U.S. March S&P PMIs - Manufacturing picks up but Services slip

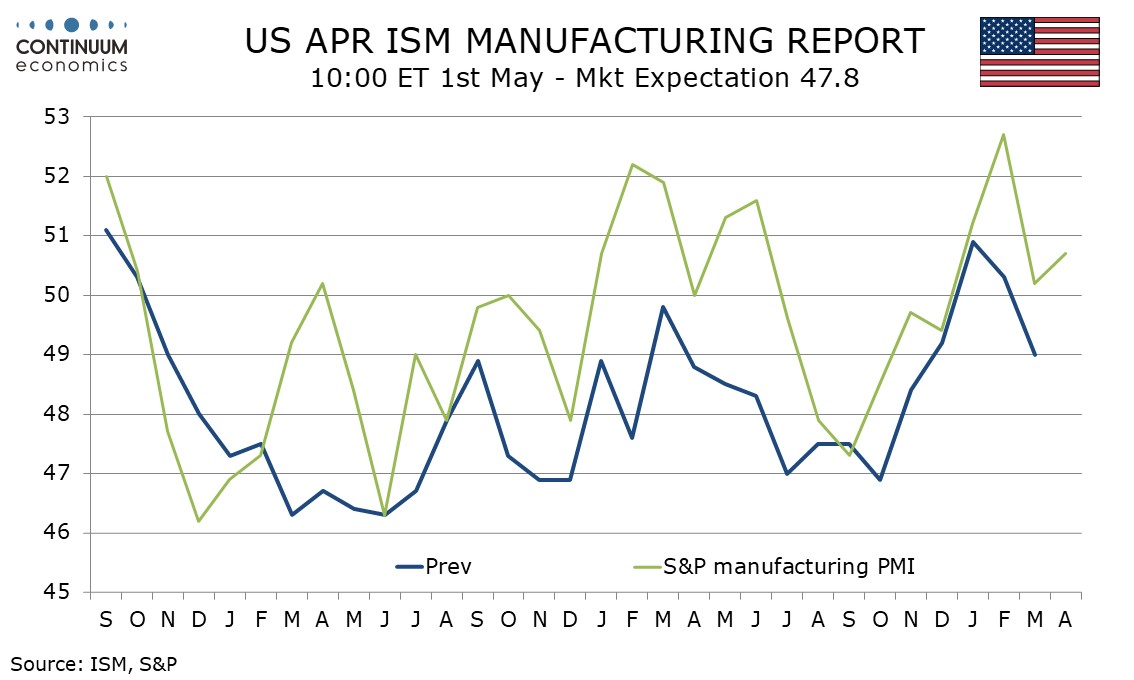

April’s preliminary S and P PMIs are mixed, with manufacturing showing an unexpected improvement to 50.7 from 50.2 but services slipping significantly to 51.4 from 54.4. This contrasts March data when manufacturing slipped but services increased, suggesting not too much should be read into the monthly swings.

.

The improvement in the manufacturing index contrasts signs of weakness in regional manufacturing surveys, namely the Empire State, Richmond Fed and particularly the Philly Fed, but does reduce downside risks for the ISM manufacturing index somewhat.

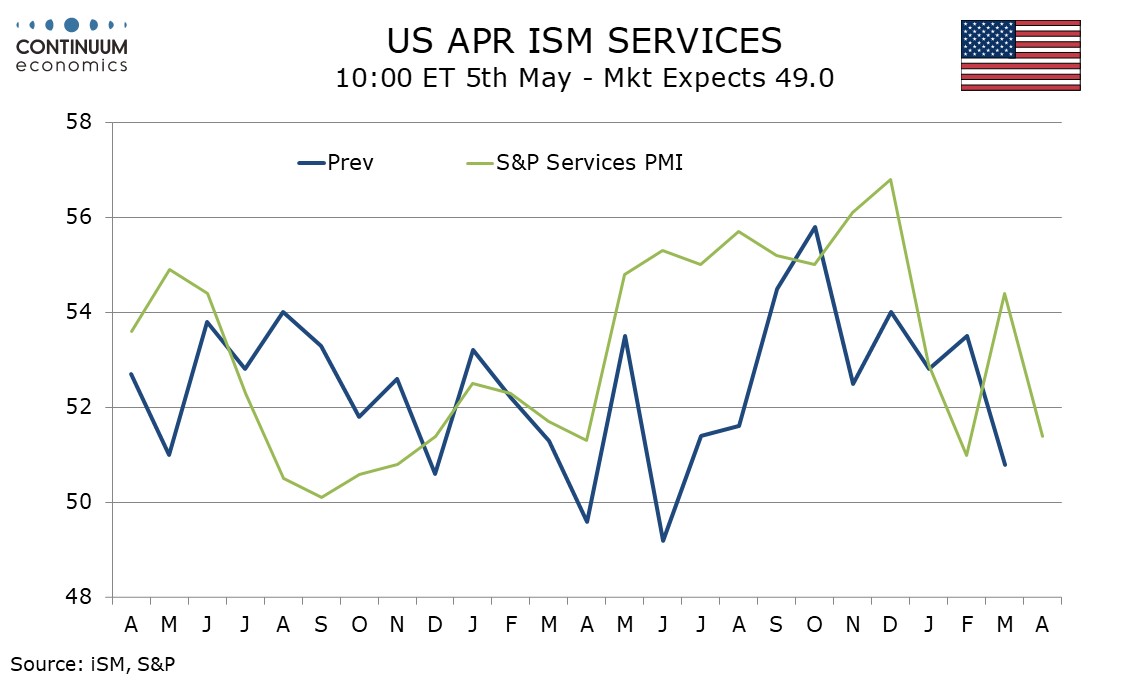

The slippage in the services index does not fully erase a bounce seen in March, but follows a similar dip in March’s ISM services index, while regional Fed services surveys in March to date have been weak too. The composite index is lower, at 51.2 from 53.5, with services slippage outweighing the manufacturing rise.