This week's five highlights

Fed Policy Easing Slowing

BoJ Serves A Nothing Burger

A Dovish Hold for BoE

Norges Bank Caution Prevails

Nearing the End for Sweden Riksbank?

The FOMC statement, FOMC medians and Powell during the Q/A left the impression that Fed easing will slow down into H1 2025. We now see two 25bps cuts in March and June 2025 driven by a Fed’s desire to avoid too much labor market slack occurring, but then pausing for the remainder of 2025 at a 3.75-4.00% Fed Funds rate. In 2026, we see the Trump administration policy producing a higher core PCE inflation than the FOMC median and thus we feel that the Fed will hike by 75bps and actually increase the degree of restrictive policy.

The December FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

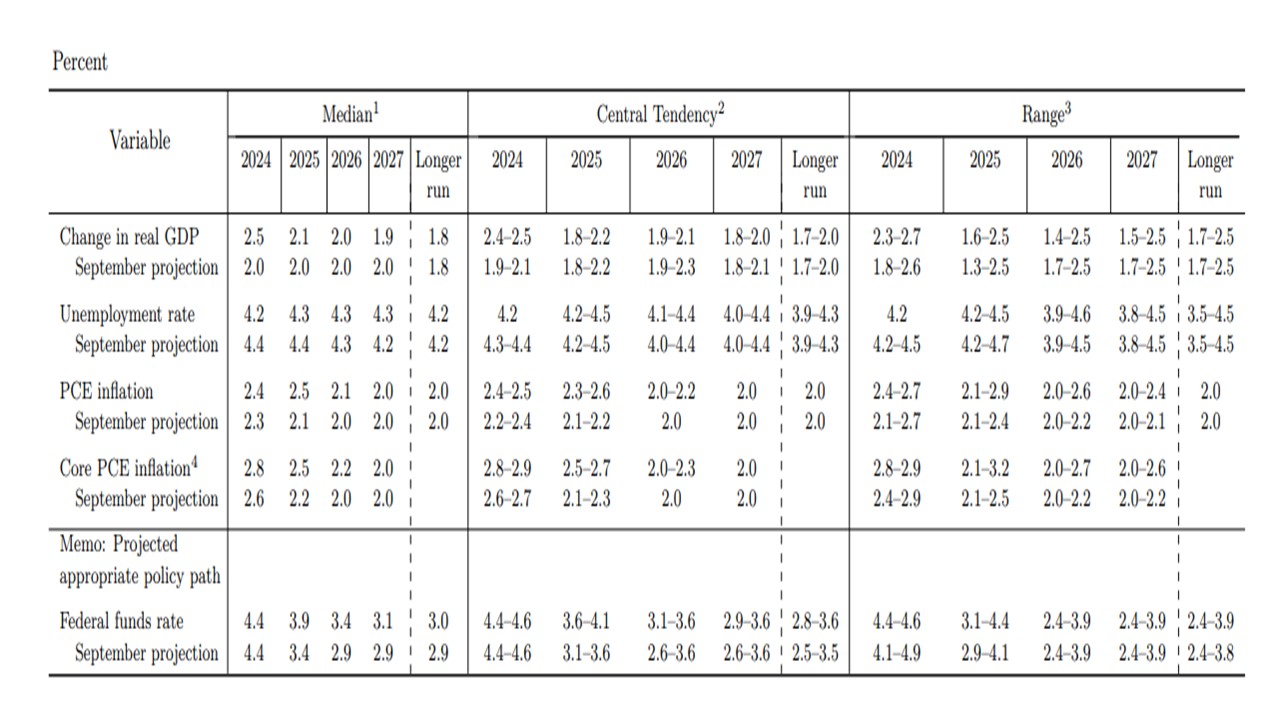

· Inflation revised. The median core PCE for 2025 and 2026 have been revised higher to 2.5% and 2.2% respectively, while the growth profile is consistent with the September view of 2.0%. However, in the Q/A Powell did note that the FOMC judgement was that the labor market now has more slack than 2019 and still cooling further – job finding rates/quits etc. Additionally, he appeared to feel that inflation progress to target was broadly on track, though acknowledged that central tendency for core PCE was skewed to the upside. The FOMC of course will need to take a view on the impact of economic policies from PresidentElect Trump, which we feel will likely boost the inflation profile in 2026 due to aggressive tax cuts and moderate tariffs with a neutral impact on GDP. Powell did acknowledge that the Fed had already started discussing the impact of tariffs, though without conclusions due to uncertainty over what will happen.

