Published: 2024-12-06T15:14:57.000Z

U.S. December Michigan CSI - Current conditions surge, expectations slip

1

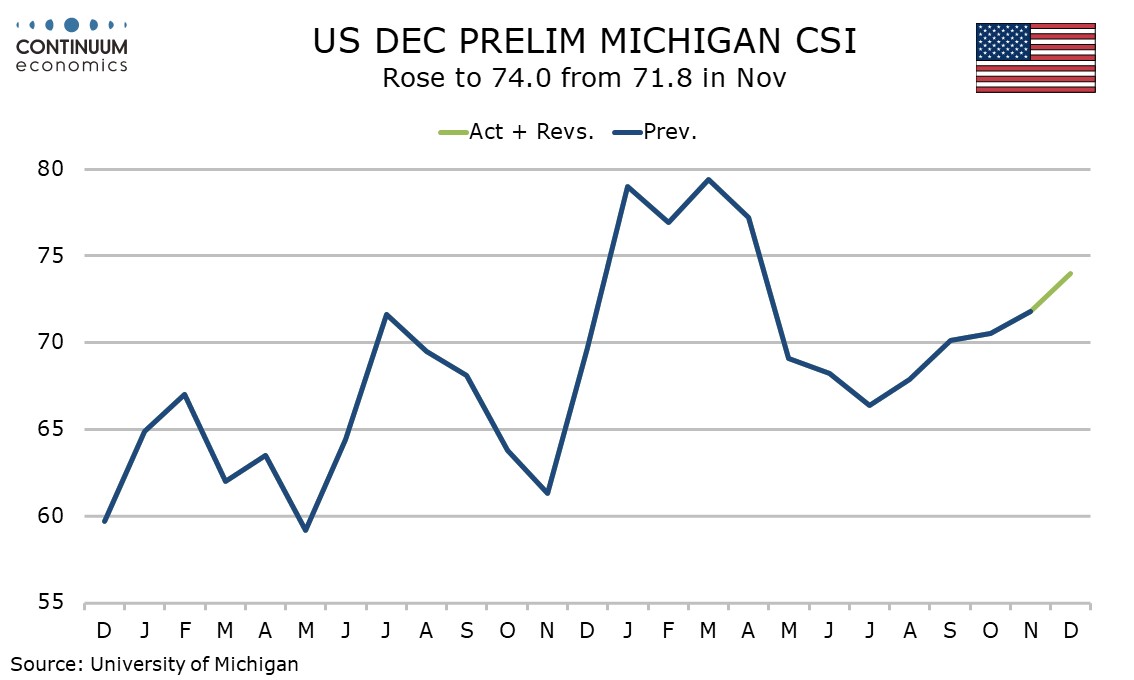

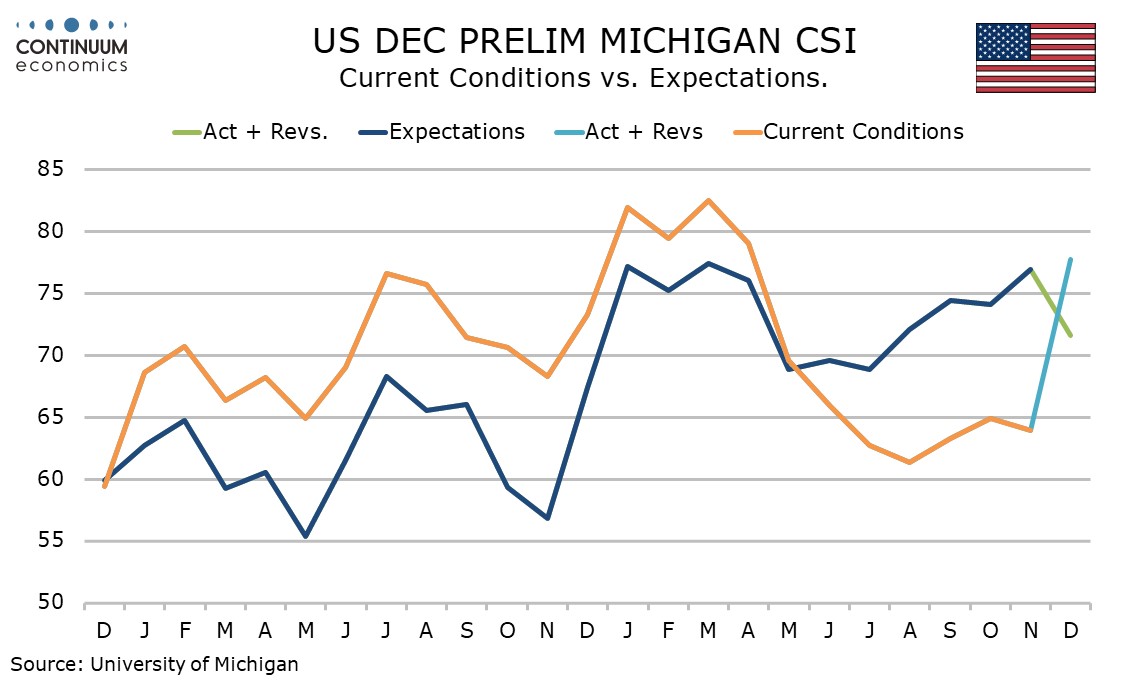

December’s preliminary Michigan CSI of 74.0 is up from 71.8 in November, but has a surprising mix in the detail, with current conditions up sharply and expectations significantly lower.

Current conditions at 77.7 from 63.9 are the highest since April, with the bounce difficult to explain. Fed easing may have helped, but that started in September. The economy may now be responding to easing.

