This week's five highlights

ECB Clearly Flagging An End to Policy Restriction

Bank of Canada delivers a second straight 50bps easing

SNB Easing Bias Toned Down

RBA Getting Closer to easing but not yet

U.S. November CPI a little higher than the Fed would like

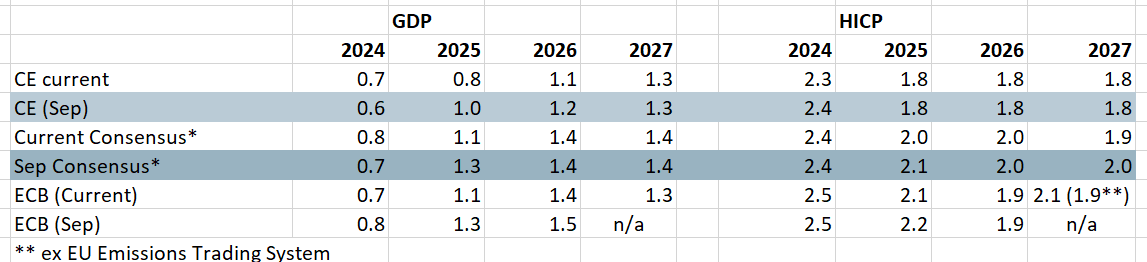

Figure: The ECB’s Revised Outlook in Perspective

A fourth 25 bp discount rate cut at this latest Council meeting, to 3%, was also the third in a row. But this meeting was important for the (as we expected) change in forward guidance in which the ECB accepts that on-target inflation is likely to be durable enough so that it no longer has to pursue policy restriction. In this regard, the first glimpse of 2027 economic projections support this as they point to a second successive year of around-target inflation even on a core basis and also on the basis of markets assuming rates fall to around 2% in 2026. Amid what has been faster easing, the ECB must be considering what neutral policy and we think the implies around four 25 bp cuts in H1 next year, with an ensuing around-neutral 2% policy rate. But it is possible that amid a continued sub-par growth outlook into 2026, then further easing may be on the cards into 2026.

As we envisaged, this meeting did see a major change in forward guidance. Indeed, and as Chief Economist Lane suggested in an interview last week, this would entail a transition in guidance moving from what hitherto has been backward-looking by being data-dependent to being forward-looking in assessing incoming risks. Admittedly, the ECB as a whole seems reluctant at this juncture to move totally away from being data-dependent, but however much Lagarde suggested otherwise, the Council must be considering what constitutes ‘neutral’. Admittedly, what constitutes neutral varies over time and according to alternative assessments. Notably, according to some ECB hawks, this 25 bp move this month would constitute policy being at least at the upper end of a range of neutral estimates. This contrasts with the more dovish ECB thinking as highlighted by BoF Governor Villeroy who has pointed to a neutral estimate between 2% and 2.5%. And somewhere in the middle there is also thinking that there may have been a bit of an upward movement in this underlying real interest rate but, albeit probably most of it being cyclical, possibly a result of a recent rise in government deficits reducing the saving/investment balance.

