USD, EUR flows: USD correcting lower, eyes on ECB account

USD lower overnight but downside still looks quite limited as geopolitical tension rises. EUR focus on ECB account of last meeting.

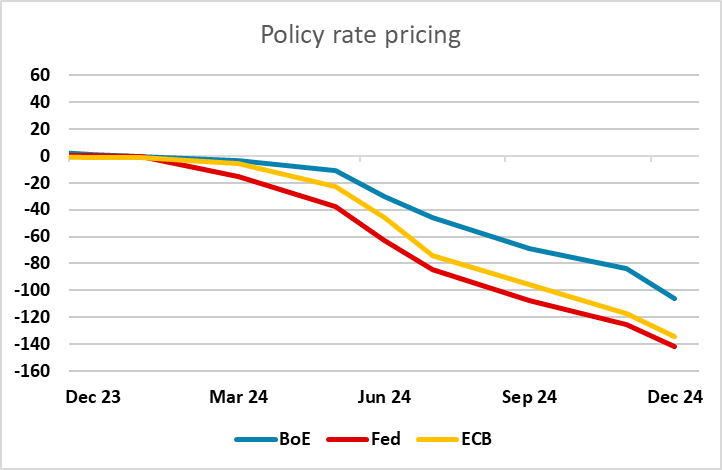

There isn’t a great deal on the calendar in Europe this morning, and the main focus is likely to be the account of the last ECB meeting released at 12:30 GMT, ahead of the US jobless claims and Philly Fed data at 13:30. While it is clear that the ECB are on hold for the moment, the account may give some idea of whether the hawks are wavering and ready to consider easing as early as Q2. As it stands, the market is nearly fully pricing a cut at the April meeting, and we see little prospect of a Q1 cut without some significant event, so the risk may be that the hawks still sound hawkish and rate cut expectations get pushed further down the road, supporting the EUR.

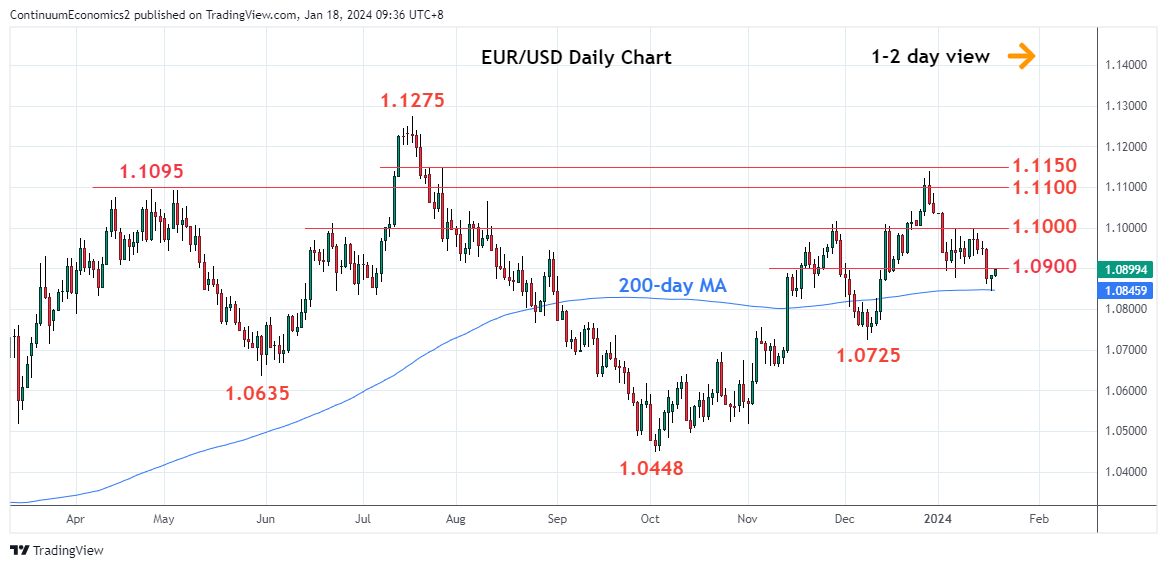

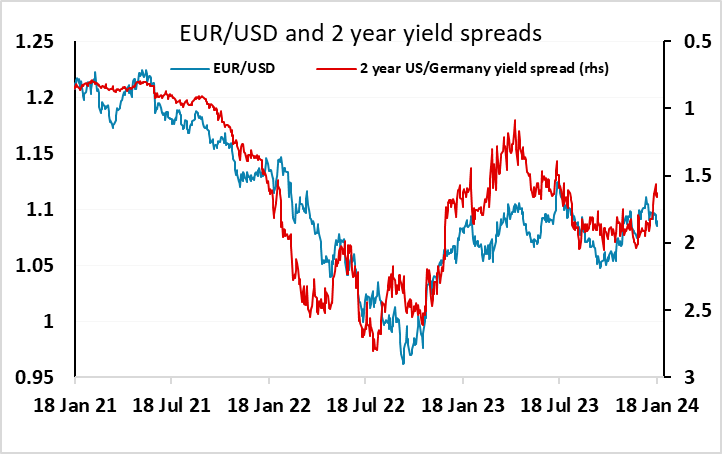

In any case, EUR/USD is starting the day better bid after the USD suffered some general corrective losses overnight. Even the AUD gained ground in spite of a much weaker than expected employment number and more weakness in Chinese equities when Chinese Premier Li Qiang signalled Beijing won’t resort to huge stimulus to revive growth at the World Economics Forum. USD losses may have been related to slightly lower US yields, but this was only a mild correction to the rise seen this week, and may have been due to increased geopolitical tension as the US military conducted another round of strikes on Houthi targets in Yemen and Pakistan’s Foreign Ministry confirmed Pakistan undertook series of military strikes in Iran. If so, it’s hard to see the USD suffering much due to rising geopolitical tension, although this might benefit the JPY and CHF on the crosses.