U.S. April PPI - Weak month, strong revisions, strong core goods, weak services

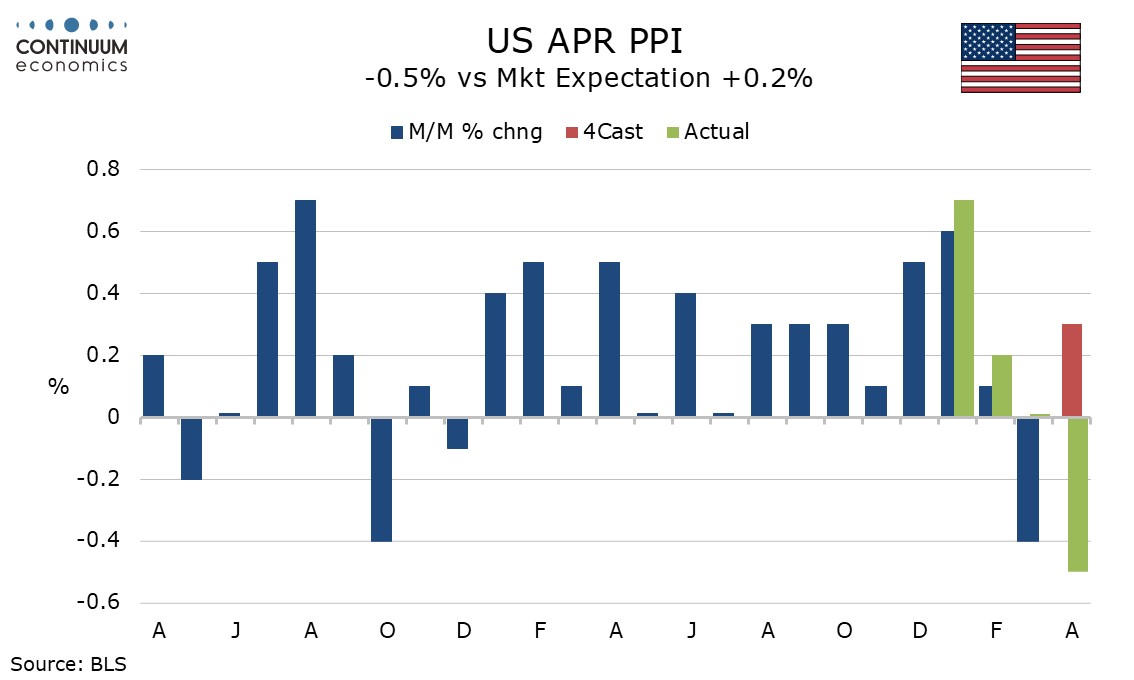

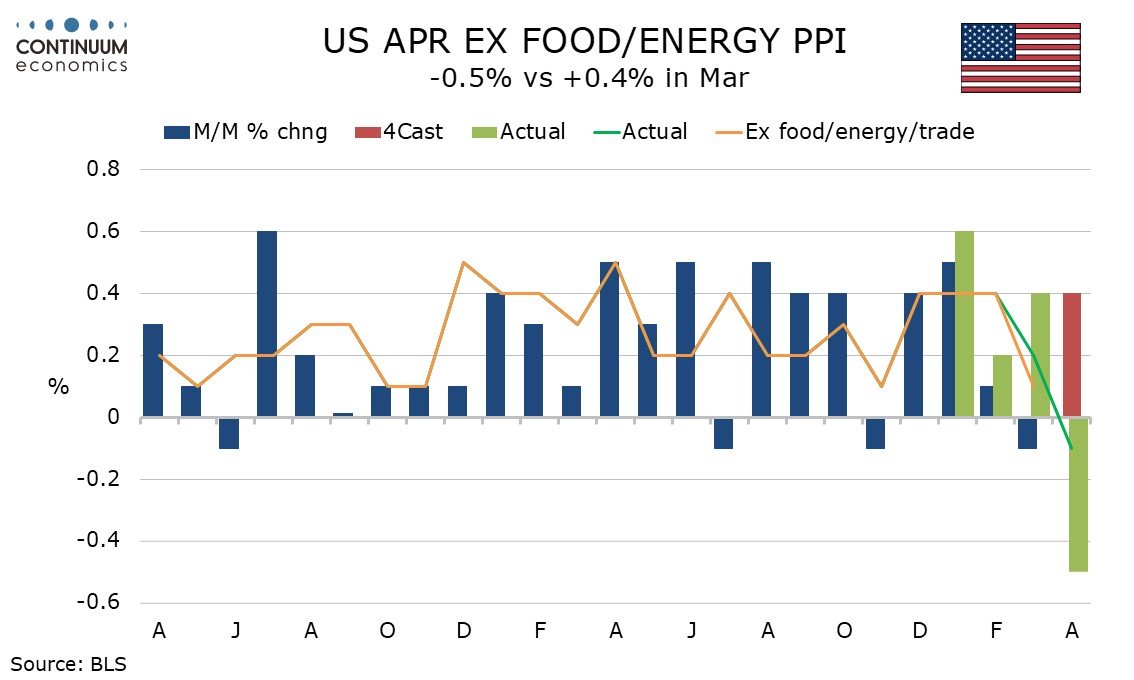

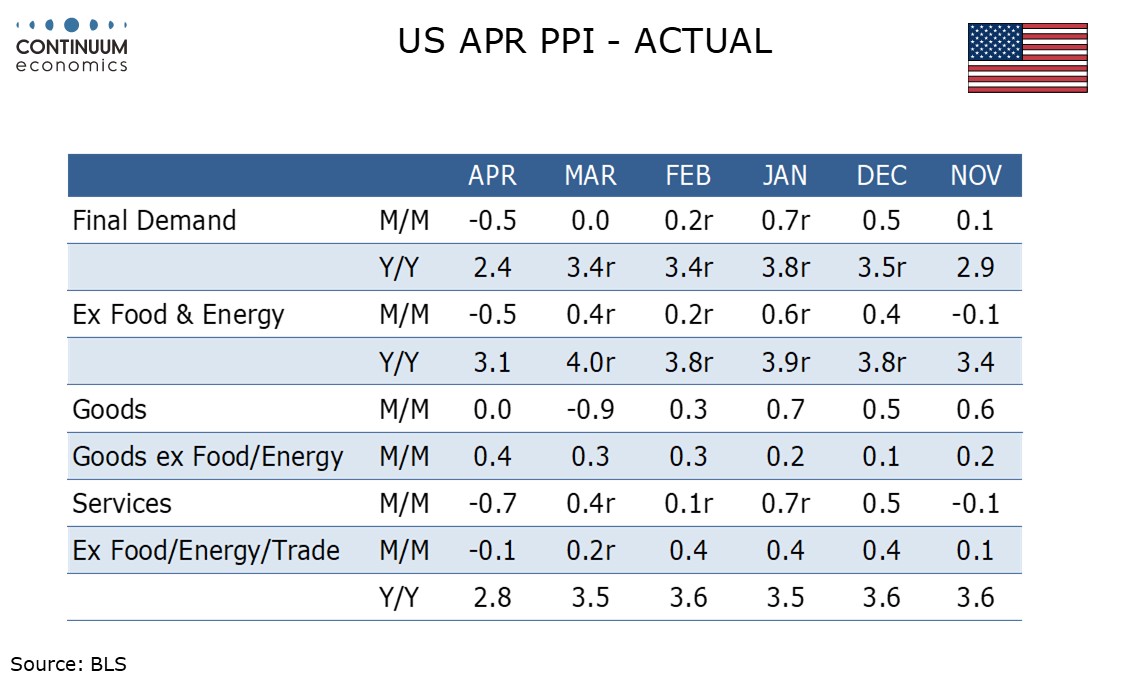

April’s PPI, even more so than April’s CPI, was surprisingly soft, falling by 0.5% overall, 0.4% ex food and energy and by 0.1% ex food, energy and trade. However March PPI saw sharp upward revisions, overall to unchanged from -0.4%, ex food and energy to a 0.4% rise from -0.1%, and ex food, energy and trade marginally to a 0.2% increase from 0.1%.

The unusually sharp revisions to March suggest there could be some problems in collecting the data given the exceptional circumstances of tariff imposition, and suggest that the weakness of April data should be treated with some caution. The upward revisions are not confined to March, with January and February PPI gains both revised up marginally by 0.1%.