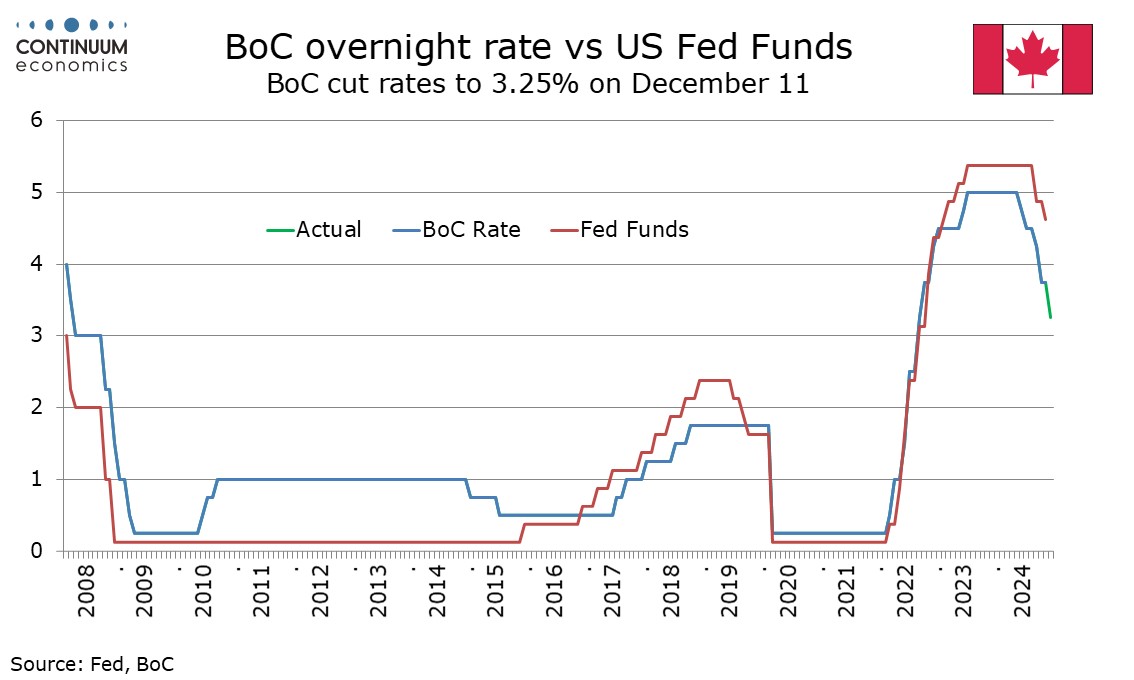

The Bank of Canada has delivered a second straight 50bps easing, taking the rate to 3.25%, as largely expected. This puts the rate at the upper end of the 2.25-3.25% range the BoC sees as neutral, and Governor Tiff Macklem stated he now anticipates a more gradual approach to policy. We expect three 25bps easings in 2025, though the threat of tariffs makes the outlook very uncertain.

The Bank of Canada’s statement for the most part reads fairly dovishly. While seeing the global economy as evolving largely as expected in October the BoC notes the 1.0% rise in Q3 GDP was weaker than projected, and adds recent data suggest Q4 will also underperform the BoC’s 2.0% forecast made in October. The BoC also expected 2025 GDP to be weaker than the 2.3% Q4/Q4 October forecast due to a reduced immigration target. The BoC did not mention that October CPI was slightly higher than expected, stating it has been near the 2% target since the summer and is expected to remain so. A brief dip in CPI to 1.5% is expected during a GST holiday that will run from December 14 through February 15, but the BoC will look through that.

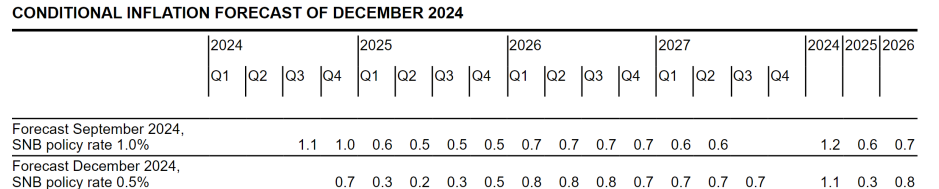

Figure: SNB CPI Inflation Projections Remain Clearly Below Target

In what seems to be ever-clearer policy front-loading, the SNB cut its policy rate by 50 bp (to 0.5%), thereby accentuating an easing cycle that had delivered three 25 bp moves since March. Possibly, this larger, but far from unexpected, reduction was driven by a fresh assessment that the inflation undershoots (both that seen of late and that projected out to 2027) is increasingly a reflection of weaker underlying price pressures rather than currency induced disinflation. But notably, and despite the marked anticipated inflation undershoot (Figure), the SNB was less explicit this time around about further cuts, save to repeat its long-standing mantra that it ‘will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term’. Possibly, and maybe reflecting recovery property prices, this signals a policy pause, but we still see another 25 bp cut in Q1 next year.

Back in September, the updated outlook suggested an even larger undershoot in the medium-term which flagged further easing not least as the SNB was explicit in suggesting that ‘Further cuts in the SNB policy rate may become necessary in the coming quarters’, rhetoric then repeated (end Oct) by SNB President Schlegel. This rhetoric was not repeated this time around, even though the inflation backdrop has proved to be weaker than expected and that even with a halving of the policy rate. Indeed, the medium-term inflation outlook still sees a marked undershoot of target (Figure ), albeit where (again) the ‘new forecast is within the range of price stability over the entire forecast horizon’.

