USD, EUR, JPY flows: French GDP only a mild EUR negative, USD vulnerable to US GDP

French GDP fell 0.1% in Q4, but the weakness is net trade related and may be offset by gains elsehwere in the Eurozone. US GDP later could extend USD losses agaianst the JPY

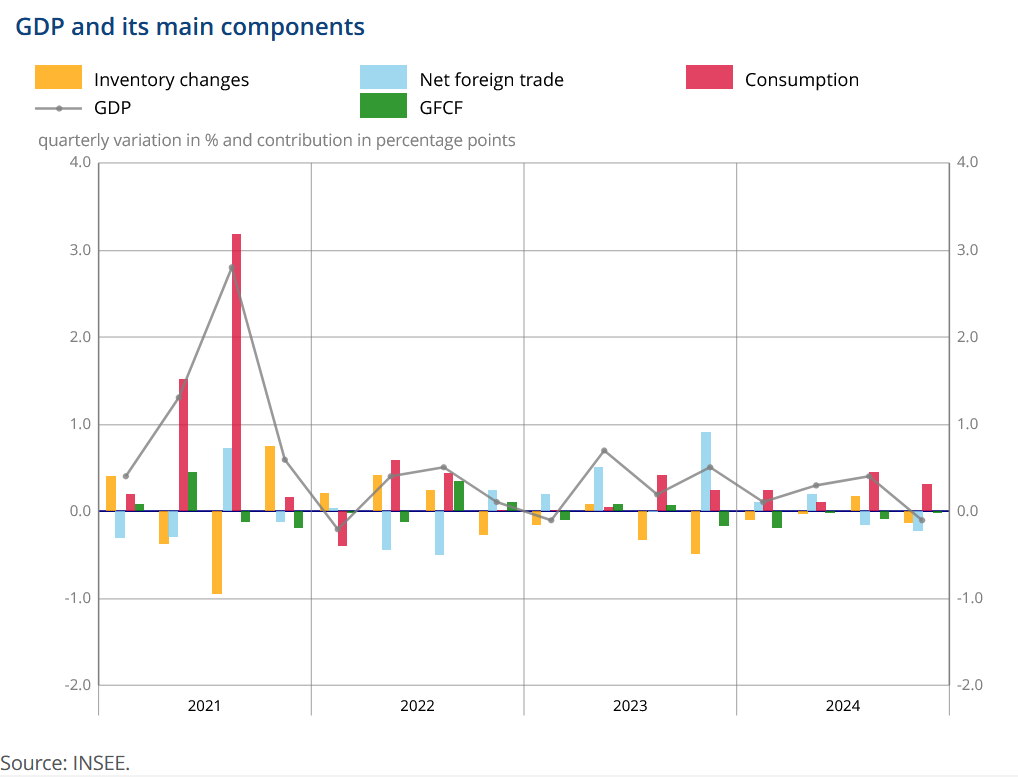

The 0.1% decline in French Q4 GDP is below the 0.0% consensus and has pushed the EUR a little lower in early trade, balancing out the above consensus 0.8% gain in Spain reported on Wednesday. However, the weakness in France was due to net trade and inventories, with domestic demand showing a positive contribution. Net trade losses for France could well be offset by net trade gains elsewhere in Europe, so this is less of a negative than weakness in domestic demand. There is also some rebound from Q3 strength due to the Paris Olympics. The German and Italian data is due at 09:00 GMT, and the Eurozone total at 10:00 GMT. Market consensus is 0.1% for the Eurozone, and is unlikely to have changed after the French and Spanish data, so the numbers are looking likely to be neutral for the EUR ahead of the ECB meeting later.

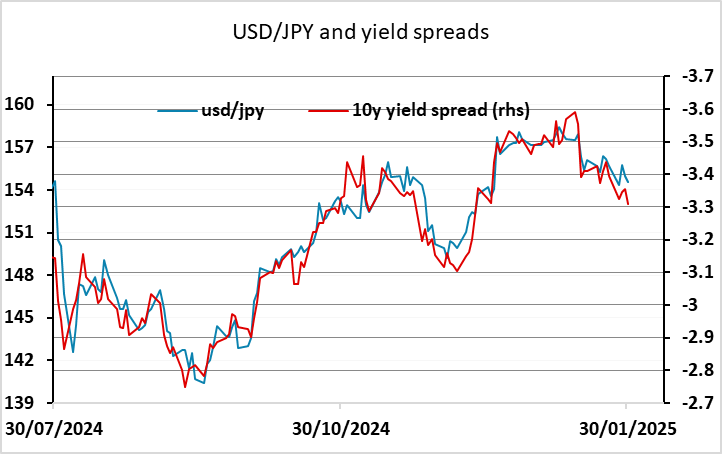

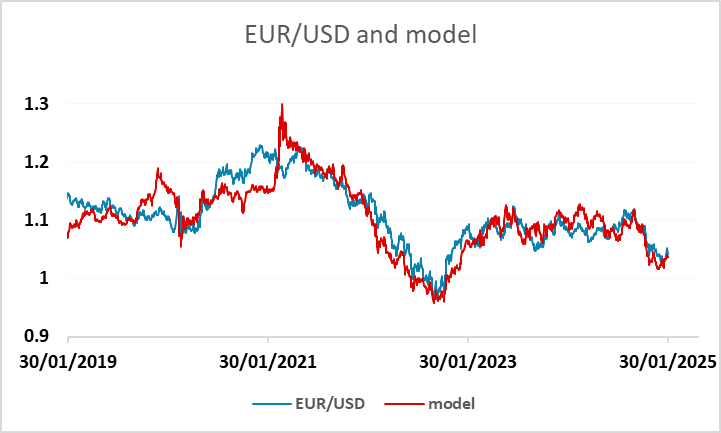

Overnight, the FOMC meeting didn’t produce much reaction, but USD/JPY fell back in the Asian session, with yield spreads still pointing lower. Recent correlations suggest current spreads are consistent with USD/JPY near 153, while longer term correlations suggest scope for a move much lower. The USD did weaken slightly after yesterday’s US trade and inventory data, which are likely to knock around 1% today’s Q4 GDP data compared to the previous consensus. But the decline was very small, and if we do see a number in line with our forecast of 1.7% q/q annualised against the 2.7% published consensus, there ought to be potential for further USD declines, particularly against the JPY but the EUR should also have potential for gains.