Published: 2025-05-16T14:15:17.000Z

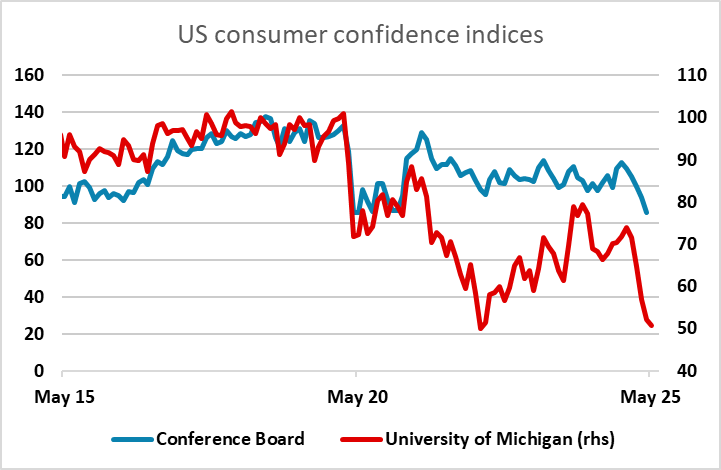

USD flows: Michigan sentiemnt shows further decline in confidence, rise in inflaiton expectations

2

Disappointign University of Michigan survey ought to be negative for risk and the USD, despite initial reaction

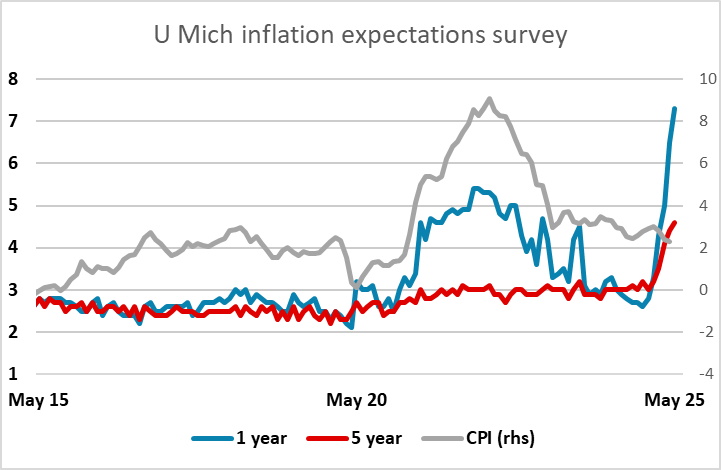

The University of Michigan consumer survey has produced another weak confidence number and a further increase in inflation expectations, which is slightly surprising given the tariff reductions announced with China and some slightly better business surveys. It may be that the survey reflects some evidence of price increases in May. The market reaction is quite muted, but if anything the USD is slightly firmer and yields slightly higher, while equities are not much changed. This looks a little inconsistent, as equities can be expected to suffer if we see significant inflation due to higher tariffs, and we would see some USD downside risks on these numbers, particularly against the JPY.