The RBA kept the cash rate on hold at 4.35% as per previewed in the November meeting when the RBA downplayed latest moderation in headline CPI, instead referred to the middle of target range and progress in underlying inflation before the chance of easing. The forward guidance statement did not change from the November statement, citing "The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions.", suggesting the RBA has not changed their view since. The RBA viewed the headline moderation of Q3 CPI to be partially attributed from the government subsidy of energy prices and stated that underlying inflation did not show the same pace of moderation. However, they also acknowledge that wage growth is slowing despite tight labor market. Combined with the weaker growth in Australian economy, the RBA should be getting ready to ease once underlying inflation shows more cooling.

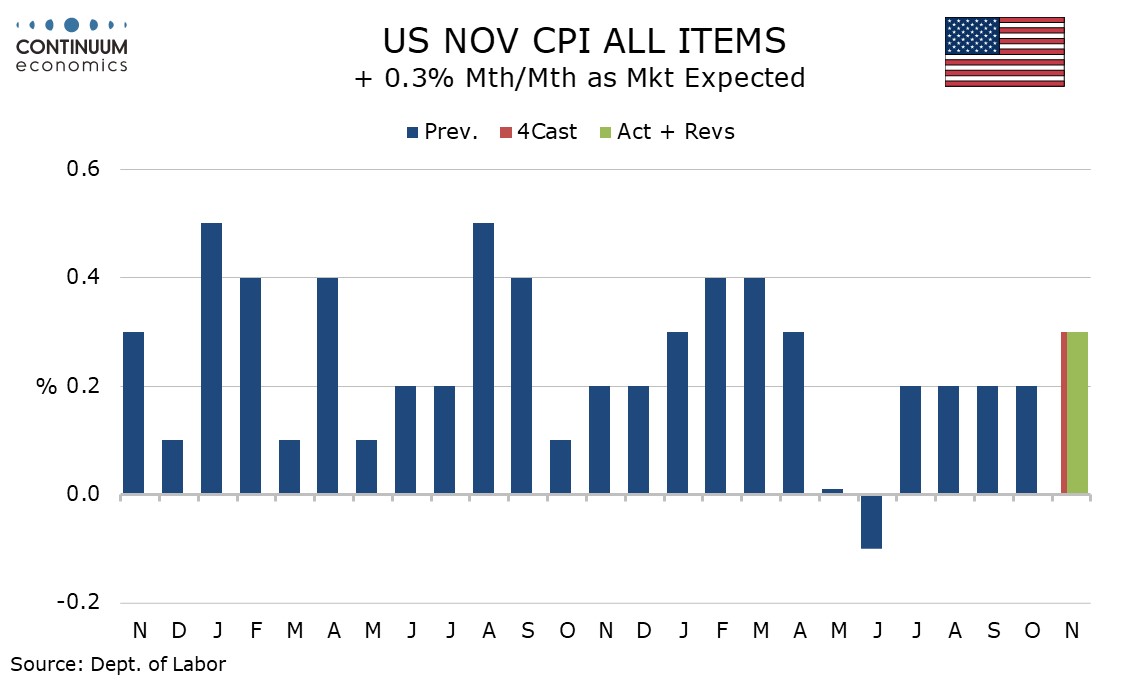

November CPI is in line with expectations at +0.3% both overall and ex food and energy, with both up by 0.31% before rounding. Core CPI with four straight 0.3% gains is still a little high for comfort but the data is probably subdued enough to allow the FOMC to deliver a 25bps easing next week, though they may hint at a slower pace of easing in early 2025.

Gasoline prices rose by 0.6% but energy overall rose by only 0.2%. Food was above trend at 0.4%. The detail is unusual in that commodities ex food and energy matched the usually stronger services ex energy, both rising by 0.3%. Commodities were supported by strength in autos, with used autos seeing a second straight strong month with a rise of 2.0% and new vehicles also accelerating with a rise of 0.6%. Apparel followed a 1.5% October decline with a modest rise of 0.2%.

This is a second straight 0.3% gain in services less energy and signals some recent loss of momentum. Transportation services, a recent source of strength both in air fares and auto services, were unchanged, restrained by a fall in auto rentals. Air fares were up a modest 0.4%. Shelter rose by 0.3% with owners’ equivalent rent up by only 0.2%, its slowest since early 2021. Loss of momentum here will be welcome to the Fed. Shelter did however see support from a 3.7% rise in the volatile lodging away from home sector.