Preview: Due February 29 - Canada Q4/December GDP - Reversing Q3 decline

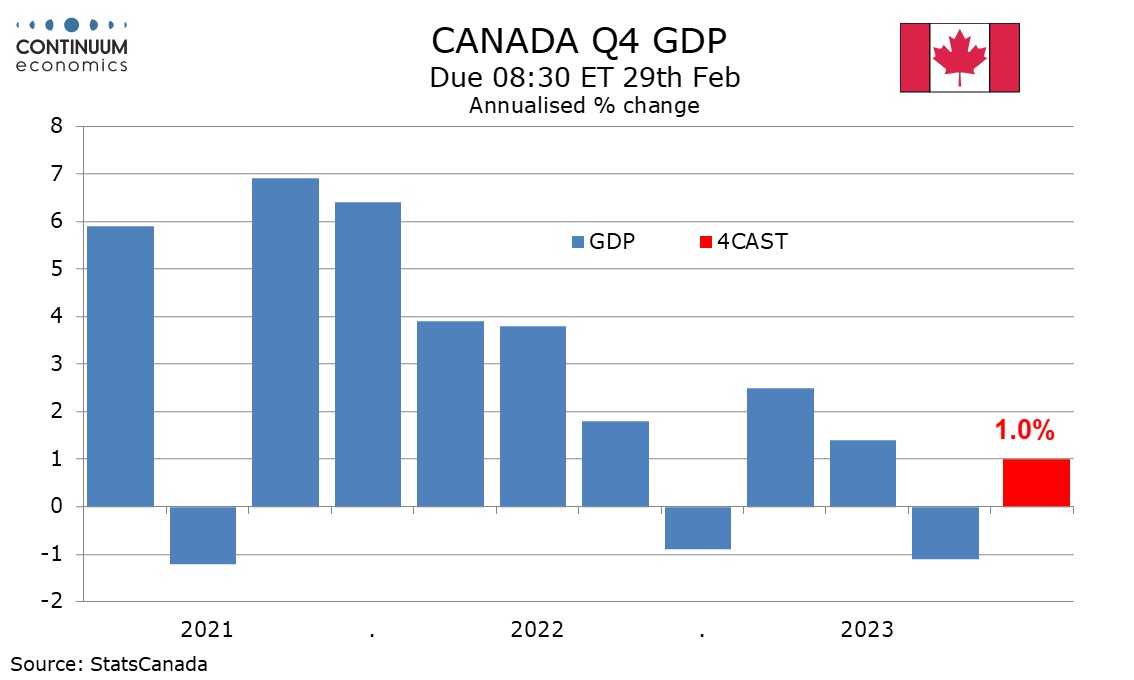

We expect Q4 Canadian GDP to rise by 1.0% annualized, almost fully reversing a 1.1% decline seen in Q3, though the underlying picture remains fairly subdued. Any increase would outperform an unchanged forecast made by the Bank of Canada in January’s Monetary Policy Report.

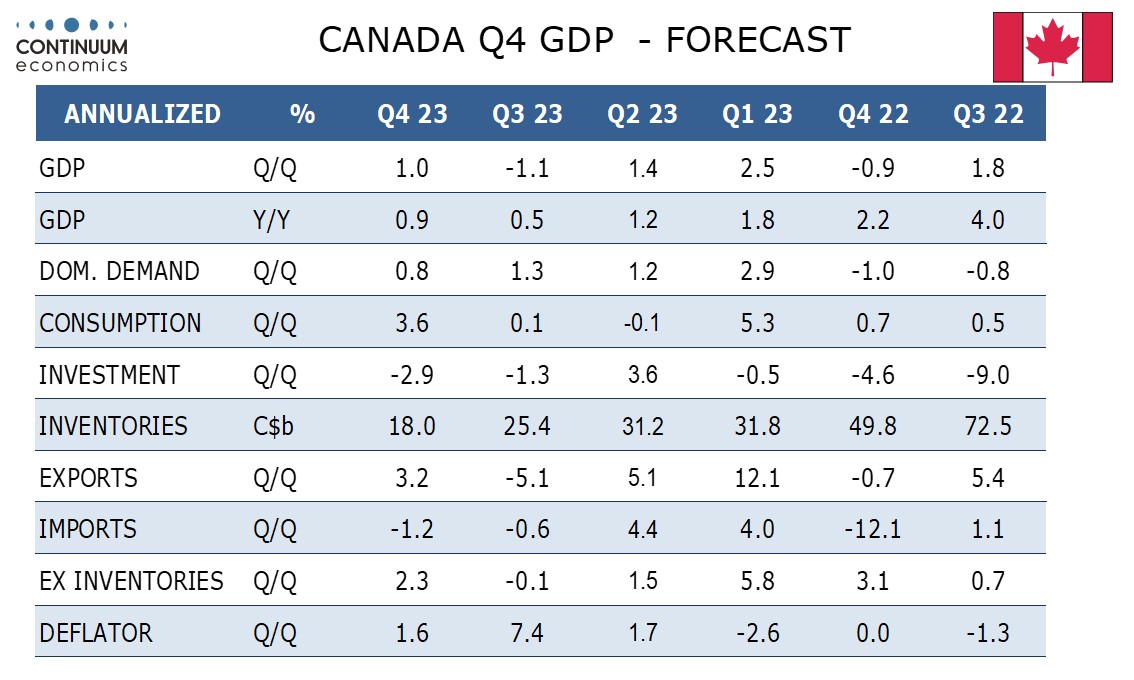

GDP looks set to see positive contributions from consumer spending and net exports, though we expect weakness in investment and a negative contribution from slower inventory growth. We expect a 0.8% annualized increase in domestic demand, the slowest since a decline in Q4 2022.