Expectations at 71.6 from 76.9 are the lowest since July. Expectations should be more responsive to the election than current conditions and it may be that Democrats have downgraded their expectations more than Republicans have upgraded them.

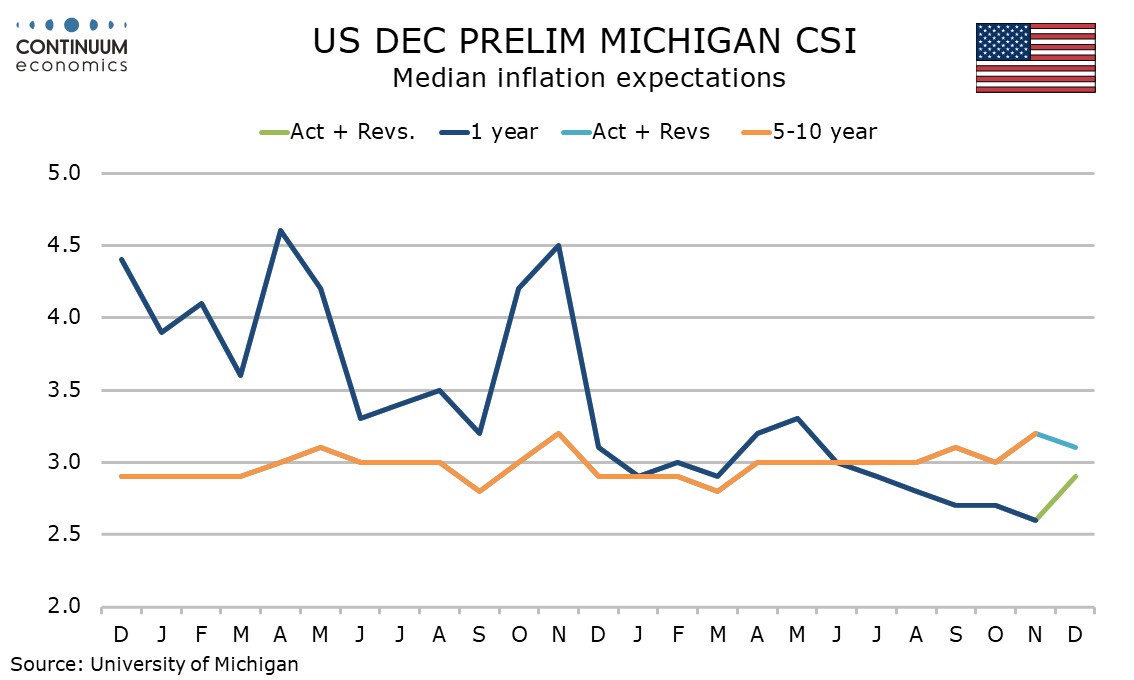

The 1-year inflation view is up to 2.9% from 2.6% and a 5-month high. Some may be fearing tariffs will lift prices, but if so the impact is seen as short term, with the 5-10 year view slipping to 3.1% from November’s 3.2% which was on the firm end of what remains a tight range.