U.S. January S&P PMIs - Close to December's, modestly positive

January’s preliminary S and P PMIs have shown almost no change from December, with manufacturing at 51.9 from 51.8 and services unchanged at 52.5.

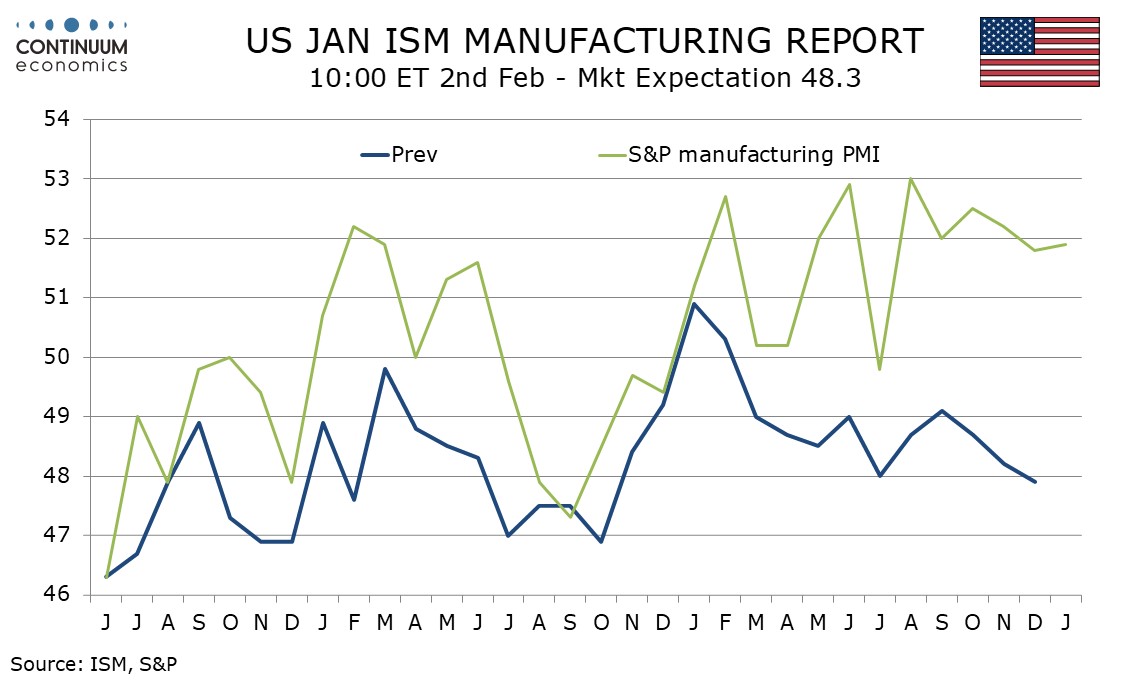

The S and P manufacturing index has been trending consistently above neutral while the ISM manufacturing index has been trending consistently below. With the Empire State and Philly Fed manufacturing indices stronger in January, the ISM index looks likely to be a little less weak.

