Published: 2025-02-03T15:18:25.000Z

U.S. January ISM Manufacturing - Move above neutral will be tested by a trade war

1

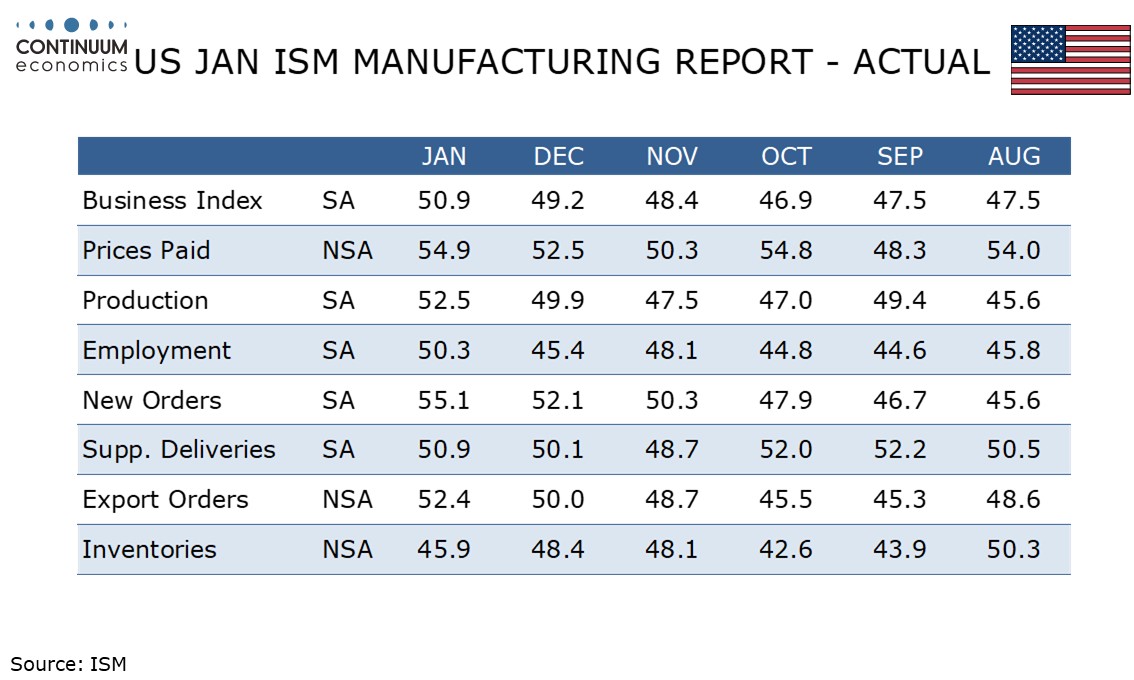

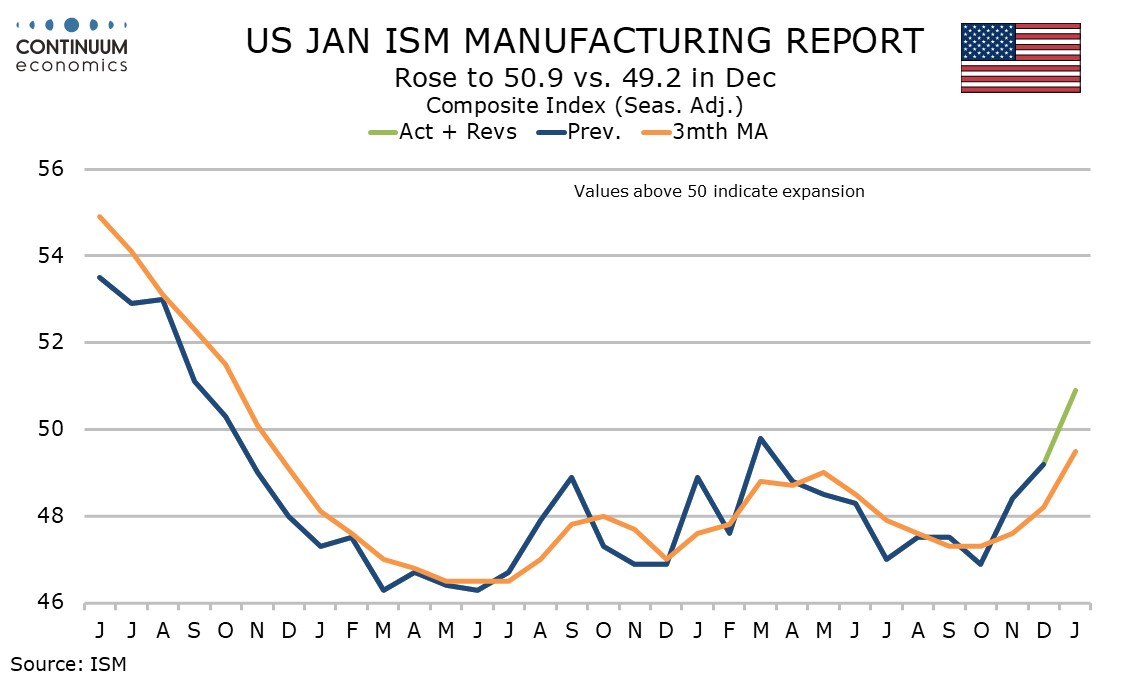

January’s ISM manufacturing index at 50.9 from 49.2 has moved above neutral for the first time since late 2022, giving a positive picture of manufacturing ahead of the commencing trade war. The trade war is likely to be negative for manufacturing as supply chains are damaged.

