Published: 2024-07-18T16:05:55.000Z

Preview: Due July 24 - U.S. July S&P PMIs - Stronger Manufacturing, Services to correct lower

9

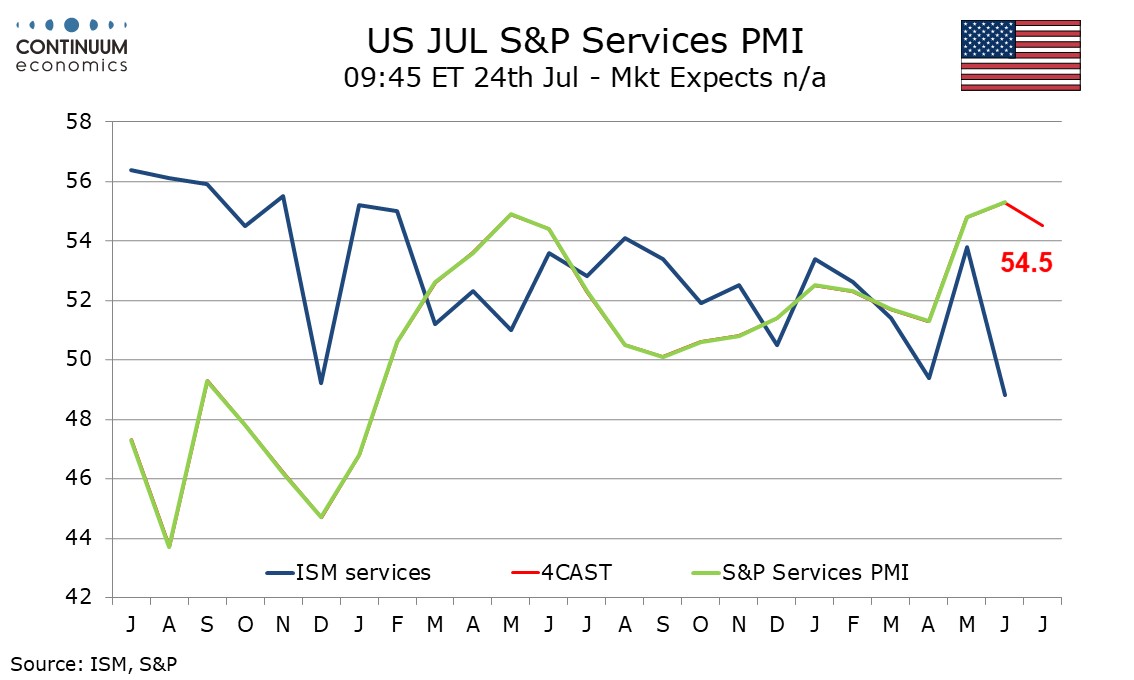

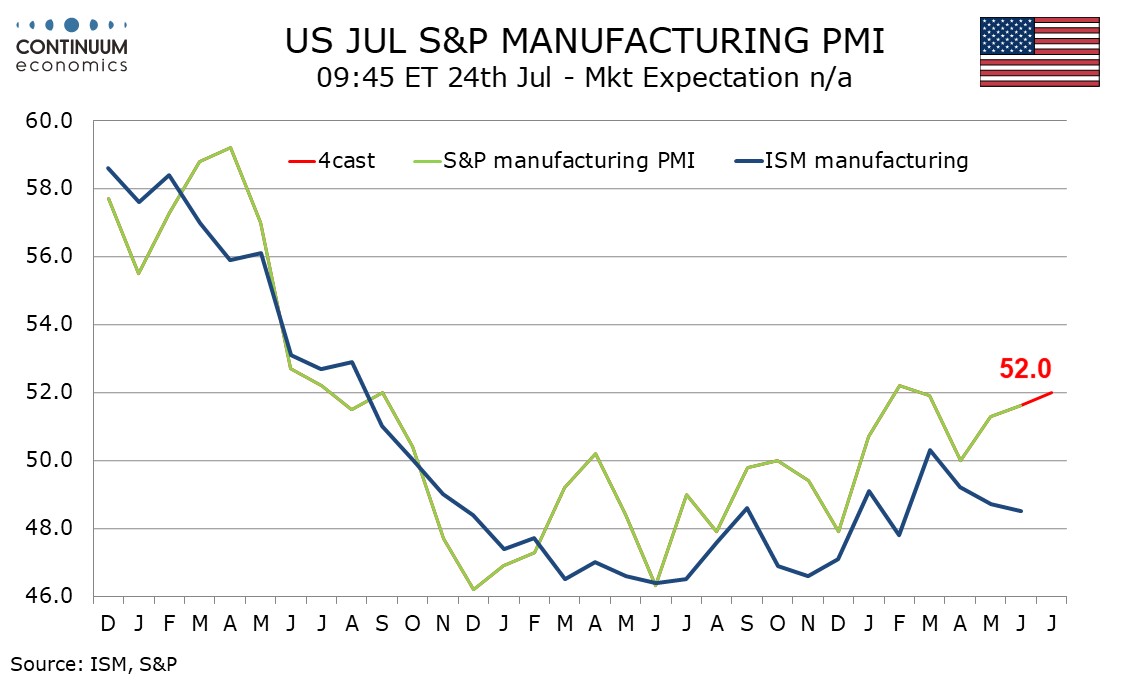

We expect July’s S and P PMIs to show continued improvement in manufacturing to 52.0 from 51.6 but a modest correction lower in services to 54.5 from 55.3.

Manufacturing has been trending firmer recently and outperforming the ISM manufacturing index, particularly in May and June. An increasingly positive July Philly Fed manufacturing survey is a positive signal, outweighing a still negative but little changed Empire State survey.

Services picked up significantly in May and June, May consistent with ISM services data but June a sharp contrast to weaker ISM data. The S and P and ISM services data do not have a good relationship and while the weaker June ISM data suggests some downside risk the S and P services index seems quite sensitive to bond yields which suggests a sharp dip is unlikely.