EUR: EUR slightly weaker after ECB bank lending survey

ECB bank lending survey shows more credit tightening and demand weakening, but at a slower pace. Unliekly to chnage any minds at the ECB, and EUR still has scope to rally if market shifts towards the first cut coming in summer.

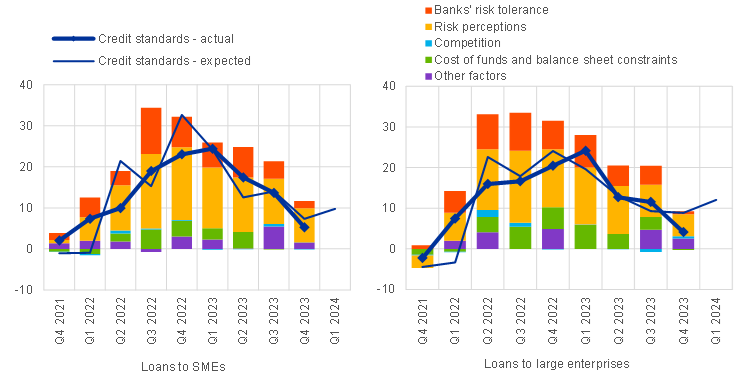

Changes in credit standards applied to the approval of loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

The ECB Q4 bank lending survey showed a continuation of recent trends, with further tightening of credit standards and further declines in demand for loans, but the tightening and declines were happening at a steadily reduced rate. While it is important to realise that the effect of the tightening is cumulative, as is the decline in demand, there will be some comfort taken from the expectation that on current trends the tightening of standards and the decline in demand will be coming close to an end on Q1 2024.

Changes in demand for loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

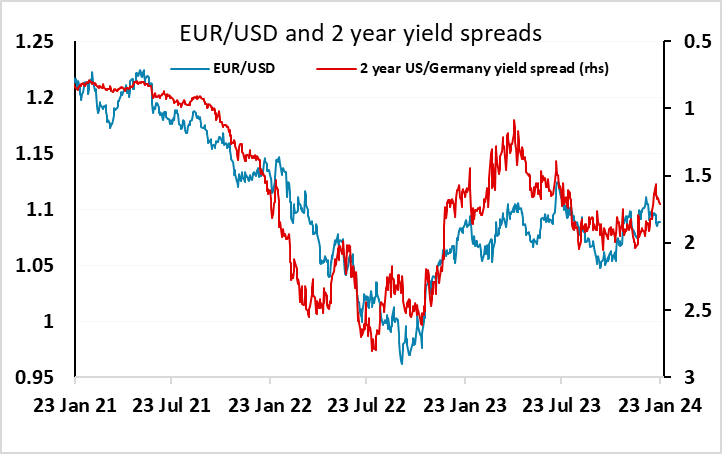

Even so, negative headlines about further tightening in credit standards and further declines in loan demand, and the fact that the tightening was larger than expected, have pushed EUR/USD a little lower, although there has been no significant decline in Eurozone yields in response. We doubt today’s survey will change any minds at the ECB, where the inclination is still to look at the first cut coming in the summer and not as early as April, which is currently 70% priced for a cut by the market. This suggests some mild upside risks for front end EUR yields, and consequently for the EUR, although the EUR direction is currently being more affected by the equity market tone, and this will continue to be an important factor.