FX Daily Strategy: N America, December 19th

BoJ meeting disappoints most market participants

JPY upside still favoured

CAD vulnerable to softer CPI

AUD may recover vs EUR after Monday sell off

BoJ meeting disappoints most market participants

JPY upside still favoured

CAD vulnerable to softer CPI

AUD may recover vs EUR after Monday sell off

The BoJ meeting was a disappointment for JPY bulls, with no change in policy and no real change in forward guidance either. The statement kept the basics unchanged, saying “The Bank will continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, aiming to achieve the price stability target, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner. " However, they did indicate that "The year-on-year rate of increase in the CPI (all items less fresh food) is likely to be above 2 percent through fiscal 2024", which seems to suggest BoJ do see an exit of ultra-loose monetary policy but is waiting for wage growth to pick up further.

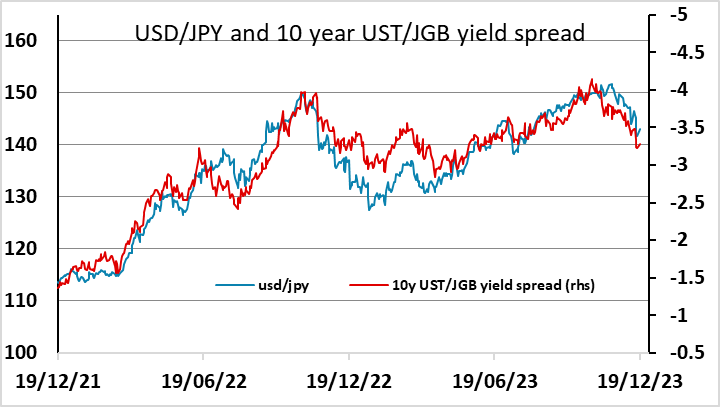

USD/JPY moved sharply higher on the statement, and JGB yields fell. However, it remains the case that yield spreads support a lower USD/JPY and also a higher JPY on the crosses. While JGB yields have fallen modestly, spreads are still consistent with a lower USD/JPY. The 10 year yield spread has risen in the last few days to 3.3% from a low of 3.22% but excluding the last week, the last time the spread was this low was July 19, when USD/JPY was trading below 140. JPY crosses look even more convincingly out of line with yield spreads.

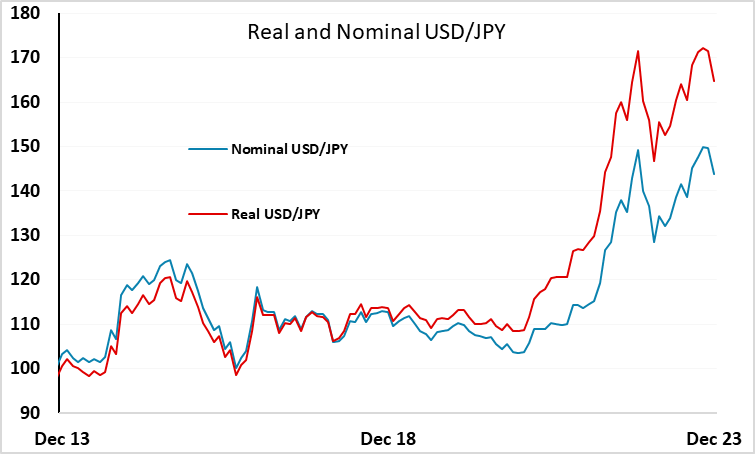

Furthermore, while the timing of BoJ action is uncertain, it remains very likely that they will tighten through 2024, while other DM central banks are easing, and that the tightening will see a rise in 10 year JGB yields to the reference ceiling of 1% and beyond. So not only does the JPY still look attractive relative to current yield spreads, those yield spreads are likely to narrow further. On top of this, the correlation with nominal yield spreads ignores the real JPY depreciation we have seen in the last few years, with relatively low Japanese inflation meaning USD/JPY has risen 13% more in real terms than in nominal terms since the beginning of 2021. Sooner or later, that rise will also be corrected, so the JPY decline after the BoJ meeting looks like a longer term JPY buying opportunity.

