Canada Q1 GDP leaves BoC rate call a close one, but we now lean to no change

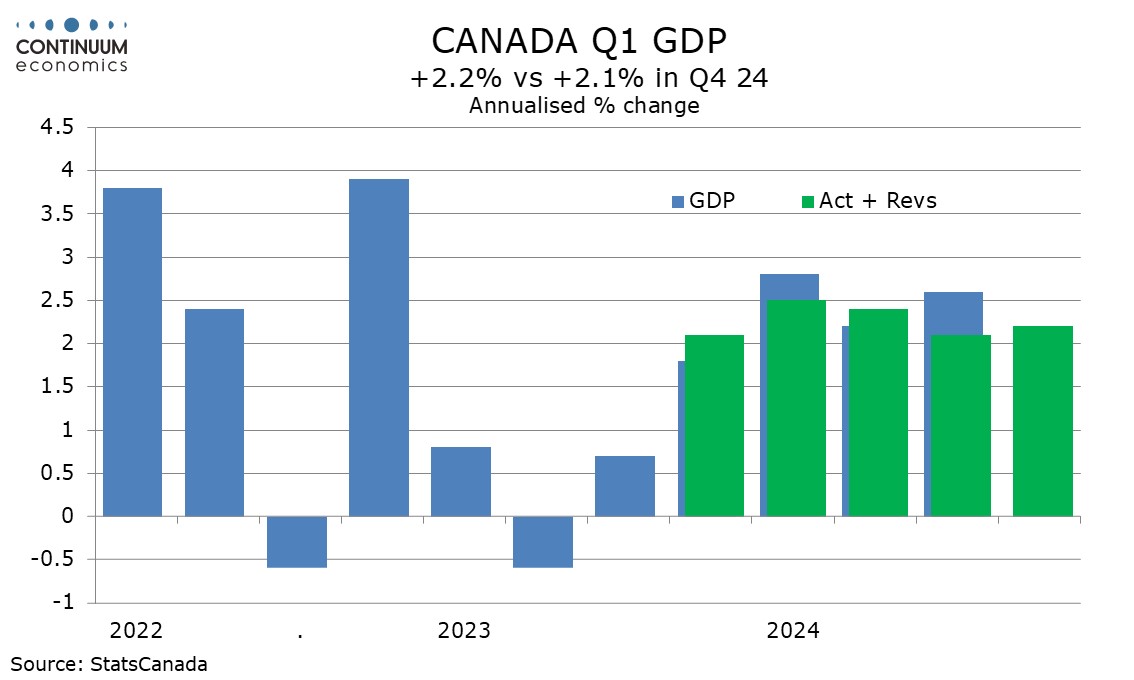

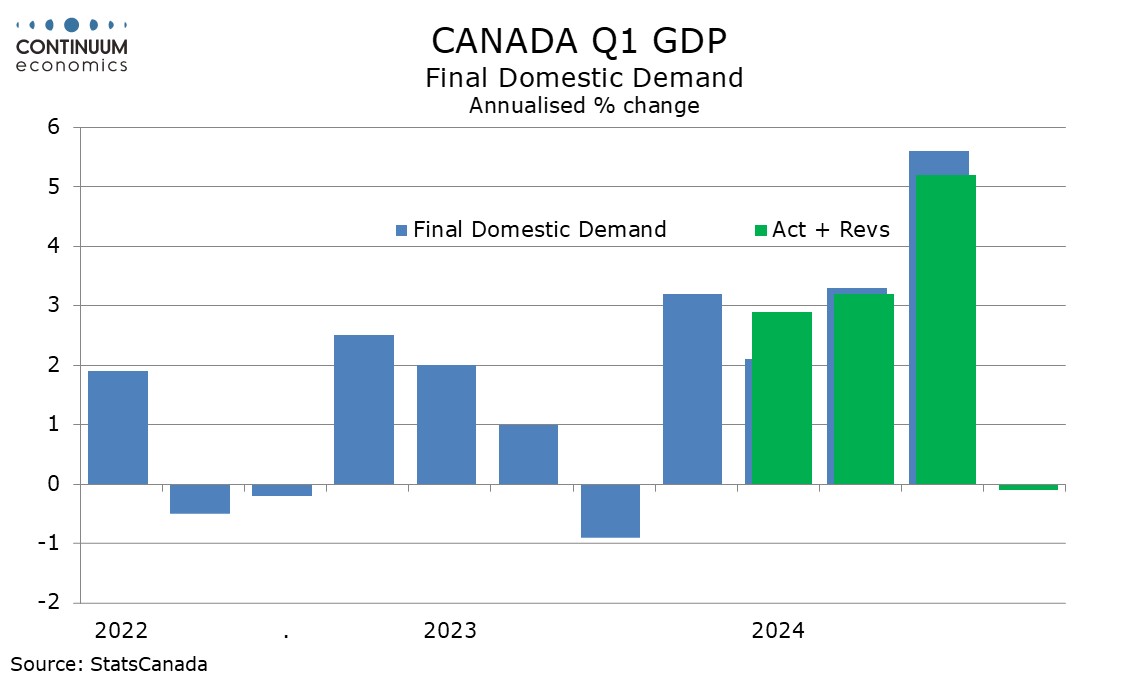

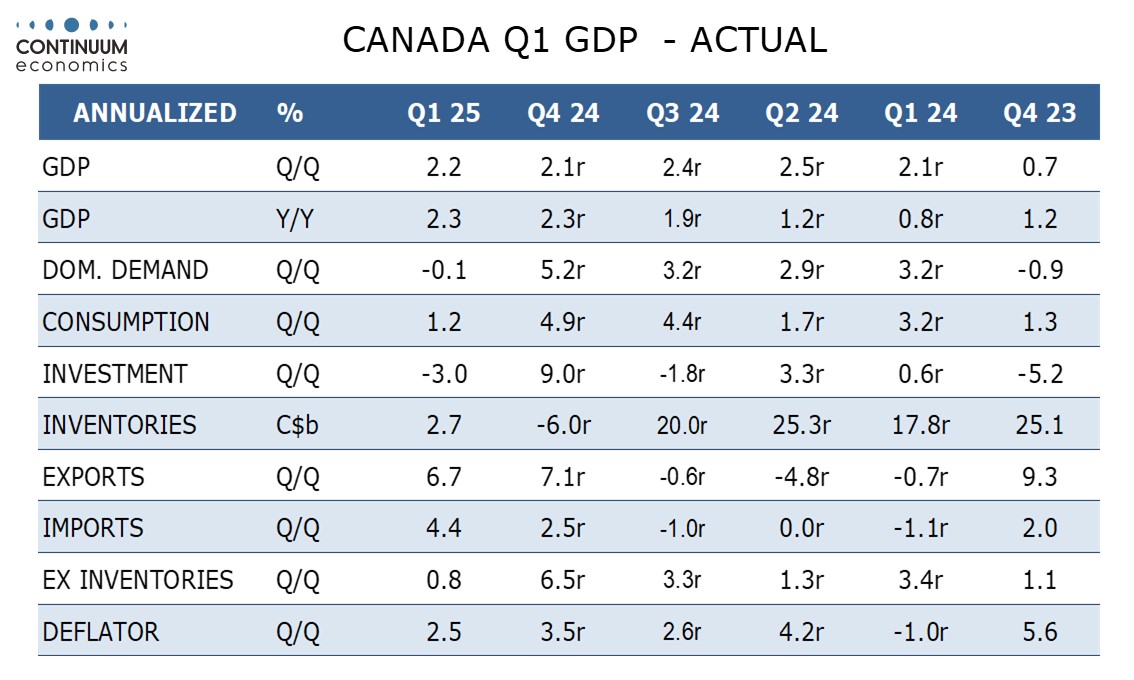

Canada’s Q1 GDP was surprisingly resilient, rising in line with recent trend by 2.1% annualized, though Q4 was revised down to 2.1% from 2.6%. Detail was less positive, with domestic demand falling by 0.1% though this follows a 5.2% surge in Q4. March GDP rose by 0.1% as expected, and the preliminary indication for April is also up by 0.1%, suggesting continued resilience at the start of Q2.

Wednesday’s Bank of Canada call is a close decision, though with GDP showing some resilience, April core inflation showing an acceleration and trade risks, while still large, having eased somewhat, we now lean to the Bank of Canada remaining on hold as it awaits further developments.

