GBP flows: GBP slightly lower on weaker GDP

EUR/GBP edges up as GDP data disappoints. Still scope for further GBP losses

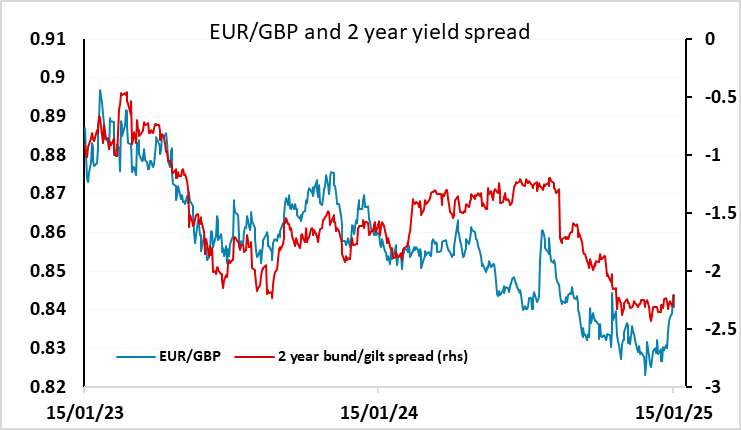

GBP has started weaker after UK November GDP came in lower than expected at 0.1% m/m, following 0.1% declines in September and October. The underlying trend in GDP now looks to be flat, with the strength seen in H1 2024 now a distant memory. The weaker data has triggered EUR/GBP gains of 10 pips to 0.8430. This is still well below yesterday’s high of 0.8463 seen in the immediate aftermath of yesterday’s CPI data, with GBP having rallied after the initial post-CPI dip. The decline in UK yields seen after the CPI data was accompanied by GBP gains, once again reversing the usual positive correlation between the currency and yields. GBP weakness in the last week has been related to negative sentiment around growth and fiscal sustainability, and lower yields are seen as positive for the government finances and consequently for growth. But weaker growth numbers that lead to lower yields are not the same as lower inflation numbers that lead to lower yields, as there is obviously not the same positive growth implication.

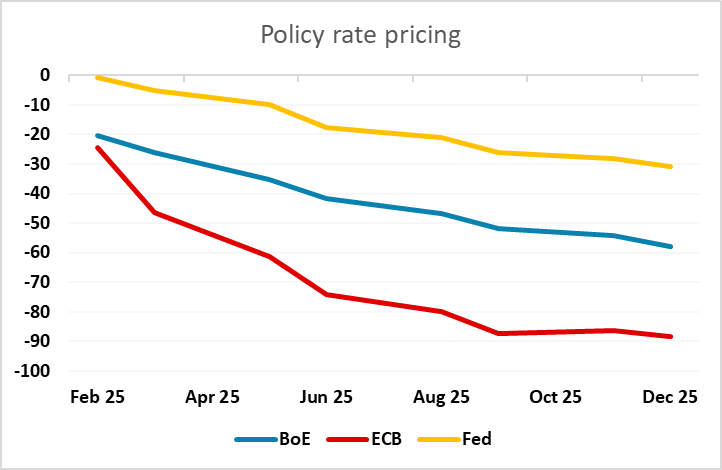

From here, we still see some downside risks for GBP as there is still plenty of scope for further declines in UK rate expectations. While the recent GBP weakness has been related to fiscal concerns and higher yields, in general lower yields have led to a weaker pound, and there is still potential for the market to rice in a BoE policy path much closer to the ECB than the Fed. If this were to come about, EUR/GBP would have potential to 0.85 and beyond, even if current uncertainties around growth and fiscal sustainability fade.