FX Daily Strategy: N America, March 28th

Tariff Man Defines the Ending Tone of Week

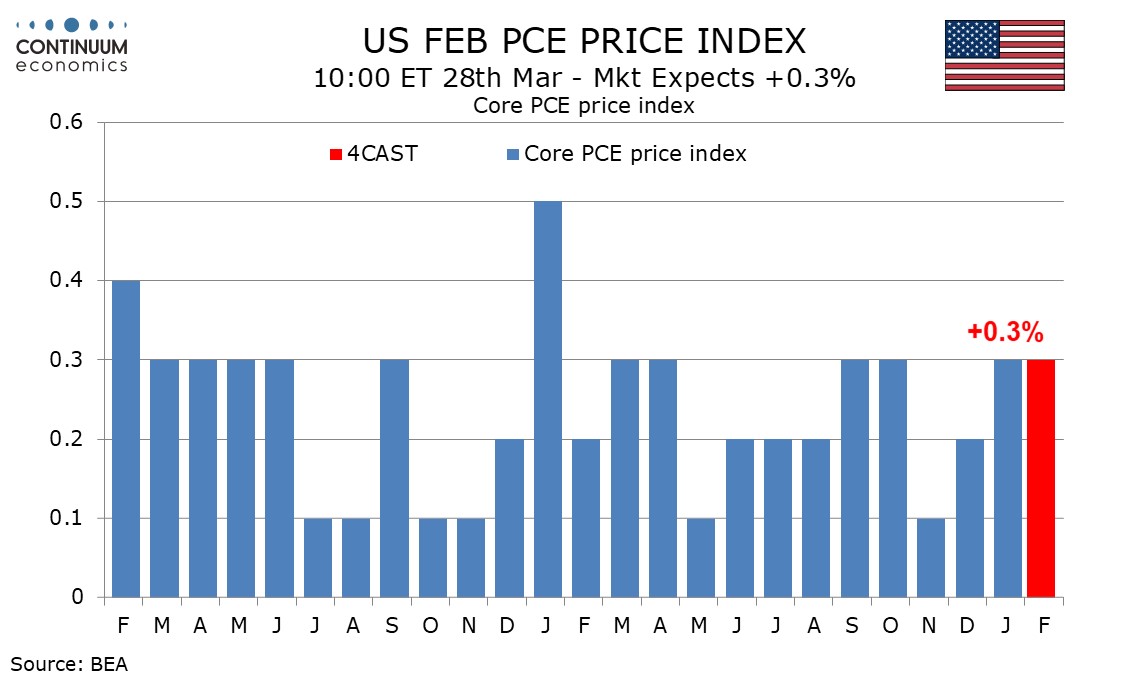

U.S. February Core PCE Prices to outperform Core CPI

Tokyo CPI To Remain Hot

But unlikely to change USD/JPY

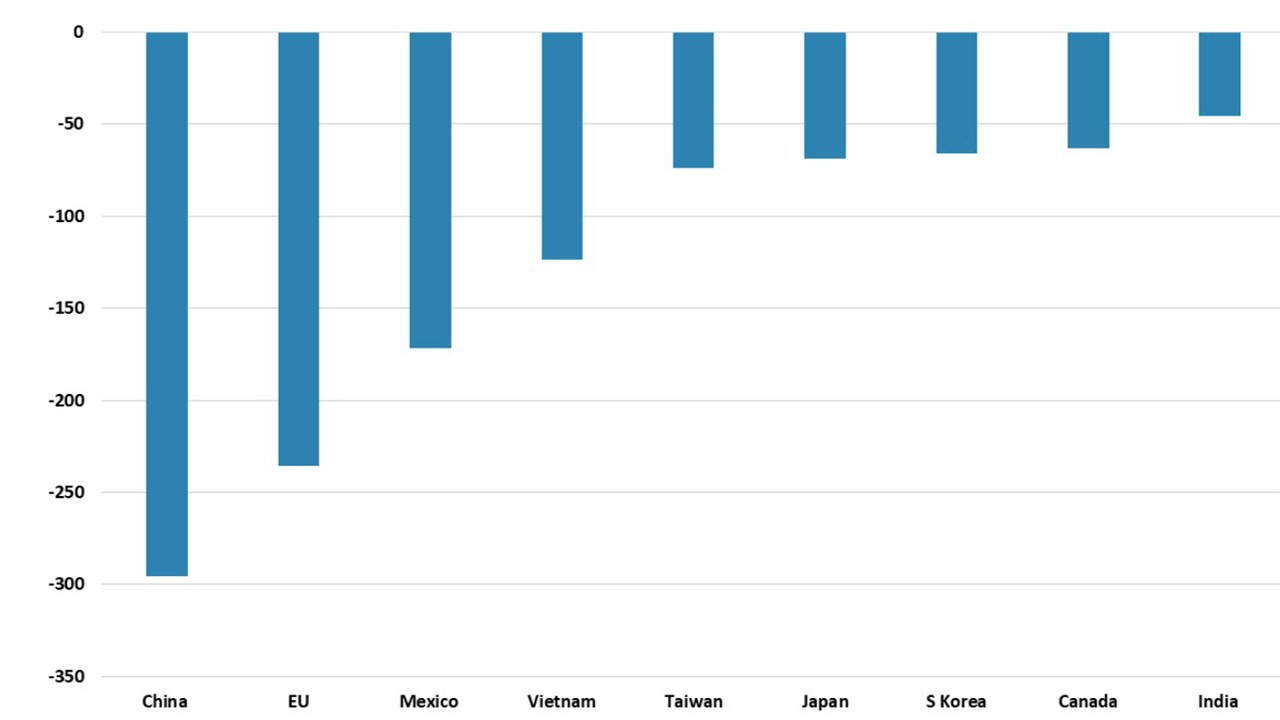

Figure: U.S. Bilateral Trade Deficit 2024 (USD Blns)

Source: BEA/Continuum Economics

The tariff man will define the risk tone to end the week. Global risk sentiment was recovering before Trump announced a 25% global auto tariff, only excluding tariff for U.S. made parts. It is a major development as most U.S. trading partners are barely digesting the previous wave of tariffs. It also creates complication with USMCA (U.S., Canada, Mexico Trade Deal). Trump continue to allow a one month grace period before the tariff takes effect, which seems to have become a trick he uses quite often to get partners to the negotiation table.