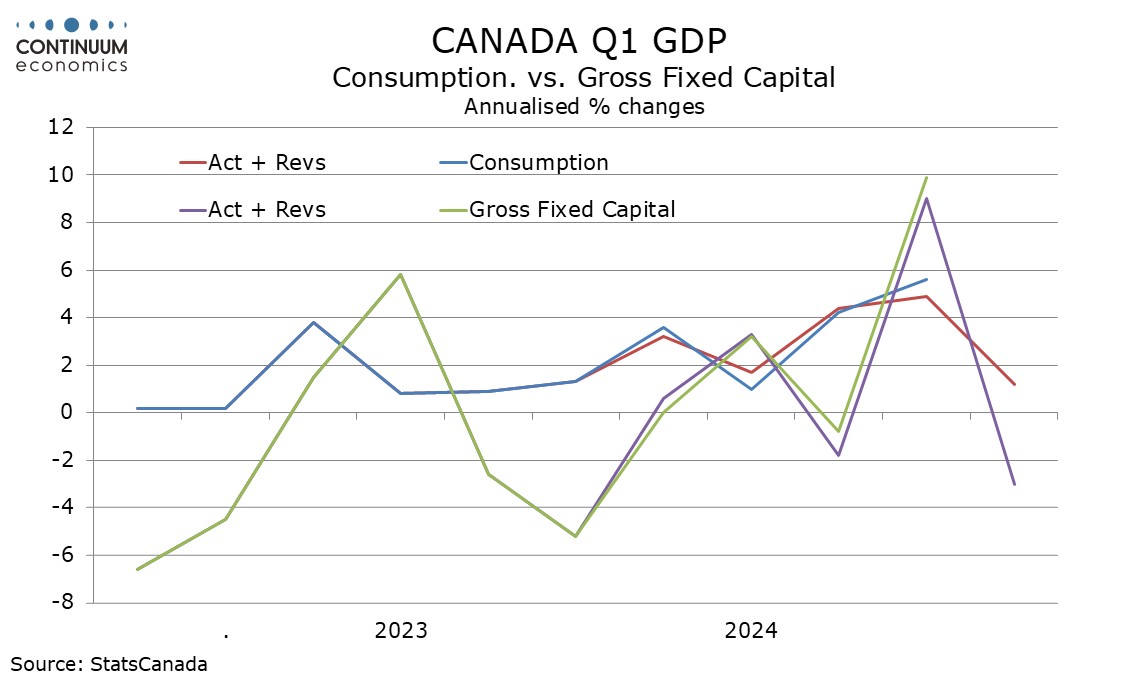

Household consumption rose by a subdued 1.2% after two straight gains of over 4% which were assisted by Bank of Canada easing. BoC easing has continued, but is now balanced by trade uncertainty. Business gross fixed capital formation fell by 3.1% after a 9.4% Q4 surge but the correction came largely in housing. Structures, machinery and equipment rose by 4.0% after a 4.7% increase in Q4.

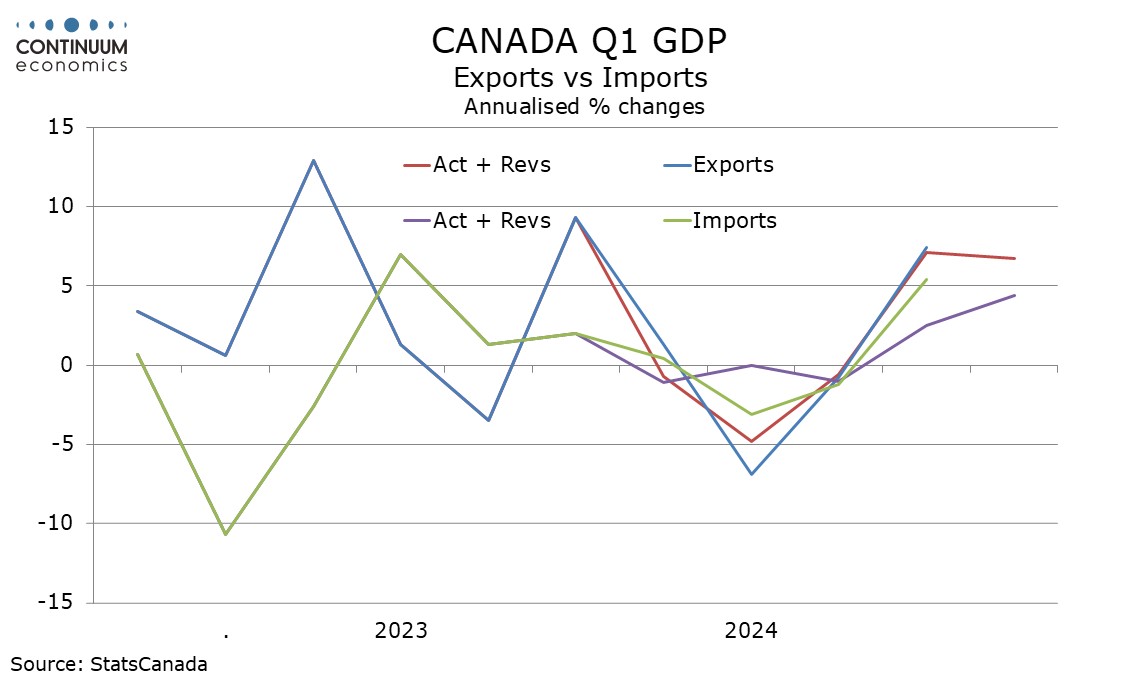

Exports rose by 6.7% outpacing a 4.4% rise in imports but the positive from net exports will be difficult to sustain as tariffs start to bite. A correction higher in inventories added 1.4% to GDP after a 4.4% negative in Q4. The Q1 rise in inventories does not leave inventories looking over-inflated.

The GDP deflator rose by 0.6% or 2.5% annualized, not a worryingly high figure but yr/yr growth of 3.2% is quite strong.

While the resilience of Q1 data does suggest a slowing is coming, the preliminary estimate for a 0.1% increase in April GDP suggests we are not in recession yet, and that may encourage BoC caution, particularly given firm core inflation data for April. April’s preliminary data does however show weakness in tariff-sensitive manufacturing, outweighed by gains in mining and finance/insurance.

March’s 0.1% rise in GDP was as preliminary data released with February’s report had suggested. Goods rose by 0.2% led by mining while services rose by 0.1%.