Preview: Due March 5 - U.S. February ISM Services - Not as weak as S&P Services PMI

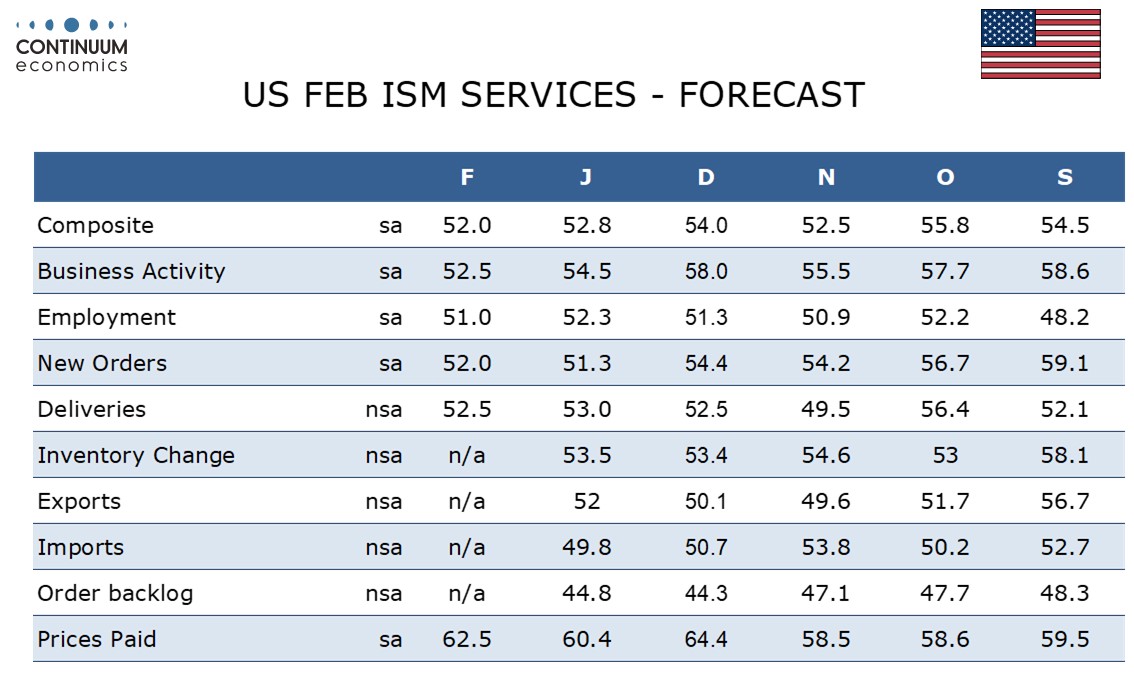

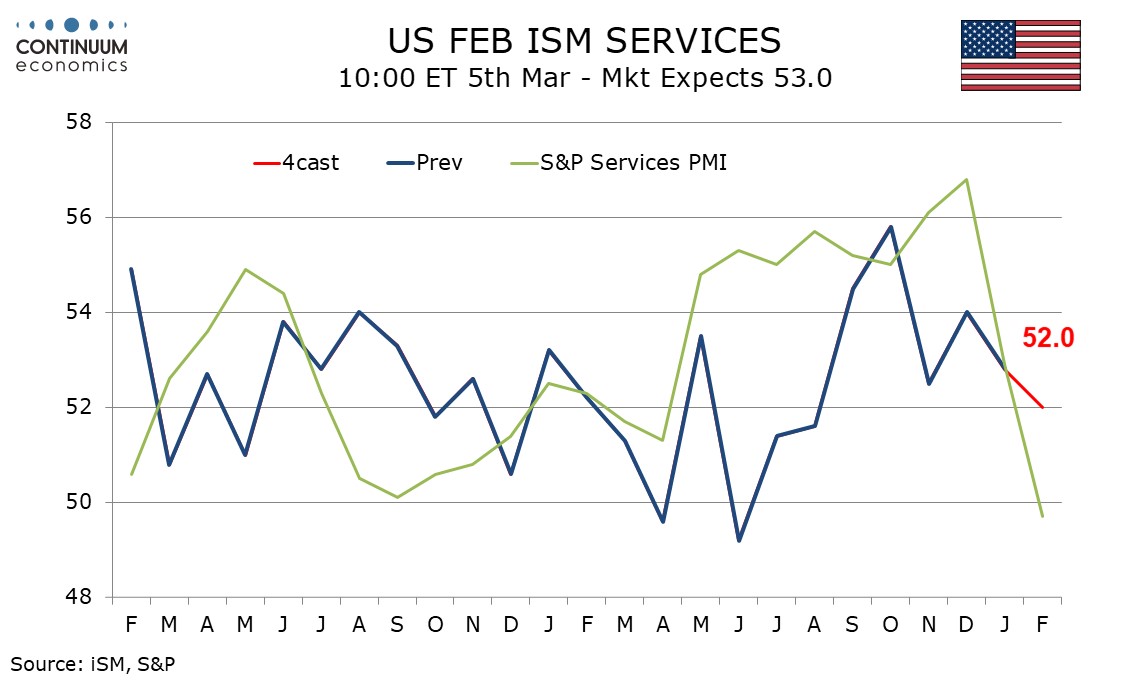

We expect February’s ISM services index to slip to 52.0 from 52.8 in January, moving the index to its lowest since August 2024 but showing more resilience than the S and P services PMI which slipped below the neutral 50 level.

The correlation between the ISM and S and P service PMIs is not strong and the latter appears more sensitive to interest rate expectations, and specifically recent scaling back of Fed easing hopes. Regional service surveys have been mixed, with the Empire State’s and Philly Fed’s increasingly negative, the Dallas Fed’s less positive but the Richmond Fed’s increasingly positive.

In the ISM services breakdown, we expect a correction higher in new orders after a significant January weakening but modest slowings in the other three contributors to the composite, business activity, employment and deliveries. Prices paid do not contribute to the composite. Here we expect a rise to 62.5 from January’s 60.4, only partially reversing slippage from December’s stronger 64.4.