Preview: Due October 30 - U.S. October ADP Employment - Weaker on strike and weather, but perhaps less so than payrolls

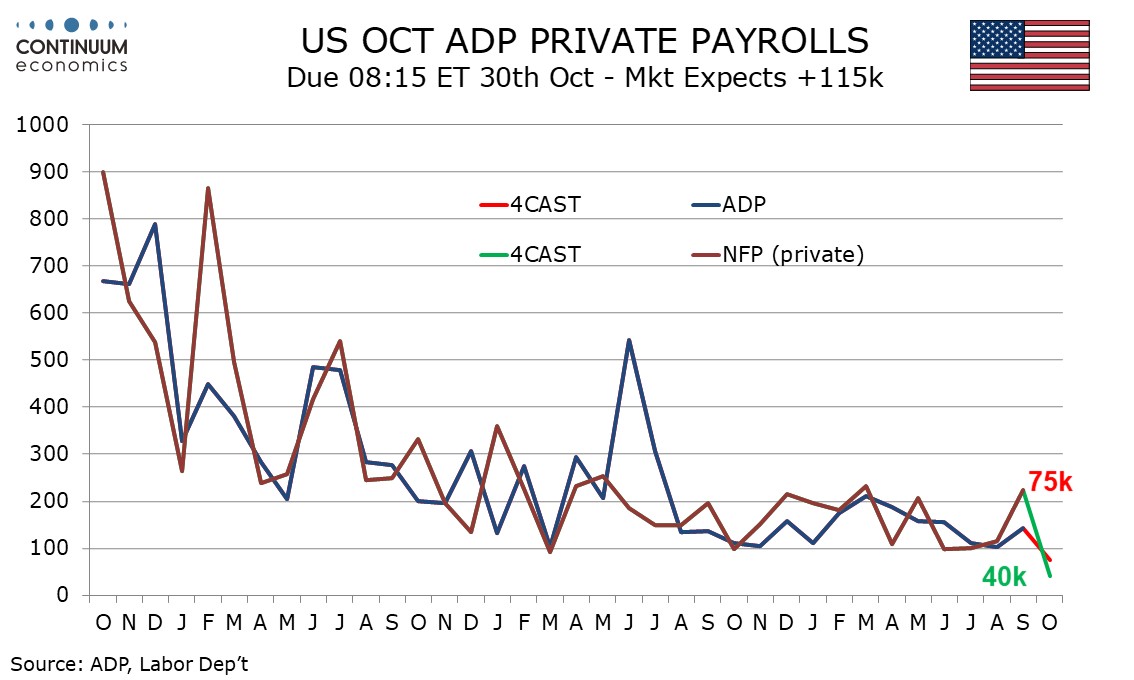

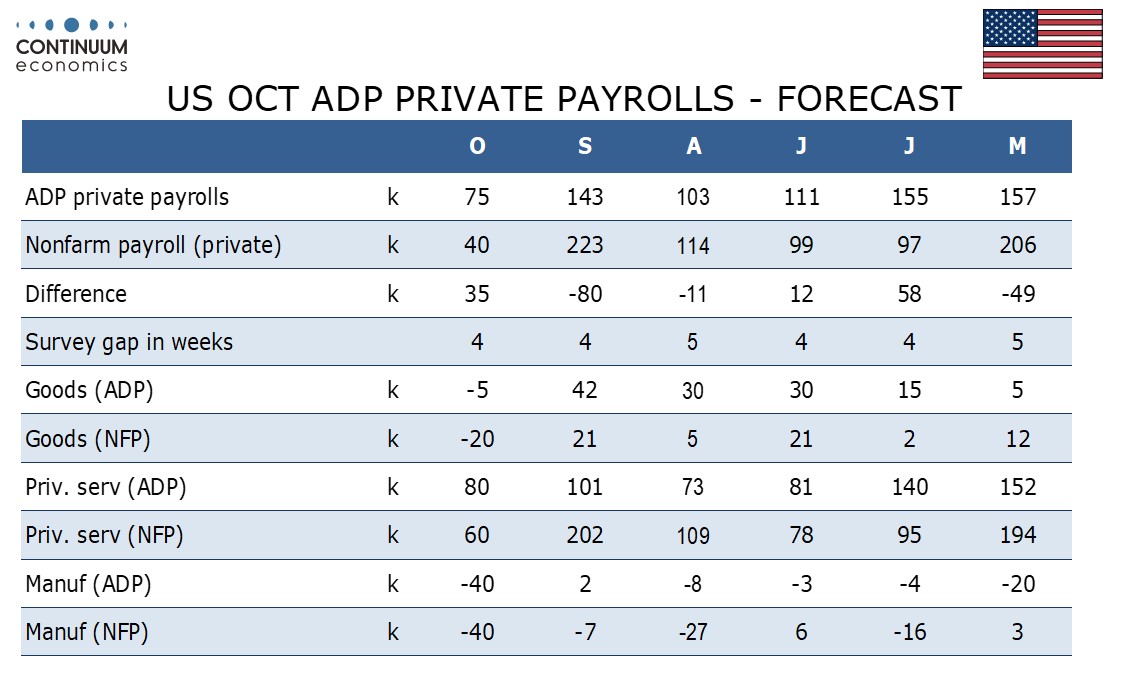

We expect a 75k increase in October’s ADP estimate for private sector employment growth, which while matching our forecast for overall non-farm payrolls is stronger than our 40k forecast for the more directly comparable private sector non-farm payroll. We expect ADP data to prove less sensitive to bad weather than the non-farm payroll.

Hurricane Helene in late September came too late to impact September’s data but could have some lingering impact in October’s survey, while Hurricane Milton hit Florida in October’s survey week. This makes the hurricanes a significant downside risk to October’s data, but the ADP survey tends to be less weather-sensitive than the non-farm payroll. We expect a strike at Boeing, which is likely to take over 30k off manufacturing payrolls, to impact ADP data equally, as Boeing uses ADP’s services.

ADP’s survey underperformed the private sector non-farm payroll by 80k in September and this adds to the risk of an ADP outperformance in October. ADP’s 143k October increase was however stronger than its August outcome of 103k and July’s 111k. Excluding the impact of the Boeing strike, we expect ADP’s October data to look similar to the data from July and August.

.