Preview: Due April 11 - U.S. March PPI - Still looking for some slowing

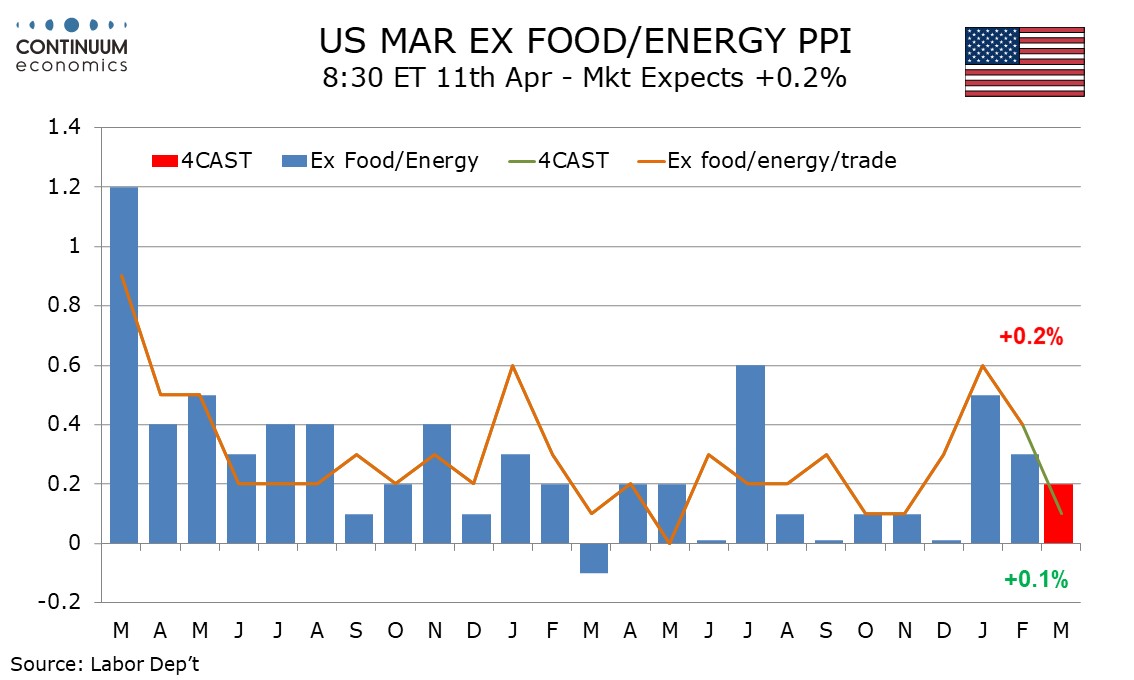

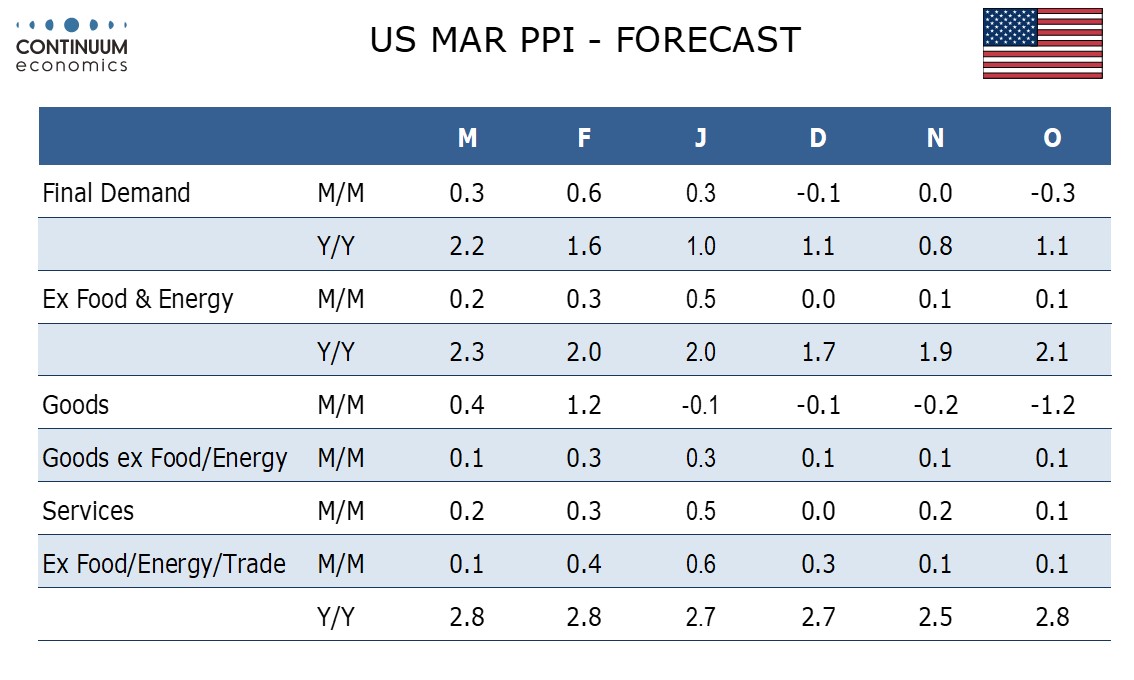

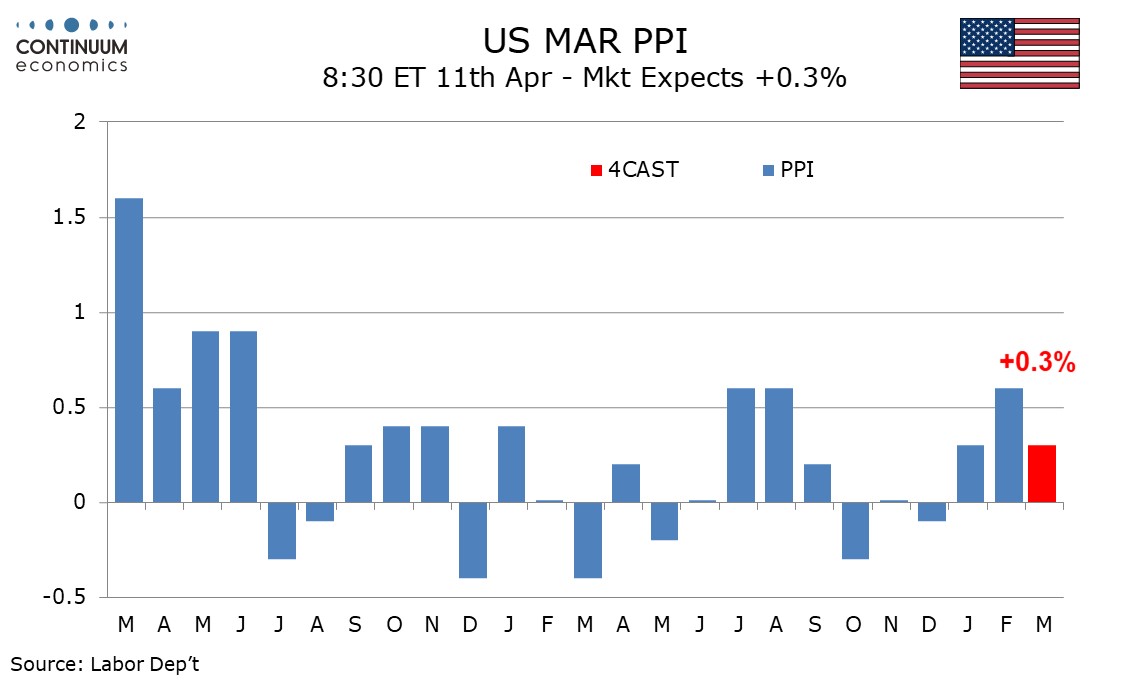

We expect a 0.3% increase in March’s PPI, with a 0.2% increase ex food and energy, the latter slowing from above trend increases of 0.3% in February and 0.5% in January, though this would still be stronger than each month from August through December of 2023. CPI is not a reliable guide to PPI, though January and February did produce strong data in both series

The New Year tends to be a time for price increases and we do not expect the recent strength to persist. March 2023 actually showed a 0.1% decline ex food and energy to correct New Year strength, though March 2022 was a very strong month, probably as a consequence of the Russian invasion of Ukraine. We expect the ex food, energy and trade series to move below trend with a 0.1% increase, following three straight months of rising by more than the ex food and energy rate.

We expect services PPI to rise by 0.2% after gains of 0.3% in February and 0.5% in January while goods ex food and energy rise by 0.1% after two straight gains of 0.3%. We expect overall PPI to be lifted to a 0.3% increase by energy even with food showing a correction from an above trend 1.0% rise in February.

Yr/yr PPI would then increase to 2.2% from 1.6% overall reaching its highest since April 2022 while the ex food and energy rate rises to 2.3% from 2.0%, to its highest since September 2023. We expect the ex food, energy and trade PPI to remain at February’s 2.8% yr/yr pace.