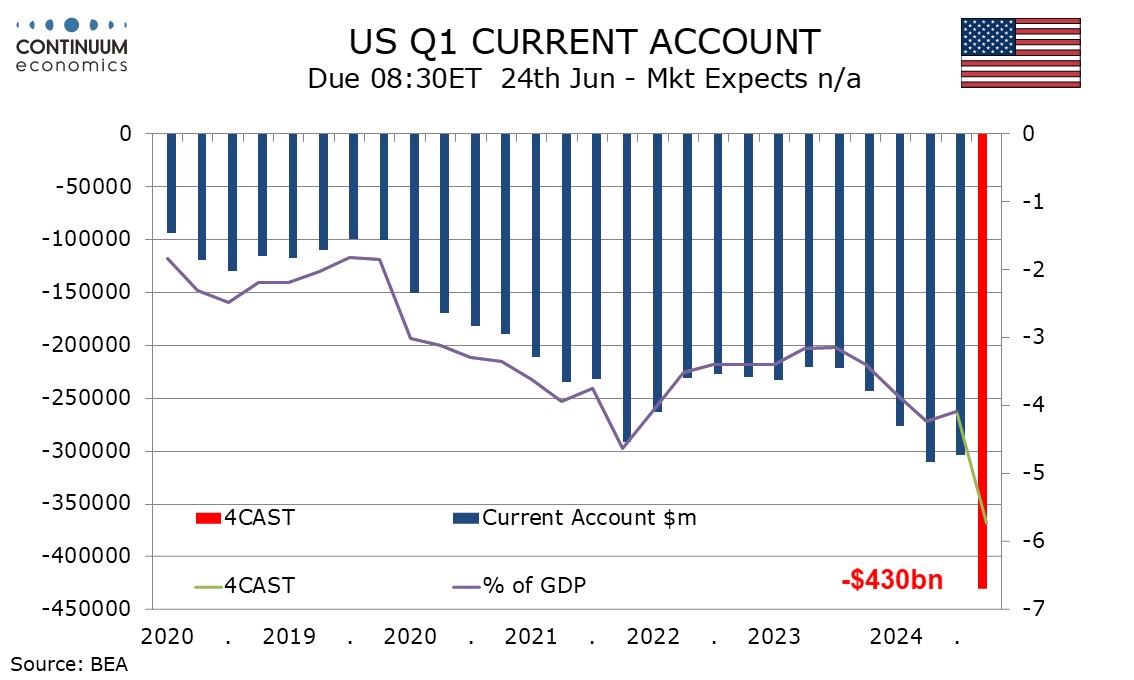

Preview: Due June 24 - U.S. Q1 Current Account - Deficit to surge but to reverse in Q2

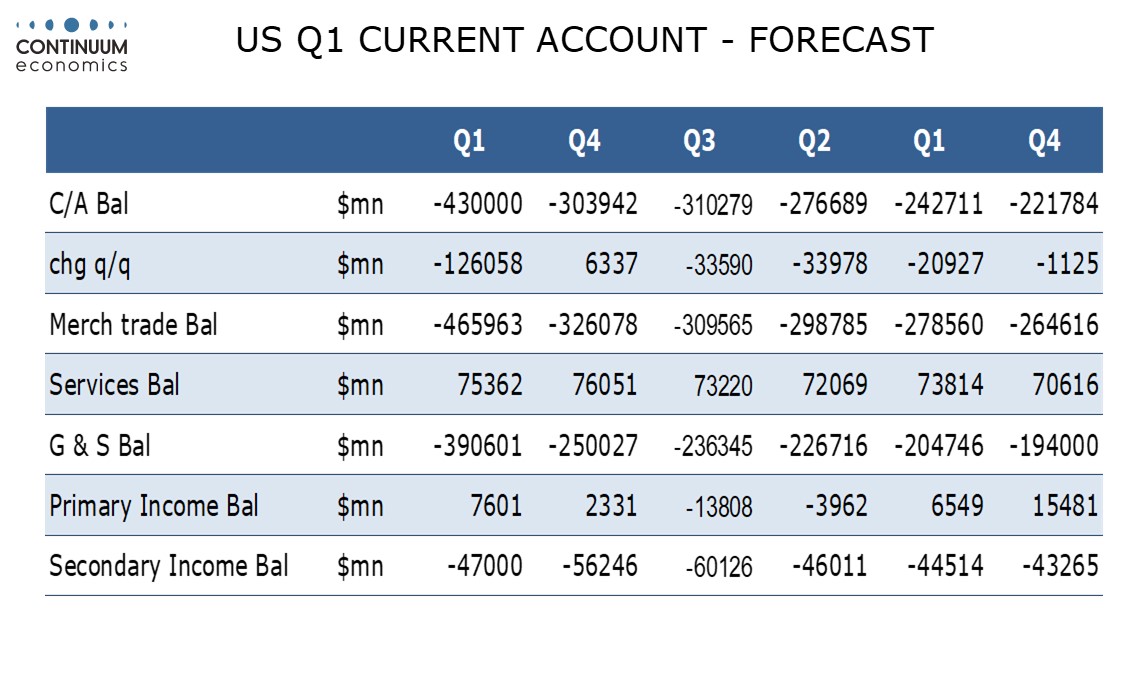

We expect a record Q1 US current account deficit of $430bn, up from $303.9bn in Q4, which will probably be revised a little lower. The rise in the deficit will be largely on a pre-tariff surge in goods imports and is likely to be reversed in Q2. As a proportion of GDP the deficit would be 5.7%, up from 4.1% in Q4 and the highest since Q3 2006.

Monthly trade data on goods and services has already been released. The Q1 goods deficit increased to $466.0bn from $328.9bn (revised from $326.1bn in the Q4 release). The Q1 services surplus slipped to $75.4bn from $78.0bn (revised from $76.1bn in the Q4 release).

Still to be released are data on primary (investment) income and secondary (unilateral transfers) income. Fed flow of funds data however suggests the balance on the former will be stronger than a $2.3bn surplus in Q4, which is likely to be revised above the $7.6bn surplus we expect in Q1. The Fed data suggests a decline in the deficit in the latter to $47.0bn from $56.2bn in Q4, which is unlikely to be significantly revised. This would return the deficit secondary income deficit to a normal level after unusually large deficits in Q3 and Q4.