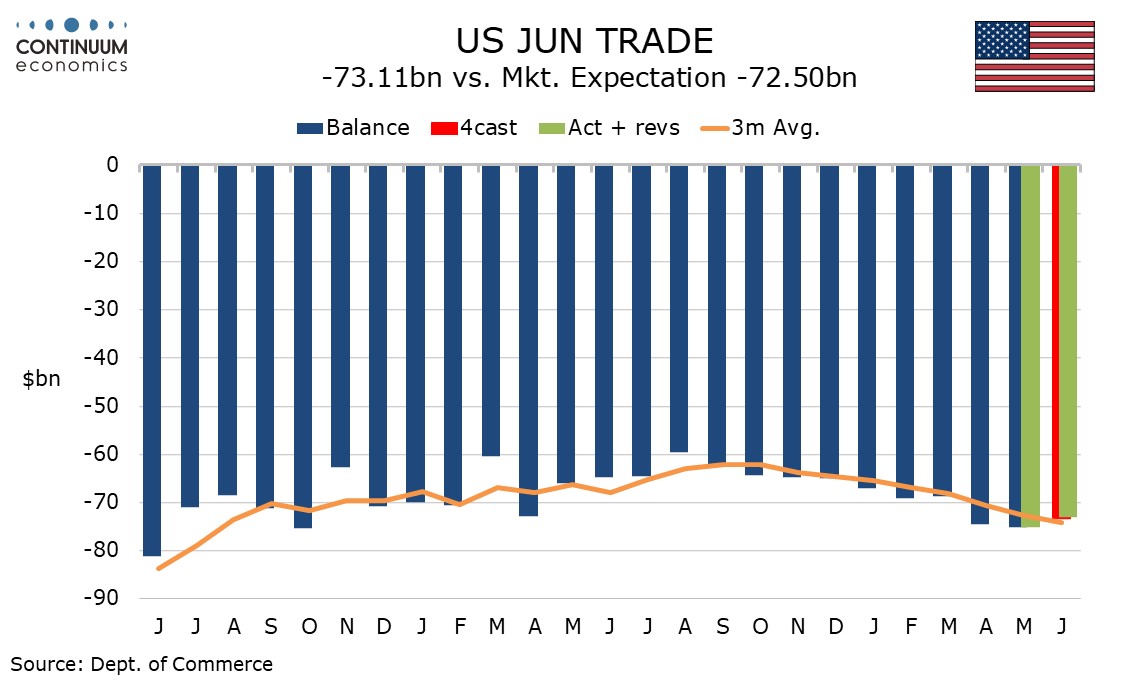

June’s US trade deficit if $73.1bn was marginally higher than expected though down from $75.0bn in May. While June’s deficit is narrower than those seen in April and May it is still wider than those seen in each month of both Q1 2024 and the whole of 2023. Goods data was in line with the signals of the advance report, with exports up by 2.6% rather than 2.7% and imports remaining up by 0.7%, both correcting from declines seen in May. In real terms goods exports rose by a strong 3.2% while goods imports rose by 0.9%.

The services surplus slipped to a 4-month low, with exports down by 0.5% and imports up by 0.2%, leaving exports up by 0.6% overall while imports rose by 0.6%. Canada also reported stronger trade data in June, with the C$0.64bn surplus the first surplus since February, and up from a C$1.61bn deficit in May.

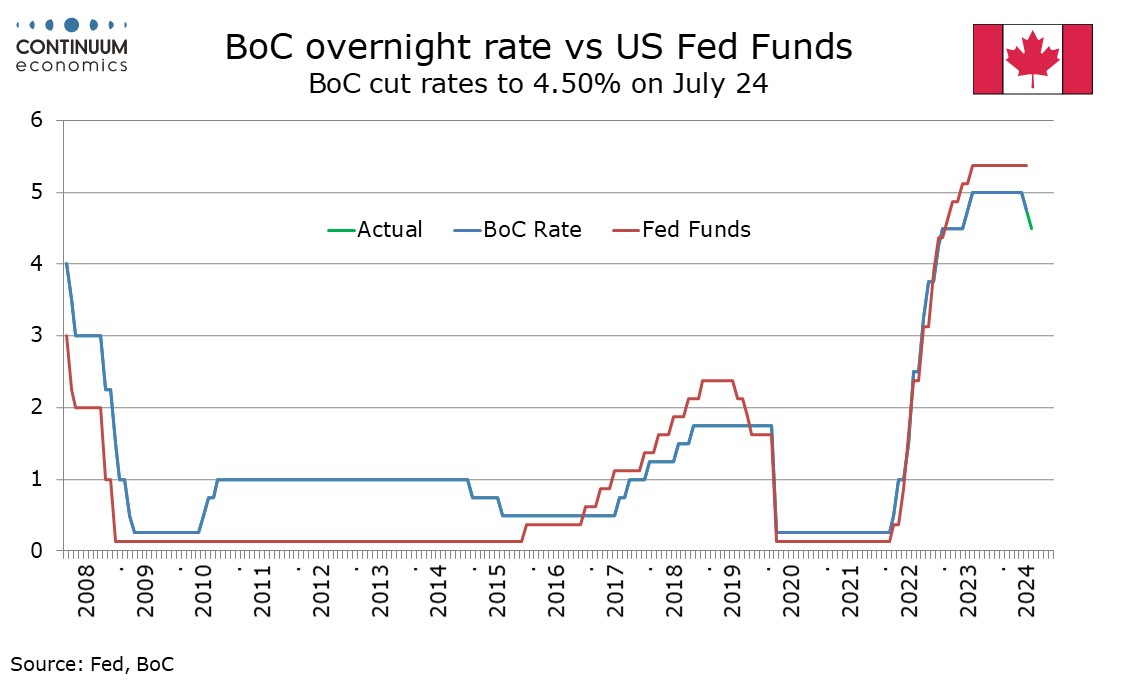

The Bank of Canada has released minutes from its July 24 meeting that delivered a second straight 25bps easing. While risks on both sides are discussed, the tone is on balance dovish, with the BoC increasingly confident that ingredients for price stability were in place. There was a clear consensus to lower the policy rate further if inflation continued to ease in line with the projection. Countervailing forces on inflation meant that progress was likely to be bumpy and that meant there should be no set path for the policy rate, with decisions to be taken one meeting at a time. Restrictive policy was still seen as justified, with the rate cut decided at the meeting simply making policy less restrictive. However while inflation is still above the 2% target, it is now in the 1-3% control range, and the BoC agreed that they needed to clearly communicate that they would be weighing factors that could pull inflation below target as well as those that could hold it above target.

On the downside the BoC noted that the economy had been growing by less than population increasing excess supply and there was risk that consumer spending could be weaker than expected in 2025 and 2026 due to households renewing mortgages at higher rates. The emergence of labor market slack was also noted. Upside risks came from strength in shelter services due to housing market imbalances and other services due to wage growth running well ahead of productivity.