UK CPI Preview (Dec 20): Headline and Core to Slide (Slightly) Further?

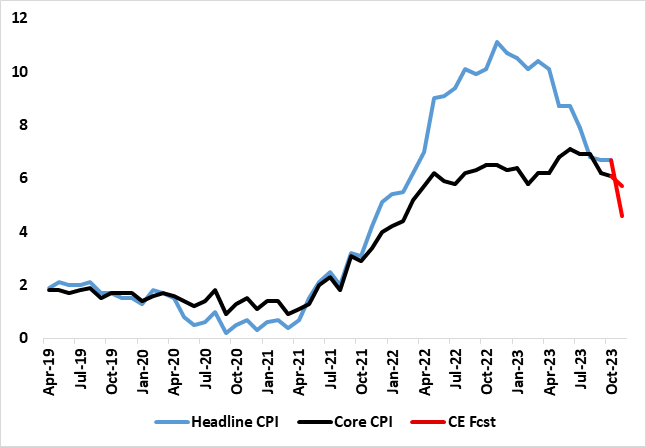

Superimposed over both upside and downside surprises, UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. We think this trend will continue in November even after the very favourable OFGEM-induced energy/utility bill base effects took the headline October down markedly to a 24-month low of 4.6% but where the core slid lower by a further 0.4 ppt to 5.7%, a 19-month low (Figure 1). WE see both sliding a little to 4.6% and 5.6%, meaning that would be some 0.2 ppt below BoE projections unveiled last month, which reflects in a) the short-term softer food and non-industrial good inflation and b) in the medium-term less of the upgraded price risk the BoE added to its latest MPR. Moreover, our estimates of seasonally adjusted data (Figure 2) add to the signs of clear disinflation trend very much continuing, albeit not intensifying.

Figure 1: Further Fall in in Headline and Core Inflation Beckons

Source: ONS, Continuum Economics

The government has made much of the fact that CPI inflation slowed to 4.6% y/y in October 2023, down from 6.7% in September and thus has more than halved from its peak of over 11% a year ago. The drop has little to do with government action, the very opposite. Instead, both supply and demand factors are reining in price and cost pressures and more broadly so. Indeed, core CPI (excluding energy, food, alcohol and tobacco) slowed to 5.7% y/y in October 2023, down from 6.1% in September; the CPI goods annual rate fell from 6.2% to 2.9%, while the CPI services annual rate fell from 6.9% to 6.6%.

The data was softer than expected, not least BoE expectations and with clearer evidence of a b road(er) fall as nine of the 12 CPI components slowed in y/y terms. All of which points to more disinflation ahead, albeit more slowly in coming months

A fresh fall in fuel prices will be a key factor in November, but lower food and non-energy goods inflation should also trim the headline rate. Indeed, more disinflation lies in store where surveys have already flagged lower food inflation and where more falls in non-energy goods prices may even be seen in addition to those utility bill base effects.

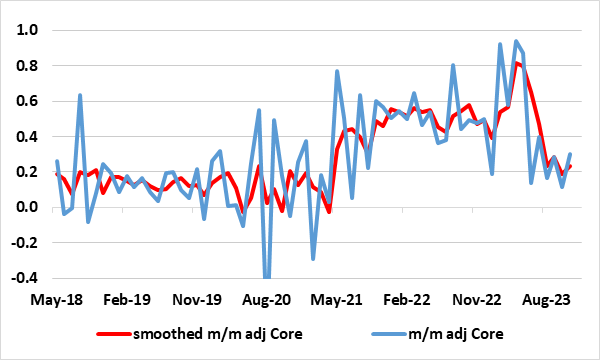

All of this is likely to reassure the BoE. The Bank may be calmed as various alternative y/y measures of core and underlying inflation have started to fall and where seasonally adjusted core prices eased further in October. However, recent months suggest that this slowing in core adjusted inflation has not intensified, instead with recent underlying inflation remaining close to target on a smoothed m/m adjusted basis (Figure 2). Regardless, it may be that downside economy risks are now taking precedence for the MPC majority.

Figure 2: Core m/m CPI Pressures Stabilising Near Target?

Source: ONS, Continuum Economics