· Guidance on Interest rates. The FOMC statement guided that additional rate cuts will be dependent on the data; evolving outlook and balance of risks. Meanwhile, the median dots pencil in a further two 25bps in 2025, with the range being symmetric. A further 50bps is then penciled in for 2026, though the 2026 medians are more uncertain as they do not fully reflect how Trump’s policies will impact policymakers interest rate views in 2026 – though Powell indicated that some FOMC members inflation views were already being impacted. Additionally, Powell indicated that the FOMC decision was a close call, which tends to argue against a January move and a wait and see approach.

· 2025/26 rate prospects. Our read is that Fed easing will now slow with two 25bps cuts in the Fed Funds rate to 3.75-4.00%, which most likely will be delivered at the March and June FOMC meetings. Thereafter we see the Fed going on hold, both as it watches the lagged easing coming through but also as the Trump administration’s policy starts to cause concern that core PCE inflation will not come back down to 2.0%. We would pencil in three 25bps hikes Q1/Q2/Q3 2026.

· Terminal v Neutral Rate. The neutral rate median has now edged up to 3.0% and a risk exists that this could edge slightly higher in 2025. The median Fed Funds does get down to 3.1% in 2027, but the 2026 and 2027 cuts are likely fluid and uncertain – the distribution in the SEP are more dispersed than for 2025. We would suspect that the Fed visibility beyond H1 2025 is limited.

At the December 18 meeting, the BoJ has kept rate unchanged at 0.25% and there is no forward guidance just like previous statement. The BoJ had taken a hawkish tilt in the July meeting, which continues to be shown in the quarterly report, citing "Given that real interest rates are at very low levels, BOJ will continue to raise policy rate if economy, prices move in line with its forecast", but it seems that the pace of action from the BoJ is slower than their words as we have seen no policy nor forward guidance change from the BoJ since July. There is also a "Review of Monetary Policy from a Broad Perspective" released along the December statement, analyzing the past policy and its impact towards the Japanese economy. There is a lot of information in the 212 pages report, but in short it concludes that it is right for the BoJ to target "a price stability" at 2%, should be keeping real interest rate above 0% so there are room to stimulate when the economy downturn. Yet, none of these are forward guidance. The rhetoric of data dependency persists and the key lies in wage/price dynamic. We now see only one 25bps hike in Q1 2025 and terminal rate at 0.75% by year end 2025.

The Japanese economic picture is also hindering BoJ's step. Private consumption has been weak in 2024 and the recover after contraction in Q1 is sluggish. With the forecast of gradual pickup, the BoJ may have to assess the impact towards the broader economy as they decided to step ahead too fast. The gradual pickup in growth will likely be supportive for BoJ's further tightening but we are afraid the window to bring terminal rate to higher ground is diminishing. While there is a certain level of underlying strength in core inflation, it is likely for inflation to tread lower in 2025. The rise in trend inflation BoJ envisioned will only be seen slowly over the coming years as Japanese residents and business adapt to the new wage/price dynamic.

The lack of forward guidance has sway market pricing meeting from meeting as there is little cue what is to come. We think the BoJ could hike at least once in Q1 2025 if there is early positive sign of 2025's wage negotiation and could bring rates to 0.75% by year end. However, if the BoJ is taking it slow and decided to only hike after the result of 2025 wage negotiation, it meant the BoJ is not confident in their own forecast and could see rates staying at 0.5% for 2025 before following the slow grind in higher trend inflation.

