CHF, JPY flows: CHF slips on CPI, JPY awaits equity turn

CHF softer after CPI. JPY still undermined by equity strength

The Swiss October CPI data released this morning is the only data likely to be of significance today, and has come in well below consensus at -0.3% m/m, 0.1% y/y, pushing EUR/CHF 10 pips higher initially. Most still don’t expect the SNB to react by taking rates negative or intervening in the FX market, so there are quite limited implications for the CHF. Nevertheless, it does emphasise that CHF strength is definitely unwelcome. The recent dip to test the lows near 0.92 underlined the technical significance of that support level, and if that level did break the SNB might be inclined to react, so the CHF bias does look to be slightly to the downside, given the high valuation and the economic problems created by the high US tariff on Switzerland. It remains hard to establish any upside momentum against the very protracted EUR/CHF downtrend, but we would nevertheless favour a test of 0.93.

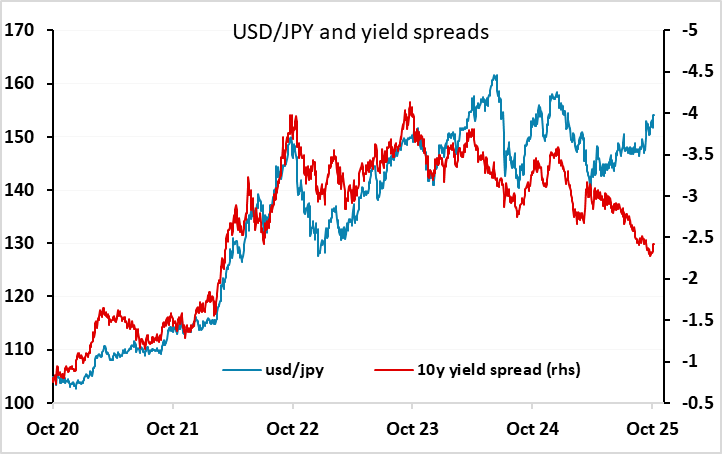

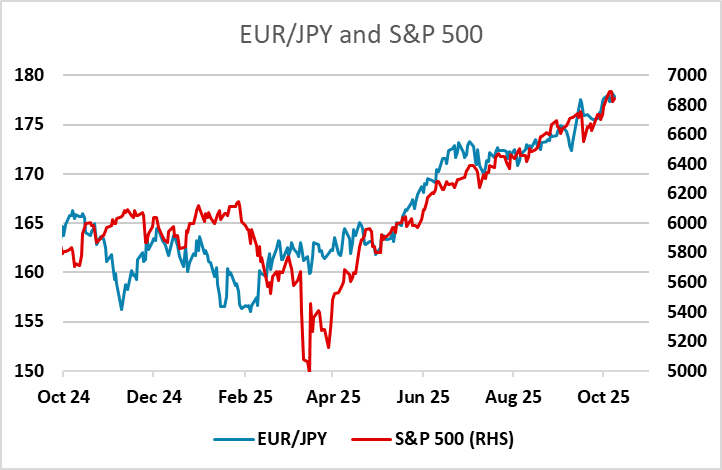

There isn’t much else on Monday’s calendar that looks likely to move markets. Japanese markets were closed for culture day which looks to have limited JPY volatility. Comments last week from new Japanese finance minister Katayama suggested that the new administration isn’t looking for a weaker JPY, but equally they haven’t shown a willingness to intervene to prevent further weakness thus far. JPY weakness continues to move with equity strength, particularly on the crosses, but on all other metrics looks overdone – with yield spreads and equity risk premia pointing to a much higher JPY.