The market this year has been reacting negatively to the announcement of new tariff and the uncertainty of context but rebounds once the details are clear and Trump exempting, even a very minor part of tariff. It would be interesting to see if such persist in this round of tariffs.

We expect a 0.3% rise in February’s core PCE price index, ahead of a 0.2% core CPI to partially offset a January underperformance when core PCE prices rose by 0.3% while core CPI surged by 0.5%. We also expect a subdued 0.1% rise in personal income to follow a strong 0.9% increase in January but personal spending to bounce by 0.5% after falling by 0.2% in January. Core PCE prices look set to be a little stronger the the core CPI with a sharp fall in CPI air fares unlikely to be reflected in core PCE prices, while PPI showed an acceleration in core goods prices despite a subdued outcome overall. We expect overall PCE prices to also rise by 0.3% in February, also matching January’s gain.

On a yr/yr basis core PCE prices would then edge up to 2.7% from 2.6% after slipping in January from 2.9% in December. Overall PCE prices however would be unchanged at 2.5% yr/yr. While non-farm payroll details imply a third straight 0.4% rise in wages and salaries, we expect personal income to ruse by only 0.1% after a 0.9% bounce in January. January’s data was inflated by strong gains in Social Security payments, on the annual cost of living adjustment, and dividends, both of which are likely to correct lower in February. Consumer spending is likely to look stronger than the 0.2% rise in February retail sales with industry data suggesting a bounce in autos which surprisingly slipped in the retail breakdown. Retail sales were also restrained by a sharp fall in eating and drinking places which are included in services. This will restrain service spending, which we expect to rise by 0.4%, but only 0.1% in real terms.

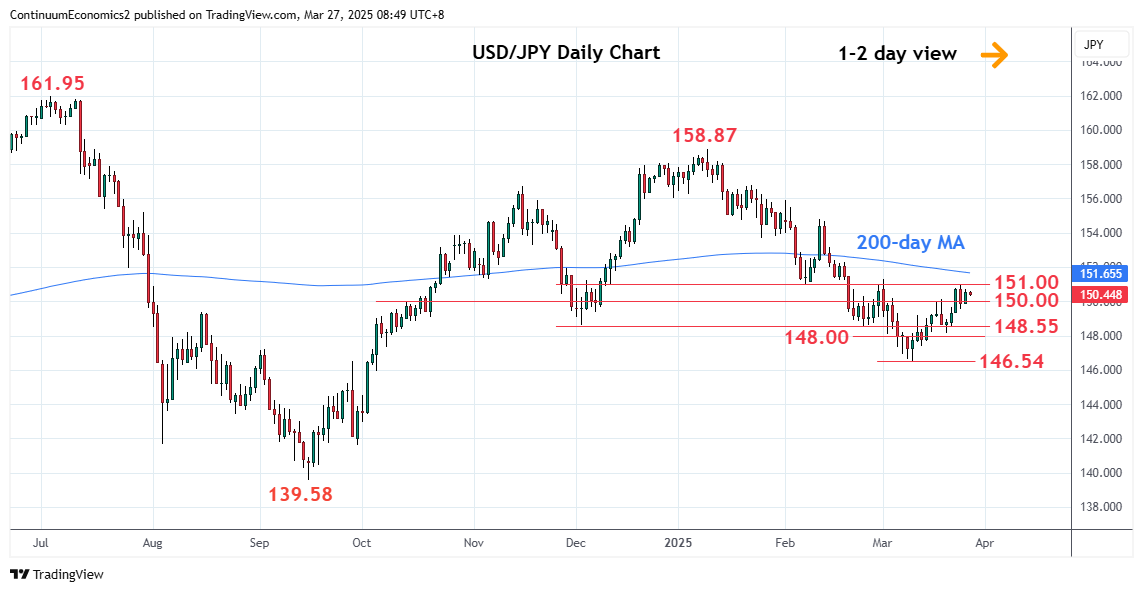

Tokyo CPI will be released on Friday's Asia session. Headline CPI, both National and Tokyo Area has been moderating from the previous spike but still hovering around 3%. We expect the March CPI to continue cooling, for the previous spike is led by energy and food price, but will stay above 2% as underlying inflationary pressure persist. So far, Japan has not reacted with U.S. tariff but the latest auto tariff will be negatively affecting the Japanese economy, thus BoJ's monetary policy. The impact towards inflation and economic growth will likely be on BoJ's mind and given history, they will be waiting for confirmation before moving their policy steps. How USD/JPY will react is going to be choppy as a knee-jerk response is JPY positive but in a medium run an imminent hike maybe unlikely and see JPY softens.

On the chart, the pair settled back from test of the 151.00 level as prices consolidate gains from the 148.55/148.00 support. Break above the 151.00 level will see room to further retrace the January/March losses to the 151.30 March high. Higher still, will see room for extension to the 152.00 congestion. Meanwhile, support is at 149.50 and where break will open up room for retest of the support at 148.55 and the 148.00 congestion. Would take break of the latter to return focus to the downside for 146.54 current year low.