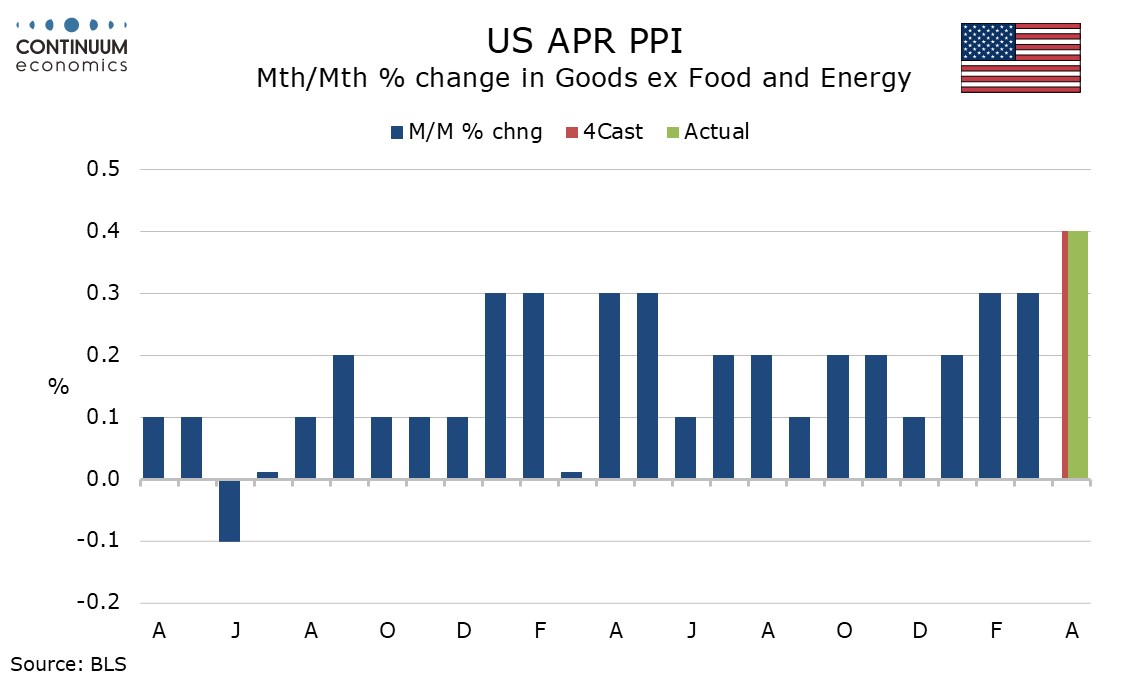

Even with the soft overall data, goods PPI does appear to be responding to tariffs, with goods ex food and energy up by 0.4% in April, after gains of 0.3% in March and February, that after eight straight months in which the gain was either 0.1% or 0.2%.

Overall goods were unchanged with energy seeing a marginal 0.4% decline, its third straight drop, and food falling by 1.0%, a second straight drop after four straight gains as eggs continued to correct from recent extreme strength.