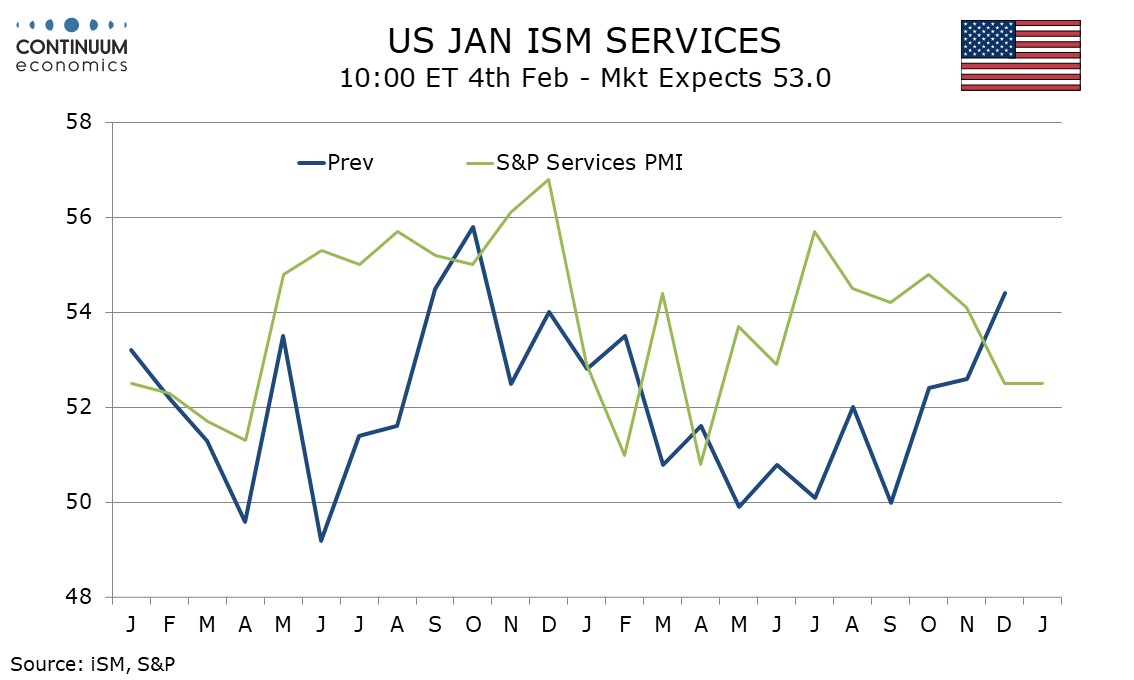

The S and P services index has remained at December’s softer level that was the weakest since April. With consumer spending outpacing real disposable income we see risk of a loss of momentum in consumer spending. That the S and P index did not bounce in January suggests a stronger December ISM services index will be difficult to sustain.

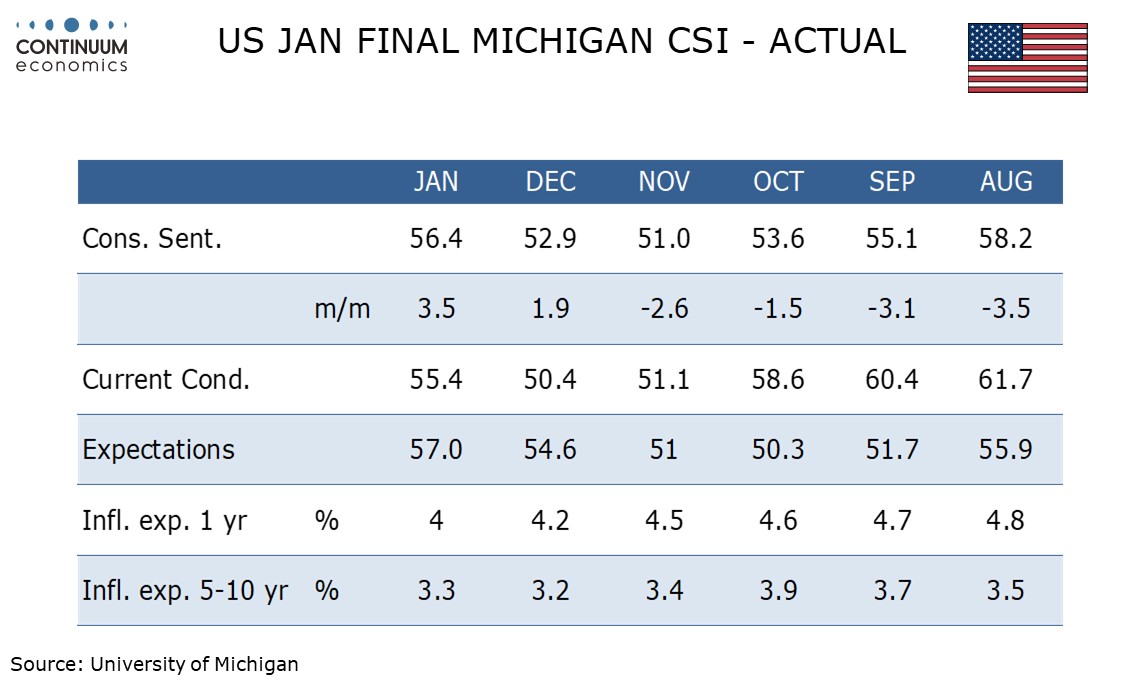

January’s Final Michigan CSI has seen a moderate upward revision to 56.4 from 54.0 which puts it at its highest since August. Inflation expectations were revised lower, the 1-year view to 4.0% from 4.2% and the 5-10 year view to 3.3% from 3.4%, The 1-year view is at a 12-month low but the 5-10 year view is still up from 3.2% in December.