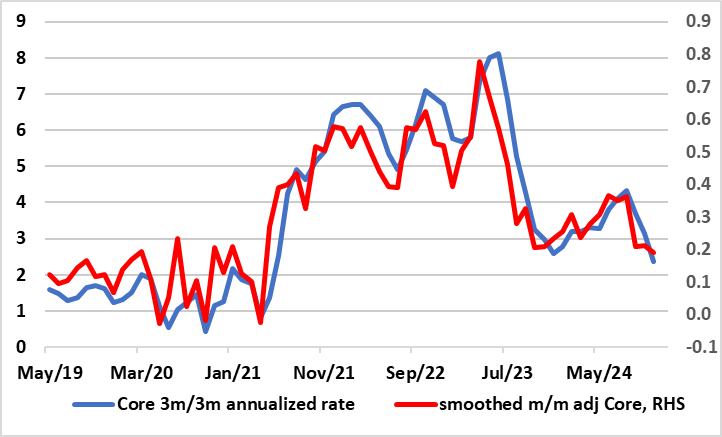

Figure: Clear Adjusted Core Inflation Drop Intact?

An expected unchanged decision left Bank Rate at 4.75% but what was not foreseen was three dissents in favor of a cut with a further member advocating a more activist strategy (presumably ahead). Overall, the BoE adhered to a gradual approach to removing monetary policy restraint remains appropriate and continued to suggest it will decide the appropriate degree of monetary policy restrictiveness at each meeting. But there were several less hawkish aspects to the statement, including that the labor market may no longer be tight; less reference to inflation persistence; that growth risks had risen to a degree where current quarter GDP may be flat and where the Bank Agents Report suggested a clear slowing in wage pressures into 2025. In addition, the minutes noted that core (and even for services), adjusted m/m data showed a weaker backdrop than headline y/y numbers (Figure).

If the November decision was seen as a hawkish easing, this may be seen as dovish policy hold. It does appear that the BoE is uncertain and is unable to give clear forward guidance, but we think its gradualist approach is consistent with at least four 25 bp moves next year and we think there could be five. Indeed, while there was less mention of its new scenario strategy which had allowed Governor Bailey recently to flag around four 25 bp cuts next year, we think this is still BoE thinking but one that is clouded by added uncertainty. In particular, the MPC majority is perturbed by the extent to which recent developments in output could reflect the weakness of both demand and supply, such that there might be fewer implications for the margin of spare capacity in the economy and thus domestic inflationary pressures. It may also be reassessing its initial judgement about how growth stimulant the Budget actually may prove to be.

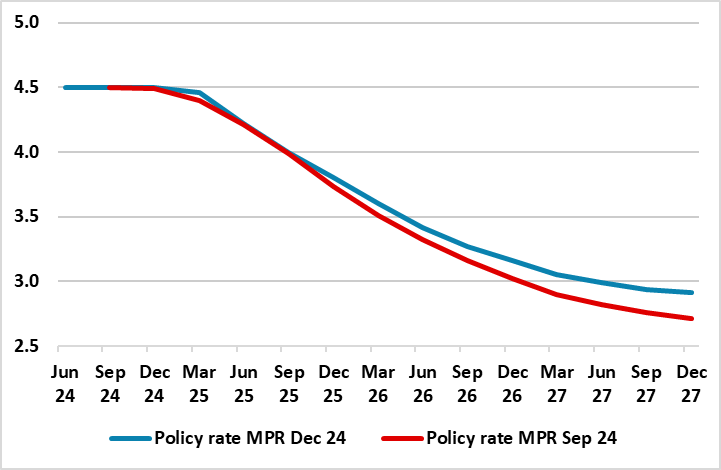

Figure: Cautious Policy Outlook Hardly Revised?

Surprising no-one, another (ie eighth successive) stable policy decision was forthcoming at this latest Board decision so that the policy rate at 4.5% has been in place for a year. The statement was more open about policy being eased but only after two more meetings, so that the first cut will come in March next year. The revised forecasts saw higher growth numbers but where the inflation outlook shaved back somewhat amid what was termed inflation pressures that appear to have been slightly more subdued than previously assumed. But the worry about business costs actually saw the policy outlook raised slightly (Figure), but with two-side risks around it, encompassing the risk of an increase in international trade barriers but with less overt concern about the weak currency this time around. Higher tariffs will likely dampen global growth, but the implications for price prospects in Norway are uncertain. The scheduled decision on Jan 23 could still see the first rate cut, although this is now less likely. We still see some 125 bp of rate cuts in 2025 – 25 to 50 bp more than the Norges Bank is advertising!