Slower growth in overall CPI despite stubborn core rates and little change in import or export prices suggests the GDP deflator will slow from a strong Q3, we expect to 1.6% annualized from 7.4%, or to 0.4% from 1.8% not annualized.

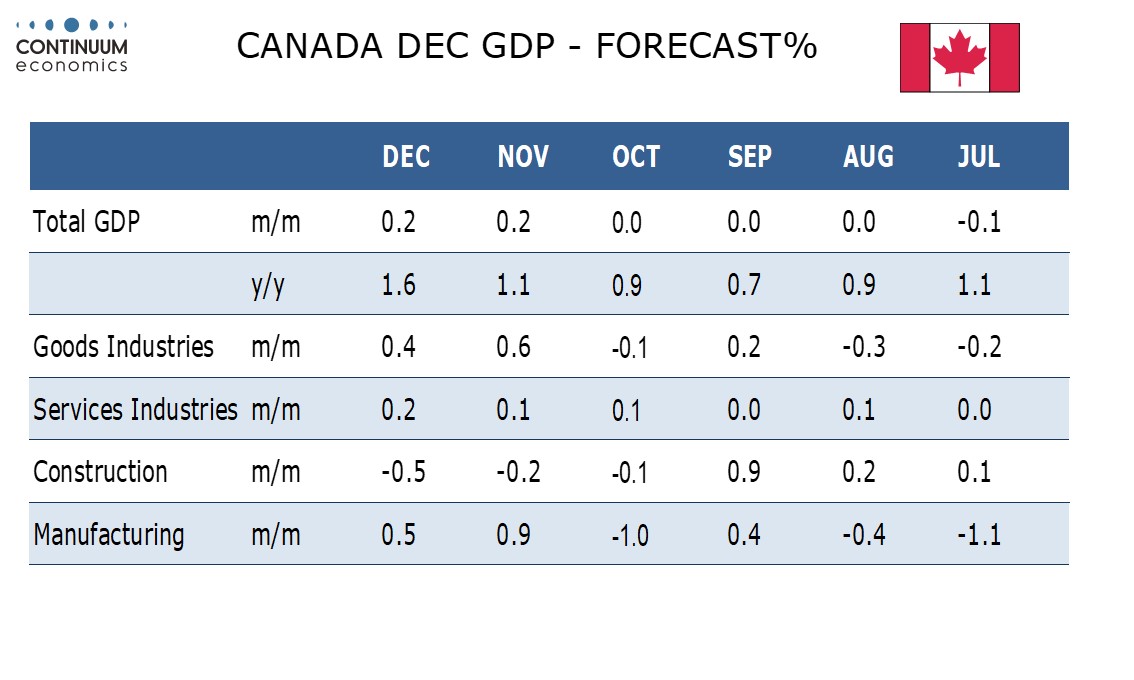

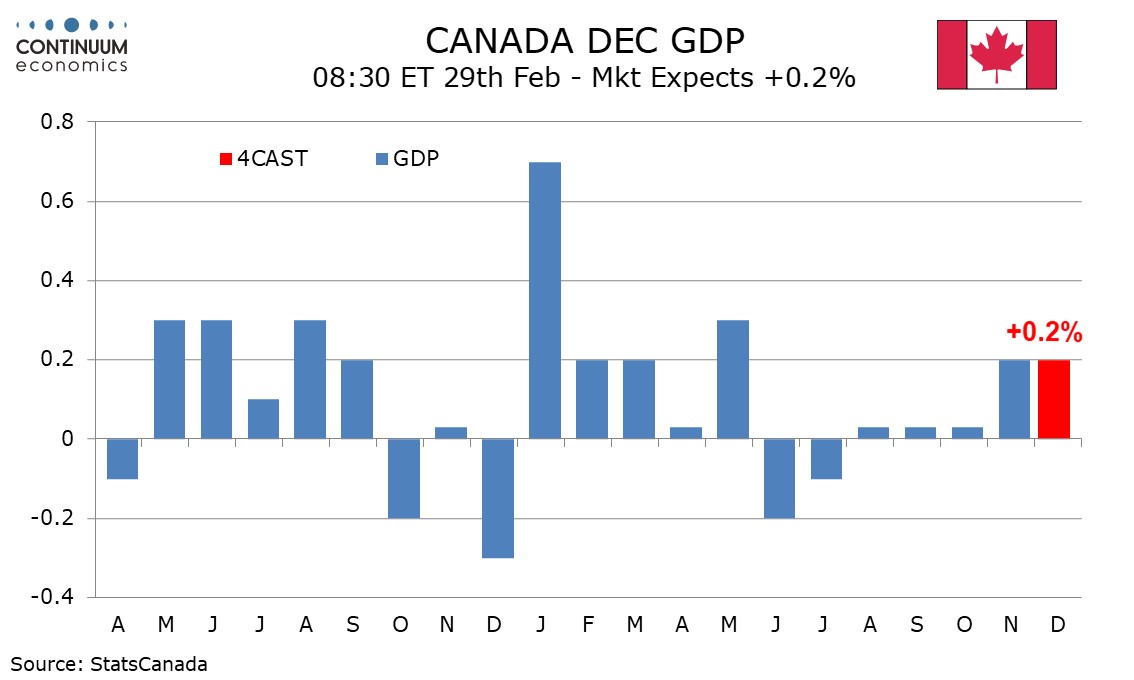

We expect a 0.2% increase in December GDP, slightly below a 0.3% preliminary estimate made with November’s report, where the 0.2% monthly increase was the strongest since matching gains in February and March.

The preliminary estimate signaled gains in manufacturing as well as real estate and mining. Monthly data for manufacturing however was quite soft in December, though retail sales completed a positive Q4.