BoE Preview: Upside Inflation Risks Diminishing?

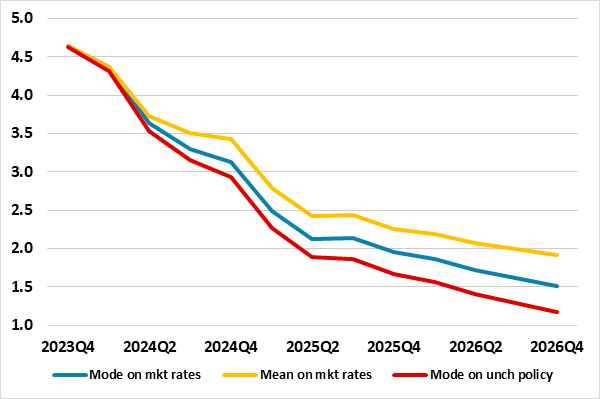

Bottom Line: As widely expected, the BoE kept policy on hold for a second successive meeting early last month. WE see this being repeated when the next MPC decision is unveiled on Dec 14, but with a slightly clearer vote in favor of keeping Bank Rate at 5.25%, with fewer dissenters than the three who favoured a further 25 bp hike last time around. A tightening bias is likely to persists as the MPC still highlights upside risks to the inflation outlook albeit where those risks were superimposed over a below target outcome 2-3 years hence, regardless of policy assumptions (Figure 1). No formal forecast update is due so this will be something of staging post meeting ahead of more data that will help form a fresh policy assessment for the looming Feb 1 MPC verdict. Regardless, we remain of the view that policy has peaked permanently after 515 bp of tightening, dating back to December 2021. Indeed, as the downside risks we envisage materialize, the BoE will be forced to start easing from Q2 next year.

Figure 1: BoE Outlook Sees Inflation Falling Below Target

Source: BoE Monetary Policy Report

Admittedly, the BoE is already fairly gloomy with the GDP growth outlook in November having been pared by a full ppt over the forecast horizon, including a 0.5% downgrade to zero for 2024 – similar to our own view. Regardless, it is clear that the BoE is in no way corroborating any early easing noting that ‘policy is likely to need to be restrictive for an extended period of time’. Given how restrictive the current stance is this rhetoric does not rule out some easing in the next year, especially as we think the BoE is overdoing the upside inflation risks. In addition, the MPC must be aware that conventional policy easing is on the cards for 2024; historically the average gap between the final rate hike and the first cut is under seven months (in pre-pandemic period of BoE independence). It may also be wary that it would have a possible communication conflict if, in coming months, it started to accept rate cuts are possible whilst continuing to tighten unconventionally. Maybe this is an additional reason why the majority of the MPC have been so keen to suggest policy easing discussion is premature.

Grappling With Uncertainty

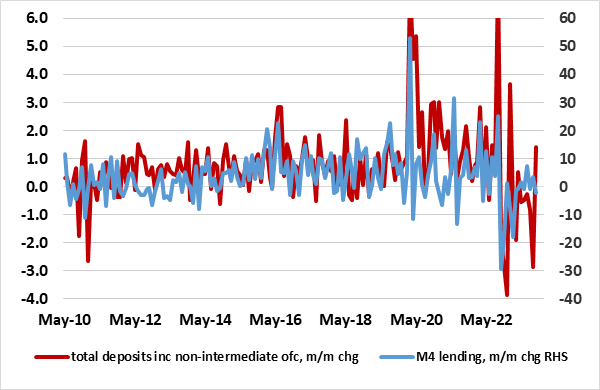

The decision last time around was no surprise and with both the decision and the policy arguments put forward by the two ‘camps’ suggesting no major differences. Instead, there were still merely different interpretations over the data, with the dissenters more of the view that ‘there was evidence of more persistent inflationary pressures’ than any division over the outlook. In this regard we are puzzled why the BoE has not followed the lead of the ECB in both providing seasonally adjusted data which gives it the potential to assess up-to-date inflation developments that are not dominated by base effects from a year before and/or by producing measures of what are considered to be persistent inflation pressures. After all, the ONS has. What we may see is a Monetary Policy Report with more discussion on the monetary side of the economy, this to address (or refute) recent criticism that the Bank must do more to foster a diversity of views and strengthen a culture that encourages challenge. Indeed, a lack of emphasis on the monetary side has been a criticism we have made of the BoE for some time, all the more notable given the weakness and possible cause of such marked weakness in bank deposit and lending (Figure 2).

Figure 2: Marked Weakness in Bank Deposits and Credit

Source: BoE

Importantly, there does seem to be growing wariness that the economy is seeing growing downside risks that are also partly materializing, this highlighted by survey data and the last batch of labor market numbers. Admittedly survey data (at least apart from construction) have been less downbeat. However, there are additional risks ahead that add to uncertainty, no least that financial institutions beyond regulated banks may cause the next financial crisis, this being a key theme of the latest BoE Financial Stability Report.

Regardless, it is clear that the MPC majority thinks that policy moves so far have yielded only around half the likely eventual impact, this accounting for the 0.5 ppt downgrade for 2024 to zero and a cumulative downgrade of around one ppt. It is also clear that the BoE has been too optimistic about real activity data of late, this ranging from how tight the labor market has been to GDP growth. This may still be the case as the downgrade it has made to Q4 GDP (to 0.1%in q/q) terms may be challenged by the yet-to-be published October data due next Wednesday!

No Clear Message

Overall, with the MPC not trying (or able) to offer any clear message (specifically to markets) about policy given the uncertainties, data inconsistencies and forecast misses seen of late, the fact that the MPC sees policy being restrictive for an extended period of time does not rule out rates having both peaked and possibly being cut into 2024. Given how restrictive the current stance is this rhetoric does not rule out some easing in the next year, especially as we think the BoE is overdoing the upside inflation risks given the weaker growth backdrop and outlook. As a result, we are even more of the view that policy has peaked permanently and as these downside risks materialize, the BoE will be forced to start easing from Q2 next year.