As Figure also shows the Board anticipates that policy will continue easing all the way out to 2027, albeit basically settling at just under 3%. It is under if this is regarded as a neutral or terminal rate. How this policy outlook arises is unclear as targeted inflation (CPI-ATE) is seen staying above target through the forecast horizon, ie around 2.4% in 2027.

The Norges Bank still sees policy risks being balanced, this view buttressed by a firmer than expected mainland real economy backdrop, the question being the extent to which the latter may as much reflect improved supply side developments related to productivity. But this did not feature (via a reassessment of the output gap) in the updated economic projections which still look too optimistic to us, not least given that they are based around a EZ picture for next year which sees 1.1% GDP growth almost twice what we envisage.

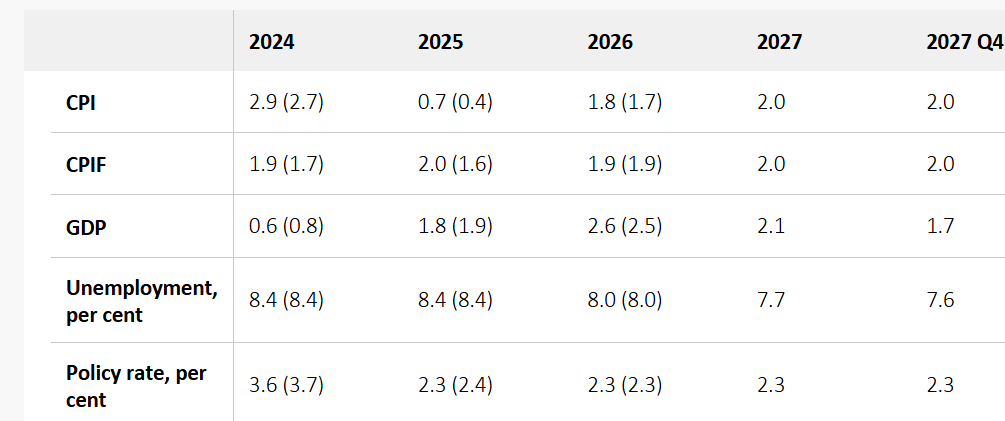

Figure: Inflation to Settle Around Target?

As widely expected, a fifth successive rate cut was seen at this December Riksbank meeting, but back to a 25 bp move rather than the 50 bp cut last time around (to 2.5% vs the 4% peak seen up until last May). But it was the updated projections (Figure) that was be the main news, not least given data of late that has been on the high side of expectations, including a small recovery in GDP and CPIF data well above Riksbank thinking. In this regard, the Riksbank did revise down its slightly above-consensus GDP outlook out to 2027, whilst still suggesting inflation will settle around target. Perhaps the question was whether a lower terminal policy rate was considered, but this does not seem to be the case with one more 25 bp reduction penciled in for H1 next year and then with the ensuing policy rate staying there out to 2027.

But amid downside growth risks and realties through Europe, we still see the policy rate troughing at 2.0% by mid-2025, but still well within the range that the Riksbank has for its’s terminal rate estimate. But deeper cuts are possible as even the Riksbank acknowledges, albeit with policy reverting back to the baseline ultimately.

Riksbank thinking is very much affected by uncertainty, both regarding the outlook for inflation and economic activity. There are several factors that could lead to a different economic development and monetary policy than those reflected in the Riksbank’s forecast. There is particular uncertainty regarding developments abroad, for instance with regard to the geopolitical tensions, lack of clarity regarding trade policy and the governmental crises arising in Europe. There are also risks linked to the recovery in the Swedish economy and the krona exchange rate. New information, and how it is expected to affect the outlook for the economy and inflation, will be decisive in determining how monetary policy is formulated.

Admittedly, the inflation surprises have been concentrated in energy and result of the EU’s new electricity directive which has caused a sharp increase in electricity prices in Sweden since its introduction in late October, this probably explaining the upgrade to the 2025 CPIF outlook. But even inflation ex energy has started to flatten out although the CPI measures on the basis is still consistent with target having already been met. Even so, the prices outlook inflation certainly for the next year has become a little more uncertain.