Published: 2024-02-27T13:22:55.000Z

Preview: Due February 28 - U.S. Preliminary (Second) Estimate Q4 GDP - Revision seen marginally lower but still strong

Senior Economist , North America

-

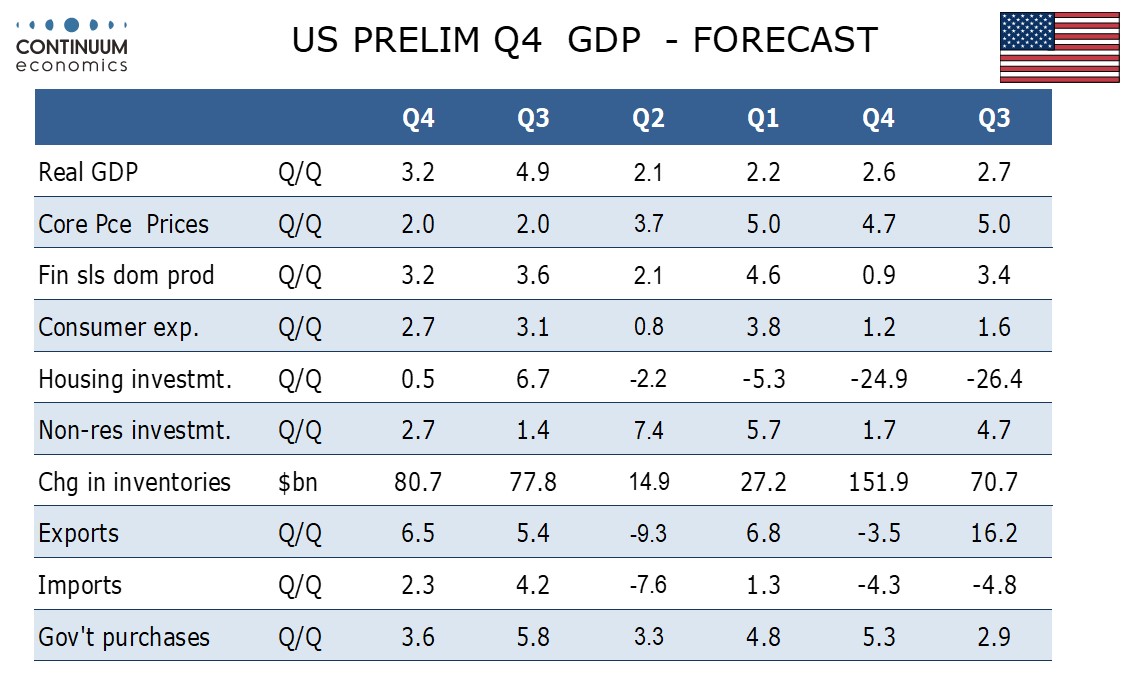

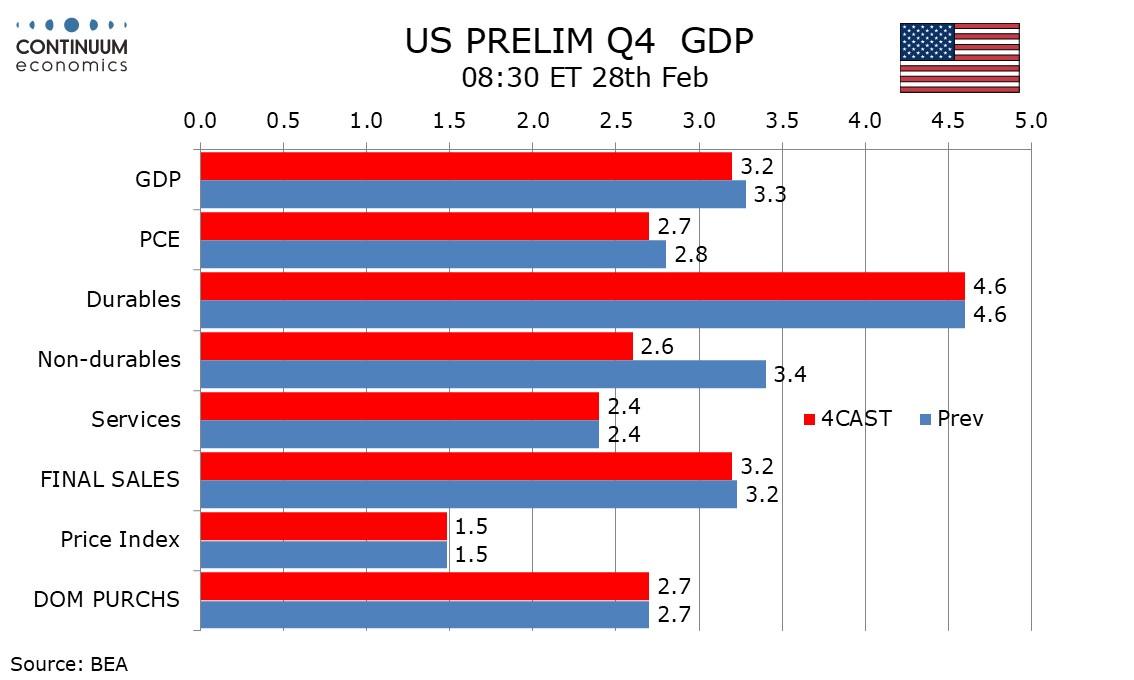

We expect the second (preliminary) estimate for Q4 GDP to be revised only marginally lower to 3.2% from the unexpectedly strong first (advance) estimate of 3.3%.

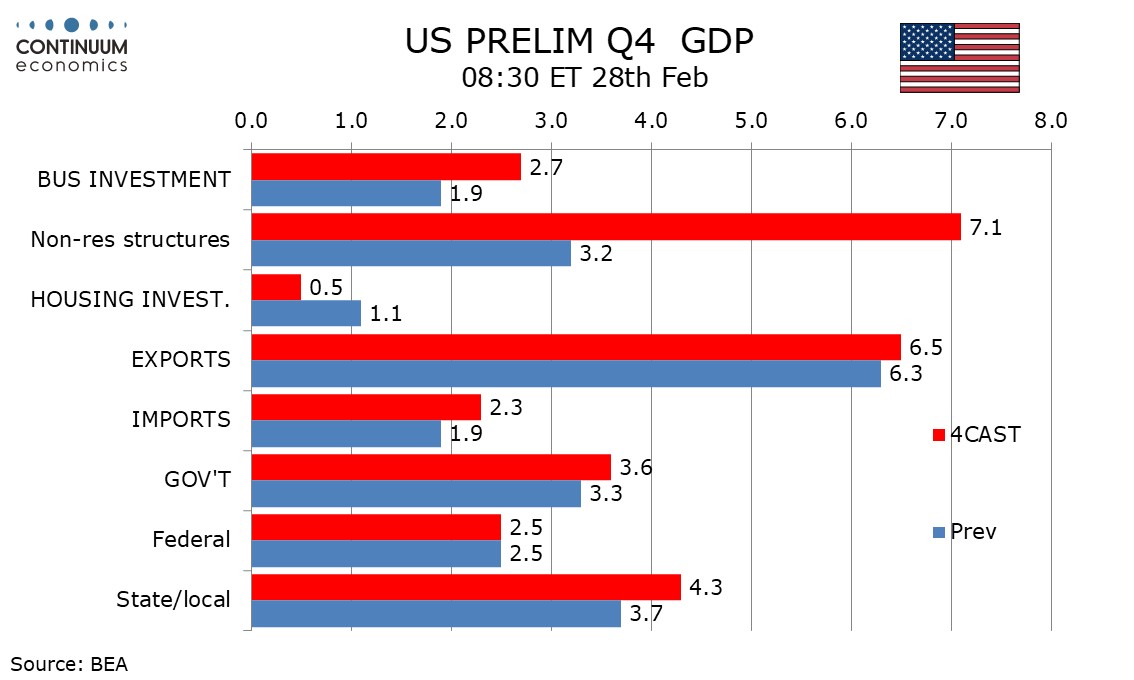

Revisions are likely to be marginal in all sectors. We expect upward revisions in non-residential construction, both private and public, but downward revisions in retail sales, housing investment, inventories and net exports, the latter on higher service imports.

We expect final sales (GDP less inventories) to be unrevised at 3.2%, and final sales to domestic buyers (GDP less inventories and net exports) to be unrevised at 2.7%. However we expect the revision to inventories to be smaller than the roughly offsetting revisions to construction and consumer spending.

We do not expect any revisions to the price indices, from 1.5% for GDP, 1.7% for overall PCE and 2.0% for core PCE. The latter was consistent with the Fed’s target for the second straight quarter.