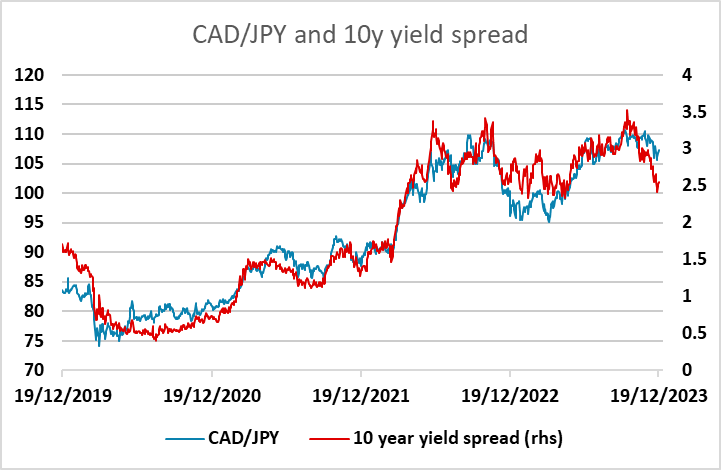

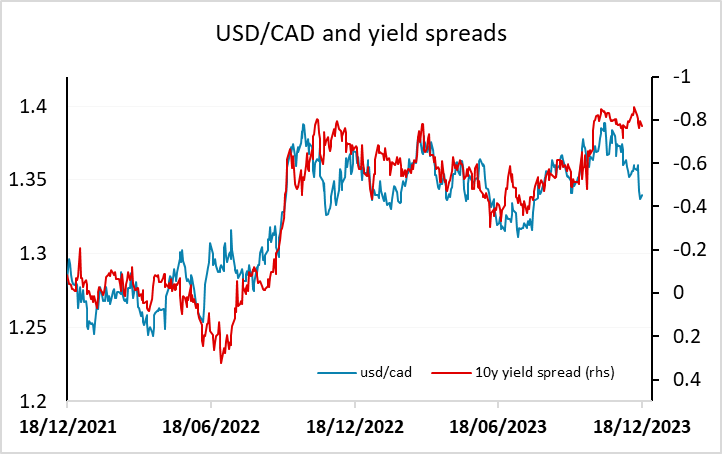

Elsewhere we have Canadian CPI. We expect November Canadian CPI to slip significantly to 2.8% yr/yr from 3.1% in October, matching the recent low seen in June. Year ago strength is likely to assist further slowing in the BoC's core rates. Our forecast is a little below market consensus, suggesting some downside risks for the CA. As it stands, USD/CAD has in any case been outperforming yield spreads in recent days, so we see some upside risks. CAD/JPY also looks particularly vulnerable, as one of the pairs that looks both most correlated with yield spreads and most out of line.

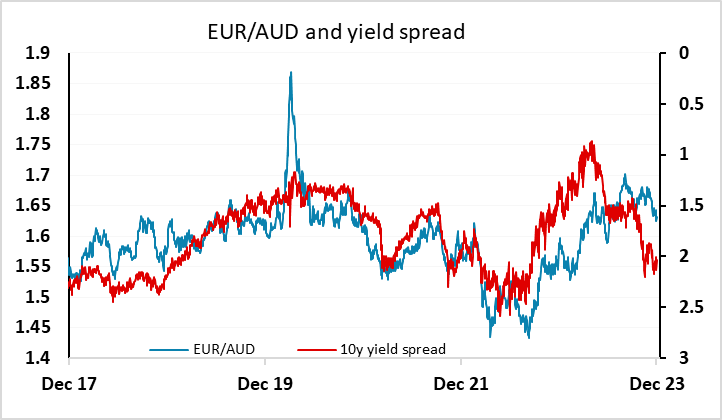

AUD/USD fell back on Monday, perhaps influenced by the weak JPY, but this has taken it to levels that look attractive, particularly against the EUR. The RBA minutes released on Tuesday ought to confirm the RBA’s relative hawkishness, and if the JPY also sees some support from the BoJ meeting, the AUD should have potential to see similar gains. EUR/AUD continues to look like the most clear-cut value for the AUD, as there is less chance that risk negative news has a significant positive impact on the EUR against the AUD compared to AUD/USD.