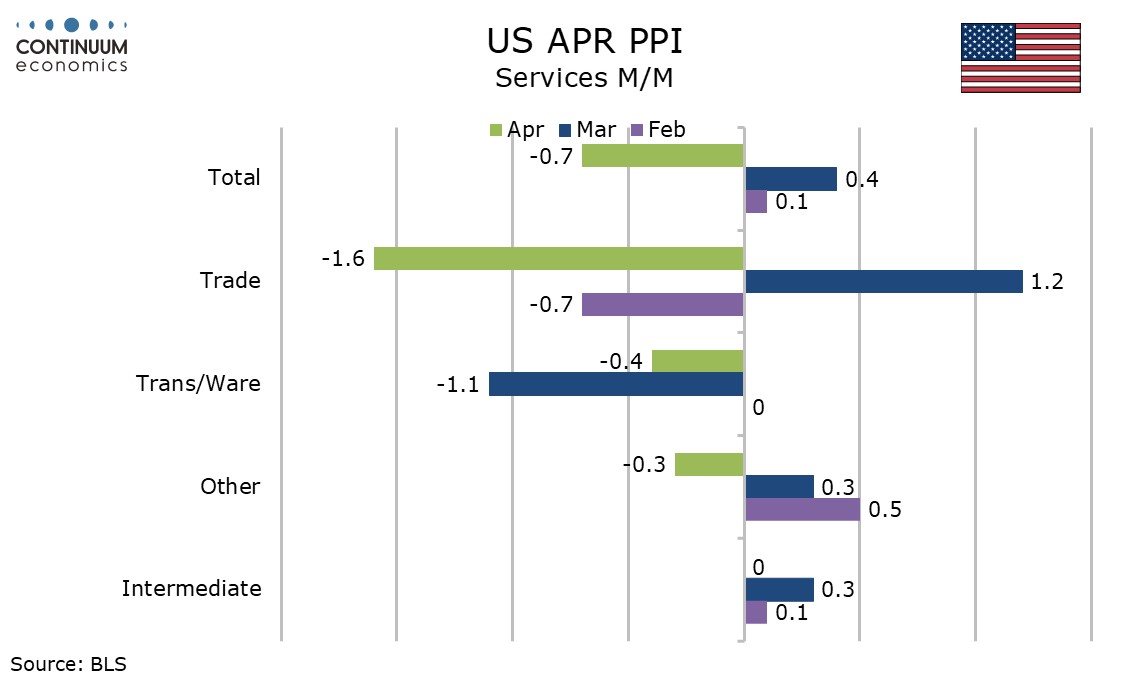

Service prices saw an exceptional 0.7% decline in April, with the volatile trade sector particularly soft at -1.6% after a 1.2% increase in March. Transportation and warehousing fell by 0.4%, a second straight decline, while others services with a 0.3% decline reversed a 0.3% March increase. Transportation and warehousing may remain weak if tariffs restrict activity, but the recent climb down over China maty reduce downside risk.

The decline ex food, energy and trade, while marginal compared with the headline and ex food and energy data, is the first since April 2020 at the height of the pandemic. This follows a 0.2% rise in March and three preceding straight strong gains of 0.4%.

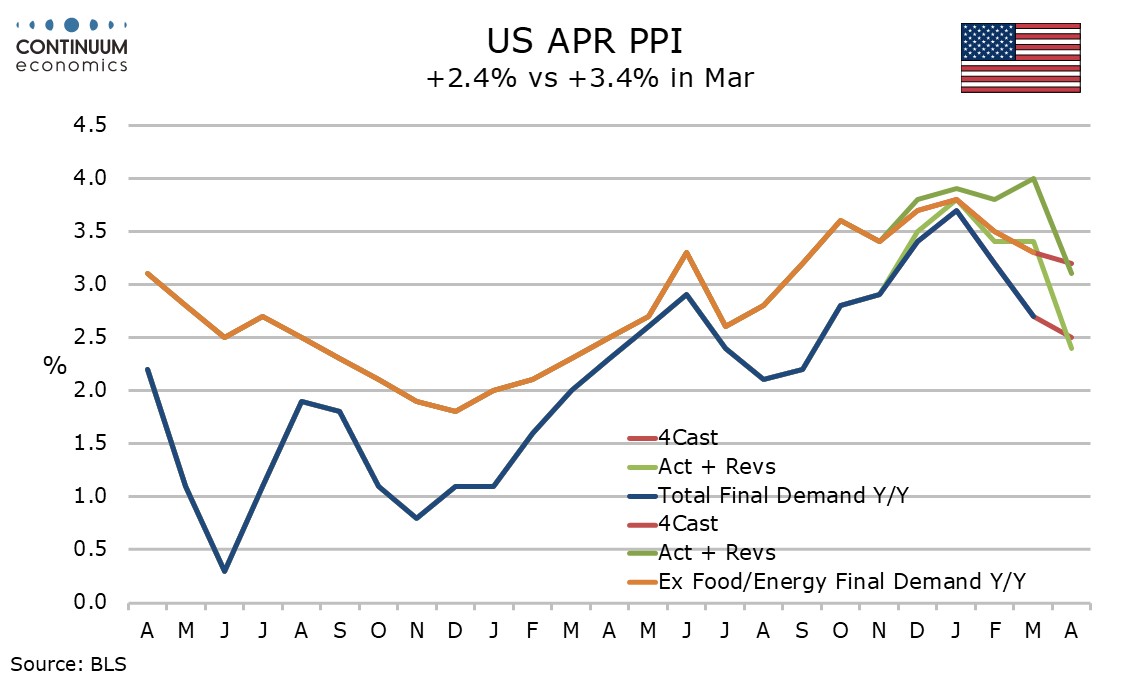

Yr/yr data slowed to 2.4% overall from 3.4%, reaching its slowest since September 2024, and to 3.1% from 4.0% ex food and energy, reaching its slowest since August 2024. The 2.9% ex food, energy and trade pace, down from 3.5% in March, is the slowest since February 2024.

Intermediate PPI data shows a similar message to the headline with processed goods up by a modest 0.2% and unprocessed goods plunging by 2.2%, but their respective ex food and energy rates quite firm with gains of 0.5% and 0.7%. Intermediate services were unchanged, led lower by trade, with the other two components seeing modest gains.