The positive ISM manufacturing index is consistent with the balance of regional surveys as will as the S and P manufacturing PMI.

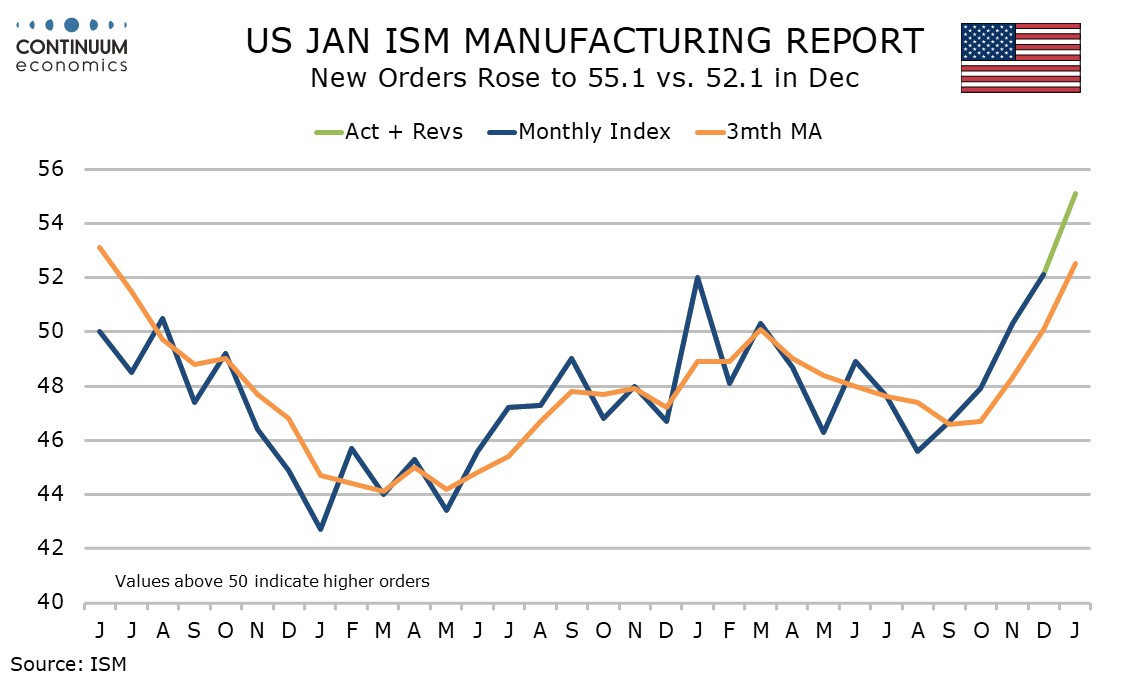

Detail for the ISM report is positive, the gain led by new orders at 55.1 from 52.1 while employment jumped to 50.3 from a weak 45.4. Production and delivery times also saw increases while the final contributor to the composite, inventories, was unchanged.

Prices paid do not contribute to the composite but also increased, to 54.9 from 52.5, not alarming but the highest since May 2024.